- My son knows how much money we make and what we’re spending on bills, car payments, and groceries.

- We’re teaching him how to spend wisely and to ensure that we manage everything within our means.

- He now actively participates in budgeting, advising on spending, and spotting deals.

Imagine a 12-year-old auditing your grocery cart. That’s my reality, and I wouldn’t have it any other way.

Many parents keep money matters away from their children, but I do the opposite. My eldest son, a curious 12-year-old, has a real say in how our family spends and saves, and it’s been one of the smartest parenting moves I’ve made. Some people judge me for it, saying that I share too much, but the results speak for themselves. His spending wisdom is definitely becoming better than some adults I know.

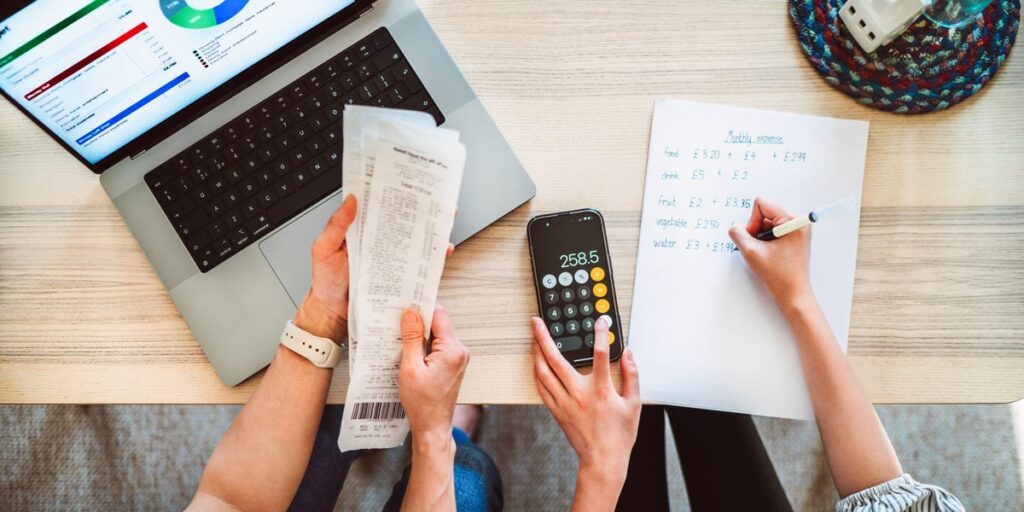

We are quite transparent when it comes to budgeting

Last November, we got a new car. The monthly payments take up a significant chunk of our income, so I decided to show my son how as a family we need to spend wisely to ensure that we manage everything within our means.

Now, every month, I share a Google spreadsheet with our updated household budget with my son. It includes line items such as our car loan, grocery expenses, and utility bills. This is teaching him to understand basic financial literacy, like how keeping electricity usage low translates to extra savings. He’s also aware of how much my husband and I earn, and instead of burdening him, it has helped him grasp financial realities earlier than many of his peers.

I have also given him independence in handling small expenses, like ordering food or buying personal items. He learned the hard way that once his allowance is spent, there’s no extra money coming his way. But that lesson has made him a more conscious spender. He no longer splurges on things he doesn’t need, and he’s even talked me out of impulse buys more than once.

I wanted to teach my son about managing money. As a bonus, I got a child who advises me on saving and keeps me accountable for my own spending habits.

My son’s confidence in handling finances is growing

A few weeks ago, we were at the grocery store, and I, driven by impulse, tried adding a ‘luxury’ brand of cereal into our cart. My son caught me and, with a withering look, said, “Mama, we need to stick to the plan.” At that moment, I felt both proud and slightly trapped. I had raised someone responsible enough to understand finances, but now I had to lead by example more than ever.

He’s a natural at spotting deals. He consistently steers us toward discount aisles and special offers when shopping. When we plan to eat out, he checks for deals and suggests places where we’ll get the best value. Once, he even pointed out an error on our restaurant bill, saving us from being overcharged. He knows the less we spend, the more we save, which can be used for bigger purchases down the road.

His understanding of budgeting goes beyond small savings. Recently, he suggested cutting his own allowance slightly so we could afford a family streaming subscription. He reasoned that it would be a net positive because “we all win,” as he explained. I was half-impressed and half-concerned. It’s not every day a 12-year-old willingly offers to take a pay cut.

My approach is unconventional, but it has amazingly positive outcomes

Some people think my approach is too much, believing kids should be shielded from financial stress. Some family members even say I’m revealing too much about our income and expenses. But my son isn’t carrying the burden of running a household. He simply understands our financial situation, and that knowledge has made him more mature, responsible, and confident.

This approach has also made it easier to negotiate my son’s demands. While he still occasionally asks for things like new bicycle or gaming system, he also understands when something isn’t financially feasible. It’s not about making kids ask for less. It’s about making them ask wisely.

Some might see this as unconventional parenting, but I see it as preparing my child for the real world. And from what I’ve seen so far, he’s more than ready for it.

Read the full article here