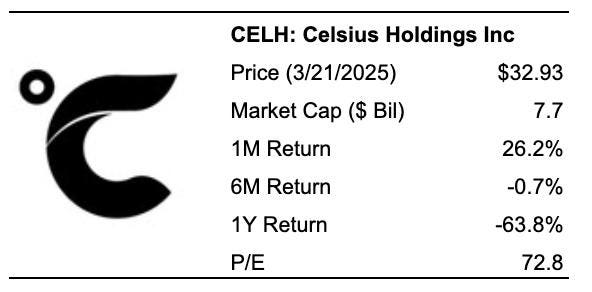

Celsius (NASDAQ:CELH) stock surged over 20% last week, following the announcement of a new distribution agreement with Suntory Beverage & Food Benelux, facilitating Celsius’s expansion into Belgium and Luxembourg. [1]

This move reinforces Celsius’ successful global expansion strategy. This move comes shortly after Celsius’ acquisition of Alani Nu for $1.65 billion.

Also, the recently released data for retail sales is largely seen as positive. Retail sales showed a slight 0.2% increase for the month, a recovery from the previous month’s revised 1.2% decline. However, this fell short of the anticipated 0.6% growth. Excluding auto sales, the 0.3% increase met expectations. [2]

After its recent move, CELH stock looks attractive but volatile – making it a tricky pick to buy at its current price of around $33. We believe there is minimal cause for concern with CELH stock, which makes it attractive, but highly sensitive to adverse events as its current valuation is very high.

We arrive at our conclusion by comparing the current valuation of CELH stock with its operating performance over the recent years as well as its current and historical financial condition. Our analysis of Celsius along key parameters of Growth, Profitability, Financial Stability, and Downturn Resilience shows that the company has a very strong operating performance and financial condition, as detailed below. That said, if you seek upside with lower volatility than individual stocks, the Trefis High-Quality portfolio presents an alternative – having outperformed the S&P 500 and generated returns exceeding 91% since its inception.

How Does Celsius’ Valuation Look vs. The S&P 500?

Going by what you pay per dollar of sales or profit, CELH stock looks very expensive compared to the broader market.

• Celsius has a price-to-sales (P/S) ratio of 5.8 vs. a figure of 3.2 for the S&P 500

• Additionally, the company’s price-to-operating income (P/EBIT) ratio is 50.5 compared to 24.3 for S&P 500

• And, it has a price-to-earnings (P/E) ratio of 73.1 vs. the benchmark’s 24.3

How Have Celsius’ Revenues Grown Over Recent Years?

Celsius’ Revenues have seen massive growth over recent years, but the growth has slowed lately.

• Celsius has seen its top line grow at an average rate of 71% over the last 3 years (vs. increase of 6.3% for S&P 500)

• Its revenues have grown 2.9% from $1.3 Bil to $1.4 Bil in the last 12 months (vs. growth of 5.2% for S&P 500)

• Also, its quarterly revenues decreased 4% to $332 Mil in the most recent quarter from $347 Mil a year ago (vs. 5.0% improvement for S&P 500)

How Profitable Is Celsius?

Celsius’ profit margins are around the median level for companies in the Trefis coverage universe.

• Celsius’ Operating Income over the last four quarters was $156 Mil, which represents a moderate Operating Margin of 11.5% (vs. 13.0% for S&P 500)

• Celsius’ Operating Cash Flow (OCF) over this period was $263 Mil, pointing to a moderate OCF-to-Sales Ratio of 19.4% (vs. 15.7% for S&P 500)

Does Celsius Look Financially Stable?

Celsius’ balance sheet looks very strong.

• Celsius’ Debt figure was $20.3 Mil at the end of the most recent quarter, while its market capitalization is $7.7 Bil (as of 3/21/2025). This implies a very strong Debt-to-Equity Ratio of 0.3% (vs. 19.0% for S&P 500). [Note: A lower Debt-to-Equity Ratio is desirable]

• Cash (including cash equivalents) makes up $890 Mil of the $1.8 Bil in Total Assets for Celsius. This yields a very strong Cash-to-Assets Ratio of 49% (vs. 14.8% for S&P 500)

How Resilient Is CELH Stock During A Downturn?

CELH stock has fared worse than the benchmark S&P 500 index during some of the recent downturns. While investors have their fingers crossed for a soft landing by the U.S. economy, how bad can things get if there is another recession? Our dashboard How Low Can Stocks Go During A Market Crash captures how key stocks fared during and after the last six market crashes.

Inflation Shock (2022)

• CELH stock fell 46.1% from a high of $25.03 on 3 January 2022 to $13.50 on 27 January 2022, vs. a peak-to-trough decline of 25.4% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 6 July 2022

• Since then, the stock has increased to a high of $96.11 on 13 March 2024 and currently trades at around $30

Covid Pandemic (2020)

• CELH stock fell 51.5% from a high of $2.21 on 4 March 2020 to $1.07 on 16 March 2020, vs. a peak-to-trough decline of 33.9% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 18 May 2020

Putting All The Pieces Together: What It Means For CELH Stock

In summary, Celsius’ performance across the parameters detailed above are as follows:

• Growth: Strong

• Profitability: Neutral

• Financial Stability: Extremely Strong

• Downturn Resilience: Weak

• Overall: Strong

Celsius Holdings stock currently commands premium valuations, but these are justified by the company’s impressive sales and earnings growth trajectory in recent years. The energy drink maker has established itself as a formidable competitor to industry giants like Monster Beverage and Red Bull.

The company received a significant boost when PepsiCo purchased an 8.5% ownership stake in 2022. This strategic partnership has been particularly beneficial, as access to PepsiCo’s extensive distribution network has accelerated Celsius’s recent growth and market penetration. The company’s entry in a new market and acquisition of Alani Nu will further bolster the company’s sales growth. Overall, despite its very high valuation, the stock appears attractive but volatile, which supports our conclusion that CELH is a tricky stock to buy.

Not too happy about the volatile nature of CELH stock? The Trefis High Quality (HQ) Portfolio, with a collection of 30 stocks, has a track record of comfortably outperforming the S&P 500 over the last 4-year period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride as evident in HQ Portfolio performance metrics.

Invest with Trefis

Market Beating Portfolios | Rules-Based Wealth

Read the full article here