One of the most common questions I get is, “Is now a good time for me to sell?”

While the question is simple, the answer depends on several factors, including your liquidity needs, your risk tolerance, and your current portfolio’s allocation. The answer does not, however, depend on the current market price of the investment.

This is when you should be selling your investment.

When People Think They Should Sell

When I am asked the question of when to sell, I often ask them what they think. Many times, they’ll come back with one of the following answers.

When It Is High

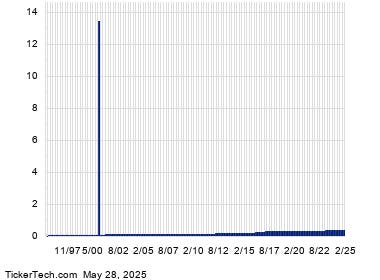

Often, investors tell me the best time to sell their investment is when the price is high. Unfortunately, a market high is something that can only be observed in hindsight. Several years ago, I was talking to an investor who had 95% of his net worth concentrated in a single position. He had originally invested around $10,000 and the security was worth a couple million dollars at that point. One might argue that it was a high point and the investor should sell. He didn’t think so. Now, that investment is worth about a third of what it was then, and he finally opted to diversify.

Usually, fear and greed are much more powerful emotions than we give them credit for. While many investors intuitively know what someone should do, they often fall victim to cognitive errors when judging how they themselves should be investing.

When You Think A Correction Is Coming

This is a similar answer to the prior answer, except it assumes you have hidden knowledge that is not already priced into the market. I observed this a lot in the last few years. Investors tell me things like, “All of this COVID-19 supply chain stuff is really going to tank the market,” The high inflation is going to drive things down,” or “These policy changes are going to lead to a trade war and the economy will go under.”

Contrary to what some might think, the market is largely efficient and prices in all current information, particularly in widely observed indexes like the S&P 500. Even with this great wealth of information, the direction of the market in any day, week, month, or year can be incredibly difficult to predict, with most analysts at major banks and funds predicting incorrectly by orders of magnitude.

When Investors Should Actually Sell

When investors should sell their positions is much simpler than trying to run models to see if your investment is at a high or if the market will be going down.

Sell When You Need Liquidity

Yes, it’s that simple. If you need the money for cash flow, for a major purchase, or for any other reason, you have a liquidity need. A major purchase need can include anything from a home, to a remodel, to a wedding, to a car, to a business.

Sell When Your Risk Tolerance Changes

Your tolerance for risk is a combination of your time until you need the money, your ability to take on risk, and your feelings toward taking on risk.

Let’s return to the investor who made the $10,000 investment that went up significantly. At the time he made the investment, he had no spouse, no child, no mortgage, and considered himself to be a speculative investor, meaning that he would be okay if the investment went down to $0. Years later, the investor gained a spouse, two children, a mortgage, and some financial goals that dictated he could not afford for his investments to go to $0. This calls for a reassessment of his risk tolerance. After reassessing, he found his portfolio should be allocated toward a growth objective and in a diversified portfolio of 80% stocks and 20% fixed income.

Your risk tolerance can also change to become more aggressive. I’ve come across investors who were fearful of investing in stocks early in their savings journey, but as they got more comfortable with investing, their tolerance for risk increased. In this case, they would sell cash or fixed income securities to gain more equity investments.

Sell When You Need To Rebalance Your Portfolio

Setting a portfolio allocation is not just a one-and-done thing. The other day, I ran into a 69-year-old woman who set her allocation based on her risk tolerance 20 years prior. She hadn’t bothered touching her allocations in all that time.

In the last 20 years, stocks have beaten fixed income investments by a wide margin. Because of that, over time, the portfolio became skewed. While she originally had 60% in stocks and 40% in fixed income, her portfolio was now 90% in stocks and 10% in fixed income, accidentally putting her into a new risk category.

Rebalancing a portfolio involves looking at the portfolio allocation how it is now versus how it should be invested for your risk tolerance. If stocks have gone up, you will sell some to purchase more fixed income and keep your portfolio consistent with your risk tolerance. If stocks have gone down, we will do the opposite and purchase more.

In a retirement account, because there is no taxation associated with rebalancing, I usually recommend my clients rebalance quarterly. In a non-retirement account, because there are taxes associated with transactions, I usually recommend my clients wait a year before rebalancing to make sure they are minimizing taxation while still maintaining an appropriate allocation.

Conclusion

Investors should sell their investments based on personal financial needs rather than market conditions. Key reasons include needing liquidity for major purchases, changes in risk tolerance due to life circumstances, and portfolio rebalancing to maintain desired asset allocation. Emotional factors like fear and greed can cloud judgment, emphasizing the importance of sticking to a strategic plan.

This informational and educational article does not offer or constitute, and should not be relied upon as, tax or financial advice. Your unique needs, goals and circumstances require the individualized attention of your own tax and financial professionals whose advice and services will prevail over any information provided in this article. Equitable Advisors, LLC and its associates and affiliates do not provide tax or legal advice or services. Equitable Advisors, LLC (Equitable Financial Advisors in MI and TN) and its affiliates do not endorse, approve or make any representations as to the accuracy, completeness or appropriateness of any part of any content linked to from this article.

Cicely Jones (CA Insurance Lic. #: 0K81625) offers securities through Equitable Advisors, LLC (NY, NY 212-314-4600), member FINRA, SIPC (Equitable Financial Advisors in MI & TN) and offers annuity and insurance products through Equitable Network, LLC, which conducts business in California as Equitable Network Insurance Agency of California, LLC). Financial Professionals may transact business and/or respond to inquiries only in state(s) in which they are properly qualified. Any compensation that Ms. Jones may receive for the publication of this article is earned separate from, and entirely outside of her capacities with, Equitable Advisors, LLC and Equitable Network, LLC (Equitable Network Insurance Agency of California, LLC). AGE-7970459.1 (5/25)(exp. 5/29)

Read the full article here