Mortgage rates may decline somewhat in 2025 but the Federal Reserve currently expects interest rate cuts to be limited. Where mortgage costs trend from here will depend in part on unemployment and inflation data, which will, in term, inform interest rate decisions from the Fed. It seems likely that mortgage costs will remain relatively high compared to recent history for 2025. However, in recent years historically unusual factors have pushed up mortgage costs fractionally and those could reverse.

Mortgage Rates Have Been Bumpy

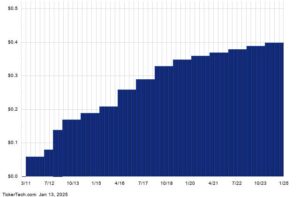

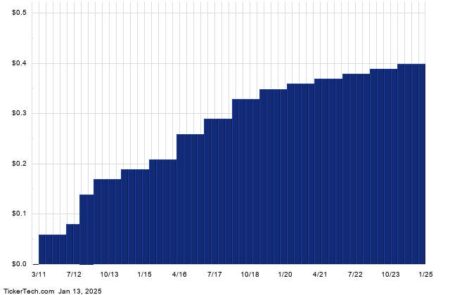

So far the decline in mortgage costs from November 2023’s peak levels has been bumpy. Despite an overall reduction in borrowing costs over the past two years, the 30-year mortgage rate recently moving up from a little over 6% in September 2024 to closer to 7% in January 2025. That contrasts with longer term mortgage rates holding at historically low levels of between 2% and 3% for much of 2020 and 2021.

In addition, Fed actions do not directly determine mortgage rates because of the influence of the changing slope of the yield curve and the spread between government borrowing and mortgage costs. Changes to these factors will impact mortgage rates too. Over the past six months, the yield curve has steepened, that’s drive up mortgage costs, which are longer term than the short-term interest rates that the Fed has been cutting since July 2024.

What Could Bring Mortgage Rates Down

In terms of economic data, if unemployment were to rise sharply in 2025, that could prompt the Fed to cut interest rates in response to recession risk and thereby drive mortgage costs down. However, according to recent reports the job market has shown resilience with larger than expected job growth. Therefore the chance of an unemployment spike in 2025 is not currently considered likely, but relatively quick and unexpected changes in unemployment are possible.

The other primary metric for the Fed is inflation. Inflation has decelerated significantly from peak levels. However, for now, inflation appears relatively sticky at closer to 3% and is not on track to hit the Fed’s 2% annual target currently. Given the relatively positive employment picture, the Fed is currently holding out for further improvements in inflation as a potential driver for future interest rate cuts. So far that hasn’t happened and interest rate cuts could be delayed as a result. Nonetheless, the overall expectation is that the Fed is looking to cut rates over time, but the timeline is uncertain.

Other Factors Influencing Mortgage Rates

Mortgage costs have risen incrementally higher in recent years as the spread between the 30-year mortgage rate and the Treasury 10-year interest rate has widened. That’s according to research by the Brookings Institution. This spread has narrowed since peak levels of 2023, but remains elevated in a historical context, meaning that mortgage costs are higher than is historically typical by approximately 0.5%.

Part of the reason for this appears to be the expectation that mortgage rates may decline in future and the associated uncertainty for long-term rates. This creates prepayment risk for mortgage lenders because today’s new mortgages may be refinanced at lower rates in subsequent years if interest rates decline as many expect.

Fannie Mae and Freddie Mac guarantee about 70% of U.S. mortgages. They therefore play an outsized role in the mortgage market. Since September 2008 both entities have been under conservatorship. Changes to this conservatorship are possible under the Trump administration in the eyes of some investors. This too, could have a potential knock-on impact mortgage rates though at this point there are no detailed plans or any timeline.

What To Expect For Mortgage Rates In 2025

Market expectations often change quickly. For now, expectations for interest rate cuts in 2025 are relatively limited. This may limit the potential for lower mortgage rates. However, other factors have push up mortgage costs to relatively high levels compared to government borrowing rates in recent years. A return to more normal levels there could help bring interest rates down a little, even if the Fed don’t cut rates materially. Drastic changes to mortgage rates are not expected in 2025, but they may decline somewhat.

Read the full article here