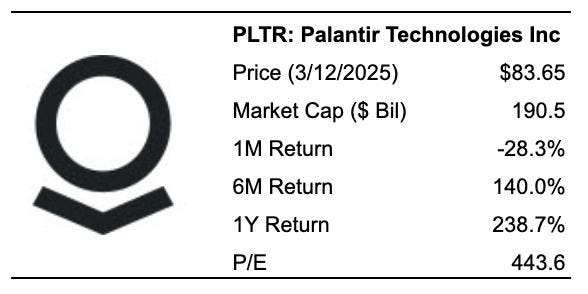

Question: How would you feel if you owned Palantir Technologies stock (NASDAQ: PLTR) and it dropped by 50% or more in the coming months? Although it may sound extreme, such an event has occurred before – and it could happen again. This year, Palantir’s stock has experienced notable volatility. It climbed by over 60% from early January to exceed $120 per share by mid-February, then lost about 38% of that high, now trading at roughly $80 per share. Palantir has benefited from the surging interest in generative AI, Donald Trump’s re-election as U.S. President, and strong earnings in recent quarters. However, broader markets are undergoing a significant selloff amid growing concerns of a U.S. recession following President Donald Trump’s tariffs on key trading partners. Given its elevated valuation, Palantir’s stock might be particularly prone to a steep correction.

Here’s the point: In an economic downturn, PLTR stock could incur substantial losses. Data from 2022 shows that PLTR stock lost over 70% of its value in just a few quarters. At present, Palantir’s stock has already dropped from $120 to $80 in only a few weeks. So, could Palantir stock continue its decline and reach around $40 if a similar situation were to occur? Naturally, individual stocks tend to be more volatile than a diversified portfolio – so if you prefer growth with lower volatility than that of a single stock, consider the High-Quality portfolio, which has outperformed the S&P 500 and delivered returns exceeding 91% since its inception.

Why Is It Relevant Now?

Palantir’s revenue growth faces risks. Approximately 55% of 2024 revenue came from government contracts, which are often unpredictable and uneven, making them less reliable. Moreover, the new Trump Administration has been working to ease geopolitical tensions, including mediating between Ukraine and Russia and addressing the Israel-Palestine conflict. Although these actions benefit global stability, they could reduce demand for Palantir’s software and services, which typically perform well during periods of geopolitical uncertainty. Palantir’s long-term growth depends on the commercial market, which it serves through its Foundry platform targeting industries such as manufacturing, retail, and healthcare. Even though U.S. commercial sales increased by 64% in the most recent quarter compared to 45% growth in U.S. government sales, challenges remain. The company’s ticket sizes are usually large, and implementation is complex and costly, so the product may not scale as efficiently for small and medium-sized firms. This could affect future growth.

Palantir’s margins could come under pressure. Although margins expanded in recent years – rising from about 26% in 2023 to nearly 35% in 2024 – this trend might not persist. The company has kept marketing expenses in check thanks to its highly customized products and strong customer loyalty, with engineers working closely with clients to tailor solutions. However, if Palantir adjusts its strategy to appeal to a broader customer base, costs may increase, impacting margins. Additionally, competition from diversified tech giants such as Microsoft, which can cross-sell solutions to existing enterprise customers, poses another risk to Palantir’s pricing power and profitability.

How resilient is PLTR stock during a downturn?

PLTR stock has experienced a greater impact than the benchmark S&P 500 index during some recent downturns. While investors hope for a soft landing for the U.S. economy, how severe could the situation become if another recession hits? Our dashboard How Low Can Stocks Go During A Market Crash illustrates how key stocks performed during and after the last six market crashes.

Inflation Shock (2022)

• PLTR stock fell 67.6% from a high of $18.53 on 3 January 2022 to $6.00 on 27 December 2022, compared to a peak-to-trough decline of 25.4% for the S&P 500

• The stock fully recovered to its pre-crisis peak by 31 July 2023

• Since then, the stock has risen to a high of $124.62 on 18 February 2025 and currently trades at around $78

That said, stock markets are often short-sighted and tend to project short-term trends into the long run. In Palantir’s case, markets expect the AI boom to persist, with the company continuing to grow its commercial business and diversifying away from its core government segment. However, significant risks remain.

Valuation

Palantir Technologies’ Revenues have grown considerably in recent years, increasing at an average rate of 23.0% over the last 3 years (compared to a 6.9% rise for the S&P 500). However, with the stock trading at a lofty 48x consensus FY’25 revenue and about 140x FY’25 earnings, Palantir might be more exposed to the broader economic environment. High-multiple growth stocks often suffer during downturns, as slower earnings growth generally leads to significant compression in P/E multiples. Moreover, investors usually shift toward more defensive sectors amid heightened risk aversion.

Given this deceleration in growth and overall economic uncertainty, ask yourself this question: Will you hold your PLTR stock now, or will you panic and sell if it begins to drop to $50, $40, or even lower levels? Holding onto a declining stock is never easy. Trefis collaborates with Empirical Asset Management—a wealth manager in the Boston area—whose asset allocation strategies yielded positive returns during the 2008-09 period when the S&P fell by more than 40%. Empirical has incorporated the Trefis HQ Portfolio in this asset allocation framework to provide clients with better returns and reduced risk compared to the benchmark index; offering a less volatile experience, as seen in the HQ Portfolio performance metrics.

Invest with Trefis

Market Beating Portfolios | Rules-Based Wealth

Read the full article here