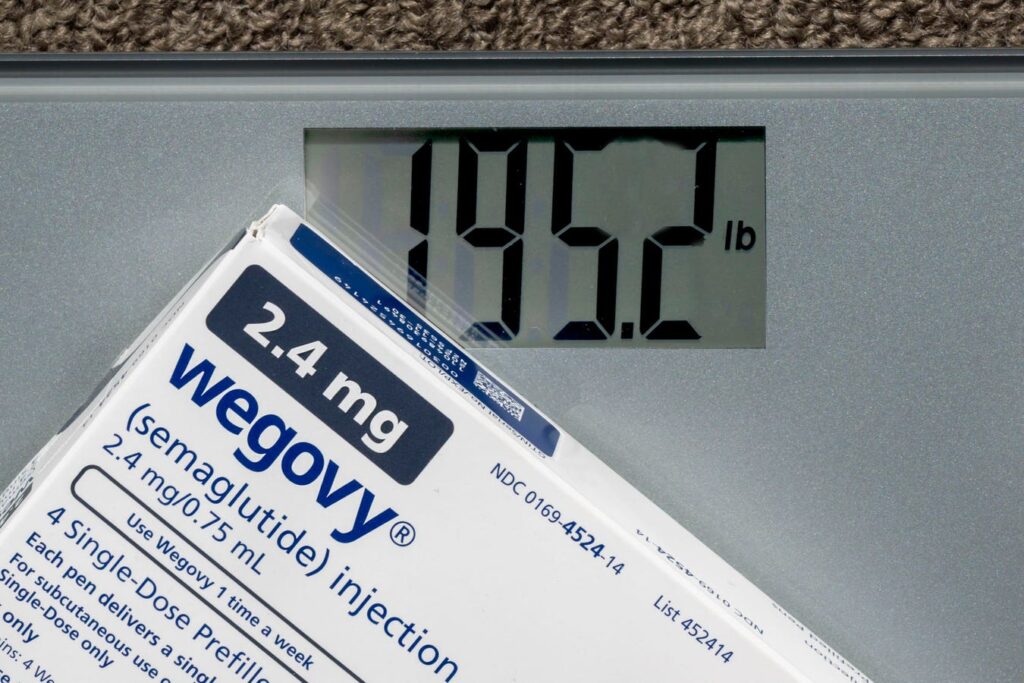

Hims & Hers Health (NYSE: HIMS), a telehealth platform, experienced an 8% increase in its stock on Friday, May 30th, following the announcement of a 4% reduction in its workforce. This move comes as the company responds to a U.S. ban, effective May 22nd, on the production of mass copies of the weight-loss medication, Wegovy. Despite this regulatory shift, HIMS has strategically teamed up with Novo Nordisk to offer Wegovy at a discounted rate on its platform. This information adds to an already impressive year for HIMS, with its stock appreciating an astounding 125% year-to-date.

The substantial gains year-to-date naturally prompt the question of whether HIMS stock still qualifies as an attractive purchase at its present price of approximately $57. From a valuation standpoint, the stock seems pricey. Nonetheless, this elevated valuation is primarily supported by the company’s solid financial performance. This makes HIMS a challenging choice for new investments at its current price. We observe negligible immediate concerns with HIMS stock due to its strong underlying performance; however, investors should remain mindful of its increased susceptibility to any negative news or market fluctuations.

Our conclusion is grounded in a thorough analysis that compares HIMS’s current valuation with its recent operational performance and both its contemporary and historical financial status. Our detailed evaluation of Hims & Hers Health concentrates on key metrics: Growth, Profitability, Financial Stability, and Downturn Resilience. This examination reveals that the company displays remarkable operating performance and financial well-being. That being said, if one seeks upside with lower volatility than individual stocks, the Trefis High Quality portfolio offers an alternative—having outperformed the S&P 500 and achieving returns over 91% since its inception. Separately, see – What’s Behind The 400% Rise In IONQ Stock?

Lofty Valuations

HIMS stock is deemed expensive by most metrics. The company trades at 6.6 times its sales, which is more than double the S&P 500’s 3.0 ratio. Its price-to-earnings ratio stands at 72.1, nearly three times higher than the market’s 26.4. Even when evaluating free cash flow, HIMS demands 35.5 times its cash generation, compared to 20.5 for the broader market. But how is HIMS able to achieve such high valuations?

Exceptional Growth Story

The justification for these elevated valuations is HIMS’ extraordinary growth. The company has increased its revenues at an average rate of 78% over the last three years, whereas the S&P 500 managed only 5.5%. This growth has accelerated recently, with revenues leaping 86% to $1.5 billion in the past 12 months. The most recent quarter showcased even stronger momentum, with revenues rising 111% to $481 million.

Robust Cash Flow Margins

Despite the remarkable growth in revenue, HIMS’s profitability presents a more tempered narrative. The company’s operating margin of 6.2% is significantly lower than the S&P 500’s 13.2%. However, its operating cash flow margin of 18.7% surpasses the market average of 14.9%, indicating that the company generates healthy cash flows despite its lower operating profits. The net income margin is at 9.2%, slightly below the market’s 11.6%.

Rock-Solid Balance Sheet

HIMS showcases outstanding financial strength. With just $63 million in debt against a market value of $13 billion, the company holds a debt-to-equity ratio of only 0.5% compared to 19.9% for the S&P 500. Additionally, the company maintains significant cash reserves, accounting for 36.2% of total assets versus 13.8% for the broader market.

Investment Verdict

HIMS offers a compelling yet risky investment opportunity. The company merges extremely strong growth and financial stability with moderate profitability and volatility issues. While the business fundamentals seem robust, the elevated valuation leaves little room for further growth. Investors looking for exposure to HIMS’ growth potential should brace themselves for substantial price fluctuations and carefully consider their risk tolerance. For context, during the 2022 inflation crisis, HIMS fell 87.3% from its peak, significantly worse than the S&P 500’s 25.4% drop. However, the stock fully rebounded by June 2024, achieving new highs of $68.74 in February 2025.

In summary, the stock’s current price reflects optimistic expectations for ongoing rapid growth. If HIMS can sustain its growth trajectory while enhancing profitability, the valuation may be warranted and could see further elevations. Conversely, any misstep in growth or broader market weaknesses might induce significant price corrections, given the premium investors are currently paying.

Keep in mind – HIMS stock is susceptible to volatility and significant fluctuations. As a long-term investment option, you might consider the Trefis High Quality (HQ) Portfolio, which is based on quality that is considerably less volatile, and aims for reliability, predictability, and compounding growth. With a collection of 30 stocks, it has a history of comfortably outperforming the S&P 500 over the last four years. Why is that? As a group, HQ Portfolio stocks delivered superior returns with less risk compared to the benchmark index; offering a smoother ride, as shown in HQ Portfolio performance metrics.

Read the full article here