Trade Desk (NASDAQ: TTD)—a digital ad technology company that assists businesses in purchasing digital ads across various publishers—recently reported its Q4 earnings. The company posted earnings of $0.59 per share on revenue of $741 million, falling short of analyst expectations of $0.57 per share and $760 million in revenue. Additionally, its forward guidance was weaker than anticipated, causing its stock to decline following the earnings announcement.

TTD stock has gained 70% since the start of 2024, significantly outperforming the S&P 500, which has risen by 27% over the same period. The company has benefited from continued growth in connected TV advertising. However, if you’re looking for exposure with reduced volatility, consider the High-Quality portfolio, which has outperformed the S&P 500 with over 100% cumulative returns since inception.

Trade Desk’s revenue for Q4 was $741 million, marking a 22% year-over-year increase. The company maintained a strong customer retention rate of 95% and processed a record $12 billion in ad spend, underscoring its expanding influence in the digital ad market. Additionally, it sustained an adjusted EBITDA margin of 47%, with net earnings per share rising 44% year-over-year to $0.59. Looking ahead, Trade Desk expects Q1 2025 revenue of $575 million and an adjusted EBITDA of $145 million, which is lower than the market’s consensus of $582 million in revenue and $193 million in EBITDA.

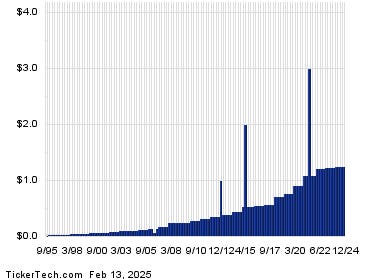

Regarding TTD stock, recent price fluctuations are not unusual. The stock has exhibited substantial volatility in previous years, with annual returns of 14% in 2021, -51% in 2022, 61% in 2023, and 63% in 2024.

By contrast, the Trefis High-Quality Portfolio, consisting of 30 carefully selected stocks, has been significantly more stable. Over the past four years, it has consistently outperformed the S&P 500. Why? Because the HQ Portfolio stocks have historically provided better returns with lower risk than the benchmark index, offering a less turbulent investment journey, as demonstrated by the HQ Portfolio performance metrics.

With ongoing macroeconomic uncertainty, including interest rate decisions and trade tensions, could TTD stock face a downturn similar to 2021 and 2022, underperforming the S&P in the next 12 months? Or will it see a rebound?

At its current price below $90 per share, TTD stock is trading at 18x trailing revenue, notably lower than its five-year average price-to-sales (P/S) ratio of 28x. While the weak Q4 performance and cautious outlook have contributed to a contraction in valuation multiples, we believe the stock is currently undervalued, with potential challenges already factored into its price.

Although TTD stock appears to have room for growth, it’s worth comparing how Trade Desk’s peers perform on key metrics. You can also explore valuable company comparisons across industries at Peer Comparisons. Separately, check out – Reddit Stock Update: What to Expect After the 15% Fall?

Invest with Trefis Market Beating Portfolios

See all Trefis Price Estimates

Read the full article here