Financial market instability, persistent inflation and geopolitical uncertainties are prompting more and more investors to seek solid safe havens. In this climate, Gold is regaining its relevance, not only as a hedge against systemic risks, but also as a strategic tool for building long-term wealth.

This trend is particularly marked among millennials, who are showing a growing appetite for Gold as part of their retirement planning, including the integration of the yellow metal into individual retirement accounts, and more specifically, Gold IRAs, which are becoming more popular.

Understanding how a Gold IRA works

A Gold IRA, or Gold-backed Individual Retirement Account, is a self-directed individual retirement account for the purchase of physical precious metals (mainly Gold, but also Silver, Platinum or Palladium).

Unlike traditional IRAs, these accounts offer real portfolio diversification through tangible assets, while retaining the tax advantages specific to pensions, whether deferred (traditional IRA) or exempt (Roth IRA).

Metals must be stored in secure, IRS-approved repositories, and are managed by specialized custodians.

Unlike traditional employer-sponsored 401(k) plans, the Gold IRA offers more flexibility in asset selection, allowing direct exposure to physical Gold or its listed equivalents.

Millennials, the new Gold champions

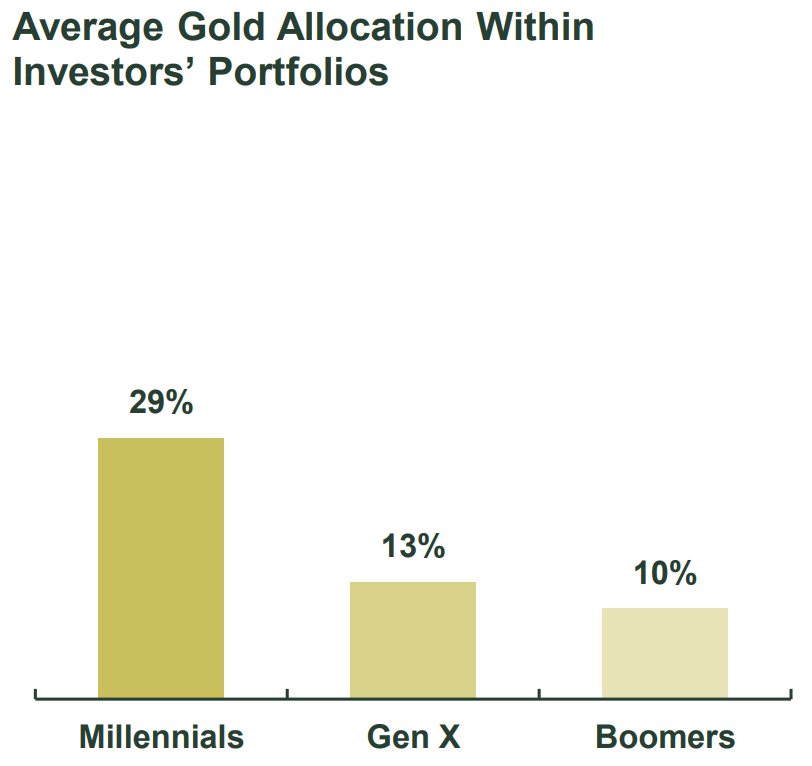

Data from the State Street Global Advisors Research Center’s 2024 Gold ETF Impact Study is unequivocal: millennials now dominate Gold ownership among affluent generations.

Over 60% of millennials say they hold Gold in their portfolios, compared to just 35% of Gen Xers and 20% of baby boomers.

Their average allocation is 29%, up sharply from 17% in 2023. This interest is not a passing fad, but a conscious strategy to protect and grow their assets.

Source: State Street Global Advisors

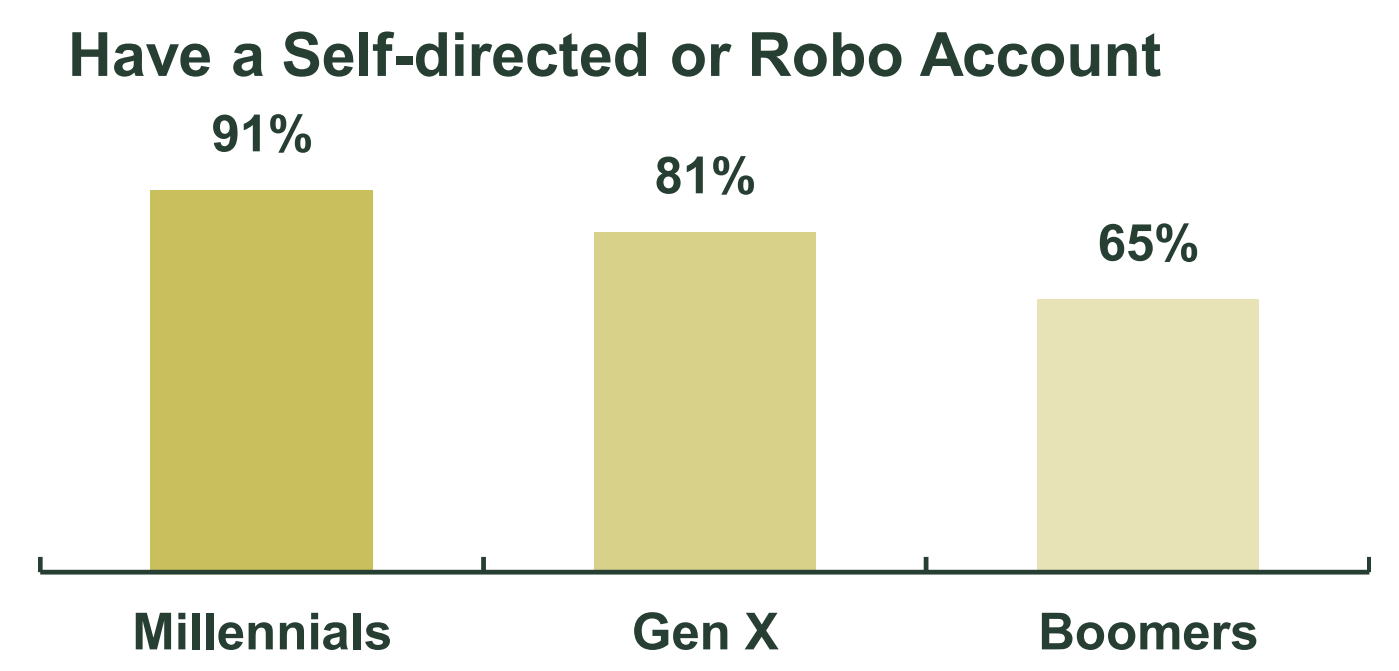

The profile of millennial investors confirms this strategic orientation: they are more highly educated than their elders, make massive use of online wealth management platforms, and don’t hesitate to steer their investments themselves.

Source: State Street Global Advisors

Their adoption of the Gold IRA is in line with their desire for financial autonomy and greater control over their future. Many of them use self-managed Roth IRAs, in which they integrate Gold ETFs to combine ease of management with tax efficiency.

The key role of financial advisors

The success of Gold IRAs with millennials cannot be understood without the active role played by financial advisors.

The study shows that over 90% of millennials who have invested in Gold have discussed this choice with an advisor. The latter widely recommend Gold-backed ETFs, perceived as more accessible, more liquid and better suited to the diversification objectives of modern portfolios.

These exchanges reinforce financial education and facilitate decision-making among young investors.

Gold ETFs for diversification

Gold ETFs, listed financial products that replicate the price of Gold, are emerging as the most popular form of access to Gold for millennials.

Nearly half of wealthy young investors hold them, appreciating their low cost, tax advantages and compatibility with Roth IRAs.

According to the study, 84% of Gold ETF holders believe that these products have improved the overall performance of their portfolios. This finding reinforces their status as a pillar of modern retirement planning.

Roth IRA, a pillar of tax-optimized retirement

In addition to the security offered by Gold as a tangible asset, millennials are taking full advantage of the Roth IRA’s tax benefits.

By investing income that is already taxed, they ensure tax-free withdrawals at retirement. This strategy is particularly well-suited to a generation that anticipates increasing tax pressure in the decades ahead.

By combining Gold ETFs and Roth IRAs, they aim to build robust, diversified and tax-efficient retirement planning.

For many millennials, the Gold IRA now complements a 401(k), bringing a dimension of security and diversification that traditional investments don’t always offer.

Towards widespread adoption of Gold IRAs?

The signals are clear: the behavior of millennials could well inspire the entire market. As Gold’s performance continues to make headlines and global demand remains buoyant, more and more investors, including those in middle-income brackets, are taking an interest in Gold IRAs.

Expanding the investor base could be facilitated by better financial education, particularly on the benefits of ETFs.

Millennials mark a clear break with the investment habits of previous generations. By including Gold in their Roth IRAs via ETFs, they combine tradition and modernity, security and performance, prudence and anticipation.

Their structured, well-informed approach offers a new reading of retirement planning, in which Gold regains its relevance as a foundation of stability. Far from being a simple return to a safe-haven asset, this 2025 version of the Gold rush is, above all, a generational strategy.

Gold Market Movers: Recovery extends to $3,350 on broad USD weakness

Gold price chart. Source: FXStreet.

US President Donald Trump expressed frustration over stalled US-Japan trade negotiations and also threatened to raise tariffs on certain countries as his July 9 deadline approaches. Adding to this, White House spokesperson Karoline Leavitt said that Trump would meet with his trade team to set tariff rates for countries if they don’t come to the table to negotiate in good faith.

Meanwhile, US Treasury Secretary Scott Bessent warned that countries could be notified that tariff rates are scheduled to rise sharply from a temporary 10% level to rates of 11% to 50% announced on April 2. This, in turn, drives some safe-haven flows during the Asian session on Tuesday and assists the Gold price to build on the overnight goodish recovery move.

Trump steps up his pressure campaign on Federal Reserve Chair Jerome Powell to lower borrowing costs in a handwritten note on Monday. This comes after the US Personal Consumption Expenditures (PCE) report showed on Friday that consumer spending unexpectedly declined in May and keeps the door open for further monetary policy easing by the central bank.

The markets are currently pricing in a smaller chance that the next rate reduction by the Fed will come in July and see a roughly 74% probability of a rate cut as soon as September. This, along with concerns about the worsening US fiscal condition, drags the US Dollar to its lowest level since February 2022 on Tuesday and lends additional support to the XAU/USD pair.

The Senate narrowly approved a procedural vote to open debate on Trump’s comprehensive “One Big Beautiful Bill,” which would add approximately $3.3 trillion to the federal deficit over the next decade. This should keep the USD on the defensive ahead of this week’s key US macro releases and support prospects for a further appreciating move for the commodity.

Read the full article here