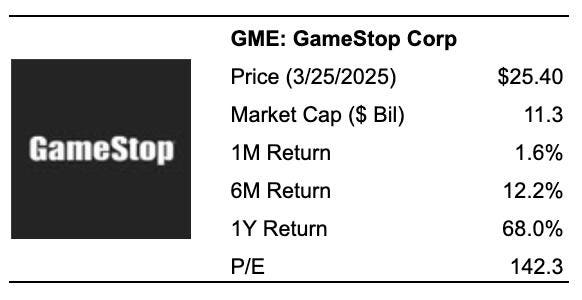

GameStop (NYSE:GME), a well-known meme stock, is experiencing an upward trend today, Wednesday, March 26, 2025, following the company’s announcement that it will invest its cash reserves in Bitcoin. This strategy aligns with that of other companies, such as MicroStrategy. It’s worth noting that GameStop reported a cash balance of $4.6 billion in its most recent quarterly report.

Despite the recent positive movement, we believe GME stock is not a good investment at its current price of about $25. We have concerns about GME that make it unattractive, even though its current valuation may appear moderate.

We arrive at our conclusion by comparing the current valuation of GME stock with its operating performance over the recent years as well as its current and historical financial condition. Our analysis of GameStop along key parameters of Growth, Profitability, Financial Stability, and Downturn Resilience shows that the company has a weak operating performance and financial condition, as detailed below. That said, if you seek upside with lower volatility than individual stocks, the Trefis High-Quality portfolio presents an alternative – having outperformed the S&P 500 and generated returns exceeding 91% since its inception.

How Does GameStop’s Valuation Look vs. The S&P 500?

Going by what you pay per dollar of sales or profit, GME stock is currently valued in line with the broader market.

• GameStop has a price-to-sales (P/S) ratio of 2.5 vs. a figure of 3.2 for the S&P 500

How Have GameStop’s Revenues Grown Over Recent Years?

GameStop’s Revenues have fallen considerably over recent years.

• GameStop has seen its top line decline at an average rate of 9.0% over the last 3 years (vs. increase of 6.3% for S&P 500)

• Its revenues have decreased 24.0% from $5.7 Bil to $4.3 Bil in the last 12 months (vs. growth of 5.2% for S&P 500)

• Also, its quarterly revenues shrank 20.2% to $860 Mil in the most recent quarter from $1.1 Bil a year ago (vs. 5.0% improvement for S&P 500)

How Profitable Is GameStop?

GameStop’s profit margins are considerably worse than most companies in the Trefis coverage universe.

• GameStop’s Operating Income over the last four quarters was $-37 Mil, which represents a very poor Operating Margin of -0.9% (vs. 13.0% for S&P 500)

• GameStop’s Operating Cash Flow (OCF) over this period was $-28 Mil, pointing to a very poor OCF-to-Sales Ratio of -0.6% (vs. 15.7% for S&P 500)

Does GameStop Look Financially Stable?

GameStop’s balance sheet looks very strong.

• GameStop’s Debt figure was $464 Mil at the end of the most recent quarter, while its market capitalization is $11 Bil (as of 3/25/2025). This implies a very strong Debt-to-Equity Ratio of 4.2% (vs. 19.0% for S&P 500). [Note: A lower Debt-to-Equity Ratio is desirable]

• Cash (including cash equivalents) makes up $4.6 Bil of the $6.2 Bil in Total Assets for GameStop. This yields a very strong Cash-to-Assets Ratio of 74.0% (vs. 14.8% for S&P 500)

How Resilient Is GME Stock During A Downturn?

GME stock has fared worse than the benchmark S&P 500 index during some of the recent downturns. Worried about the impact of a market crash on GME stock? Our dashboard How Low Can GameStop Stock Go In A Market Crash? has a detailed analysis of how the stock performed during and after previous market crashes.

Inflation Shock (2022)

• GME stock fell 62.2% from a high of $47.40 on 28 March 2022 to $17.92 on 28 December 2022, vs. a peak-to-trough decline of 25.4% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 14 May 2024

• Since then, the stock has increased to a high of $48.75 on 14 May 2024 and currently trades at around $25

Covid Pandemic (2020)

• GME stock fell 18.3% from a high of $1.04 on 19 February 2020 to $0.85 on 26 February 2020, vs. a peak-to-trough decline of 33.9% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 10 March 2020

Global Financial Crisis (2008)

• GME stock fell 72.4% from a high of $15.82 on 25 December 2007 to $4.38 on 20 November 2008, vs. a peak-to-trough decline of 56.8% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 22 January 2021

Putting All The Pieces Together: What It Means For GME Stock

In summary, GameStop’s performance across the parameters detailed above are as follows:

• Growth: Extremely Weak

• Profitability: Extremely Weak

• Financial Stability: Extremely Strong

• Downturn Resilience: Weak

• Overall: Weak

In summary, GameStop’s performance across the parameters we’ve examined appears to be weak. This weakness, in our view, is not adequately reflected in the stock’s currently moderate valuation, which is why we find it unattractive. This reinforces our conclusion that GME is not a favorable stock to buy.

While you would do well to avoid GME stock for now, you could explore the Trefis Reinforced Value (RV) Portfolio, which has outperformed its all-cap stocks benchmark (combination of the S&P 500, S&P mid-cap, and Russell 2000 benchmark indices) to produce strong returns for investors. Why is that? The quarterly rebalanced mix of large-, mid- and small-cap RV Portfolio stocks provided a responsive way to make the most of upbeat market conditions while limiting losses when markets head south, as detailed in RV Portfolio performance metrics.

Invest with Trefis

Market Beating Portfolios | Rules-Based Wealth

Read the full article here