JOHANNES EISELE/Contributor/Getty Images

The stock market has had quite a run over the past two years, with the S&P 500 returning more than 25 percent in both 2023 and 2024. Other assets, such as cryptocurrencies and gold are also near all-time highs, causing some to worry about a possible market bubble.

The strength has been driven by enthusiasm for artificial intelligence, which has seen a boom in spending by the largest tech companies. The potential for a friendly business environment following the reelection of President Donald Trump has also sent prices higher, particularly for cryptocurrencies.

So what can you do if these lofty prices make you squirm? Whether you work with a financial advisor or manage your investments yourself, here are some tips on what to do when so many investments have already gone up, and it’s feeling kind of frothy out there.

4 tips to protect your portfolio from a market bubble

1. Avoid the craziness

What you don’t own can be just as important as what you do. A good first step to avoid getting hurt in an overheated market is to make sure you steer clear of the hottest areas. Recently, that has meant avoiding the stocks most closely associated with AI that trade at the priciest valuations. In the crypto world, memecoins have attracted a lot of attention, but can fall just as fast as they rise. Steering clear of these areas can protect your portfolio in a downturn.

Instead, make sure the stocks — or stock funds — in your portfolio are composed of profitable companies that are likely to continue growing over time. Remember that stocks aren’t just prices that flash on a screen, but represent real ownership interests in a business. Stock prices should follow the performance of the business over time.

Need an advisor?

If you’re looking for expert guidance when it comes to managing your investments or planning for retirement, Bankrate’s AdvisorMatch can connect you to a CFP® professional to help you achieve your financial goals.

2. Embrace boring

It’s also a good time to make sure you’re taking care of the basics. Look at your 401(k) or other workplace retirement plan and make sure you’re contributing enough to receive the maximum match your employer offers, and that the funds are being invested in simple index funds that don’t have too much exposure to the market’s high flyers.

There are many trendy investments that have generated outsized returns over the past few years, such as Tesla and Nvidia. These companies may continue to do well for shareholders, but with their lofty valuations and business uncertainties, you will likely find others that offer more of a bargain today.

Consider steady growers with solid dividend yields and reasonable valuations instead. Companies like this aren’t likely to double or triple in the near term, but should deliver attractive long-term returns compared with many of the hot stocks of today.

Think about investing in ETFs or mutual funds that own companies with consistent dividend payouts over the years instead of chasing the hottest names of the month in the crypto space or the latest tech high flyer.

3. Look for unloved investments

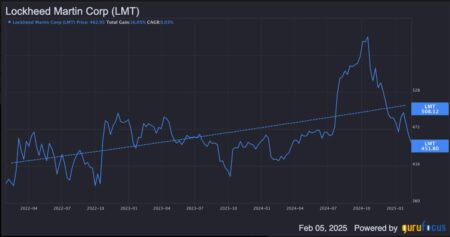

While many stocks have seen fantastic performance in recent years, there certainly are some laggards that might represent interesting bargains currently. If you’re worried about a possible bubble, it might make sense to spend time researching the areas that have underperformed.

You may want to look at international stocks, small-cap stocks or value stocks for starters. These areas have lagged the performance of the largest stocks and broad U.S. indexes such as the S&P 500. One of the best indicators of long-term returns is starting valuation, and those areas trade at lower multiples of earnings than large-cap U.S. stocks do.

4. Consider holding some cash in your portfolio

Most people agree that cash is a lousy long-term investment. It’s virtually certain that it will lose value over time, but one thing it can add to your portfolio is optionality. If you think most of the investment opportunities today are unattractive, cash gives you the option to pounce quickly on opportunities in the future, though when those might come is always unclear. You also earn a decent return on cash these days, unlike a few years ago when you earned essentially nothing.

To be sure, holding cash can be psychologically difficult, particularly in speculative environments when everything seems to be going higher. It doesn’t feel good to have cash just sitting there earning less than you might in the market. But when the emotions of the market inevitably swing in a more fearful direction, holding some cash today could end up proving to be valuable.

If you’re concerned about today’s lofty valuations, consider holding 5-10 percent of your portfolio in cash and cash equivalents — it’s one of the most contrarian investments you can make.

Bottom line

Many asset classes have increased considerably over the past couple years, leaving valuations high and future return expectations low. Make sure you’re limiting your exposure to the most speculative areas of the market like AI stocks and cryptocurrencies.

Consider holding a portion of your portfolio in a highly liquid investment — like a money market fund — to be better positioned for future opportunities. Make sure you’re taking care of the basics and consistently contributing to a workplace retirement plan like a 401(k). Remember that slow and steady typically wins the investing race.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Read the full article here