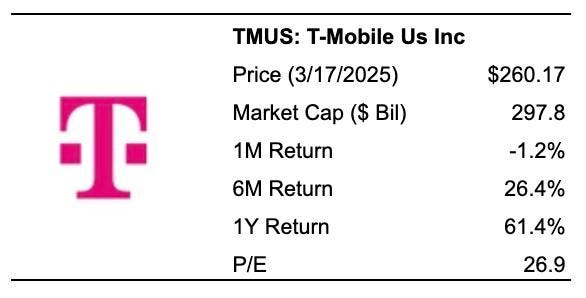

Question: How would you respond if you owned T-Mobile stock (NASDAQ: TMUS) and its value dropped by 25% or more in the coming months? Although this scenario might seem extreme, it has occurred before and could happen again. In fact, T-Mobile stock has performed strongly this year, rising 15% year-to-date in 2025 and nearly 60% over the past 12 months. These gains were driven by robust postpaid phone customer acquisitions powered by its 5G network and by synergies from the Sprint merger that boosted earnings. The company has also successfully expanded into the broadband market with its fixed wireless offering, utilizing excess spectrum acquired from Sprint. However, the broader market is experiencing a significant sell-off, fueled by growing concerns about a U.S. recession following tariffs imposed by President Donald Trump on major trading partners. Although telecom stocks are generally considered defensive, T-Mobile’s premium valuation and status as a growth stock might make it more vulnerable to a correction during a market downturn.

Here’s the point: The main takeaway is that in a downturn, T-Mobile stock might suffer significant losses. Data from 2020 shows that TMUS stock lost more than 26% of its value within a few quarters and experienced a peak-to-trough decline of about 57% during the 2008 financial crisis—performing slightly worse than the S&P 500. This raises the question: Could the stock be sold off to the point where it falls to $120 if a similar scenario were to occur? Naturally, individual stocks tend to be more volatile than diversified portfolios. Consequently, if you seek growth with lower volatility, you might consider the High-Quality portfolio, which has outperformed the S&P 500 and generated returns of over 91% since its inception.

Why Is It Relevant Now?

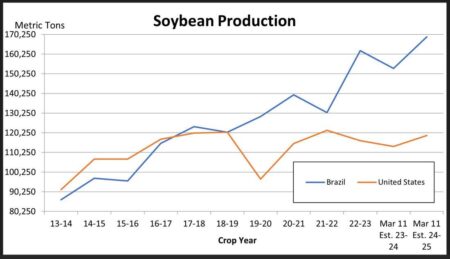

Possibility of Lower Customer Growth: T-Mobile has been increasing its share of the U.S. wireless industry’s net customer additions by leveraging its valuable mid-band spectrum for 5G wireless technology. This mid-band spectrum offers a balanced combination of speed and coverage, in contrast to the millimeter-wave spectrum—which delivers ultra-fast speeds but limited coverage—that competitors like Verizon and AT&T initially emphasized. For context, the carrier added a record 903,000 net postpaid phone connections in Q4 2024. However, this growth may begin to slow as the wireless market becomes more competitive, with other players progressively deploying their own mid-band 5G spectrum and thereby reducing T-Mobile’s early-mover advantage. Furthermore, rival AT&T has been notably aggressive with its device promotions in recent years, which could also affect T-Mobile’s future performance. Additionally, intensified competition might lead to higher churn rates or a slowdown in new sign-ups, ultimately impacting margins. These combined pressures could weigh on both profitability and stock performance in the near term.

Economic Uncertainty Could Also Impact T-Mobile, as the company is highly dependent on consumer spending. President Donald Trump’s aggressive tariff measures—including a 20% tariff on Chinese imports and 25% on imports from Canada and Mexico, along with stricter immigration restrictions—have raised concerns about a potential resurgence of inflation. These factors suggest that the U.S. economy might face significant challenges and even a recession – see our analysis here on the macro picture. Last week, in an interview, the President did not dismiss the possibility that new tariffs could trigger a recession.

Considering the increased uncertainty stemming from the Trump administration’s policies, these risks are particularly significant. The ongoing Ukraine–Russia conflict and global trade tensions further cloud the economic outlook. Tariffs raise import costs, which in turn lead to higher prices, reduced disposable income, and diminished consumer spending. Although T-Mobile’s wireless services are essential and likely to hold up in a downturn, the rising cost of its plans could deter customers from upgrading to premium offerings. This shift could affect T-Mobile’s growth and profitability in the future.

How Resilient is TMUS Stock During a Downturn?

TMUS stock has proven to be more resilient than the benchmark S&P 500 index during some recent downturns. While investors hope for a soft landing in the U.S. economy, one must wonder how severe a recession could be if it were to occur again. Our dashboard How Low Can Stocks Go During A Market Crash illustrates how key stocks performed during and after the last six market crashes.

Inflation Shock (2022)

• TMUS stock declined by 12.1% from a high of $115.57 on 6 January 2022 to $101.62 on 23 January 2022, compared to a peak-to-trough drop of 25.4% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 3 February 2022

• Since then, the stock has risen to a high of $272.83 on 3 March 2025 and is currently trading at approximately $255

Covid Pandemic (2020)

• TMUS stock dropped by 26.0% from a high of $100.49 on 19 February 2020 to $74.32 on 18 March 2020, in contrast to a peak-to-trough decline of 33.9% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 18 May 2020

Global Financial Crisis (2008)

• TMUS stock declined by 57.5% from a high of $50.42 on 9 October 2007 to $21.42 on 20 November 2008, compared to a peak-to-trough drop of 56.8% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 24 October 2016

Premium Valuation

At its current price of about $255 per share, T-Mobile is trading at roughly 24x consensus 2025 earnings, which appears somewhat expensive compared to its peers. For example, AT&T trades at below 13x forward earnings, while Verizon trades at below 10x forward earnings. Although T-Mobile’s recent financial performance has been robust, markets are often short-sighted—projecting short-term achievements into the long term. In T-Mobile’s case, it is assumed that the company will continue its strong record of subscriber additions and achieve double-digit earnings growth. However, there is a genuine possibility that subscriber growth may slow as competition intensifies and as other U.S. carriers further deploy their mid-band spectrum. Additionally, the substantial cost reductions T-Mobile experienced following the winding down of its Sprint integration might eventually diminish, affecting earnings growth. Furthermore, increasing economic uncertainty in the U.S. could also negatively impact the stock.

Considering the potential slowdown in growth and broader economic uncertainties, ask yourself the question: will you hold onto your T-Mobile stock, or will you panic and sell if it starts dropping to $225, $200, or even lower? Holding onto a declining stock is never easy. Trefis works with Empirical Asset Management—a Boston-area wealth manager—whose asset allocation strategies yielded positive returns during the 2008-09 period when the S&P lost more than 40%. Empirical has integrated the Trefis HQ Portfolio into its asset allocation framework to offer clients improved returns and lower risk compared to the benchmark index—a less turbulent experience, as demonstrated by the HQ Portfolio performance metrics.

Invest with Trefis

Market Beating Portfolios | Rules-Based Wealth

Read the full article here