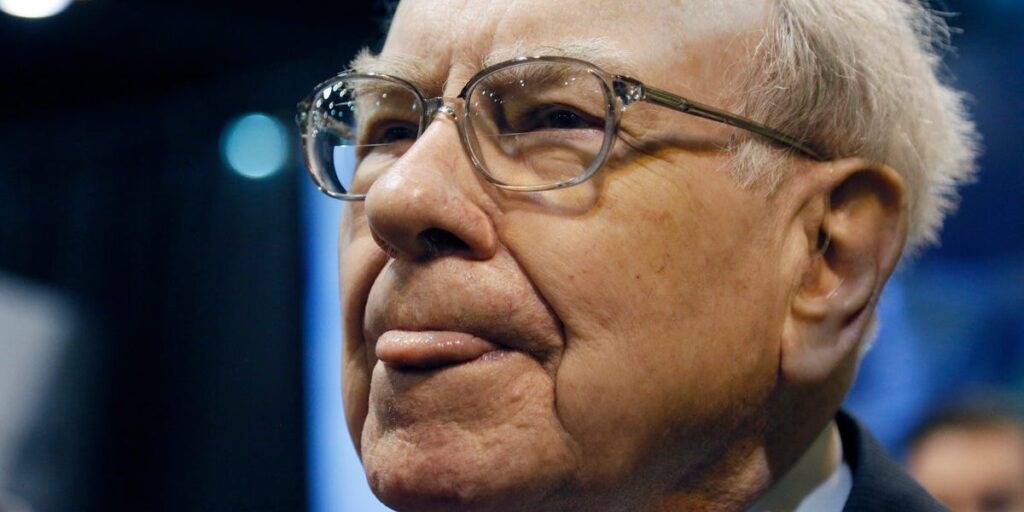

Warren Buffett just delivered a masterclass in succession planning with his own theatrical flourish, balancing his desire for a smooth departure and his taste for high drama.

The famed investor shocked the world on Saturday when he told a stadium packed with Berkshire Hathaway shareholders that he planned to step down as CEO at the end of this year, making way for his hand-picked successor, Greg Abel.

Years in the making

The “Oracle of Omaha” has been preparing his shareholders for his retirement as CEO for a long time.

He’s frequently underlined his advanced age in shareholder letters and interviews. He’s also talked up Abel’s management prowess and central role in running Berkshire, and even compared him to his late business partner, Charlie Munger.

“At 94, it won’t be long before Greg Abel replaces me as CEO and will be writing the annual letters,” Buffett wrote in this year’s missive. He said that in the rare moments when bargains abound, Abel has “vividly shown his ability to act at such times as did Charlie.”

Buffett has built a team to replace him that includes Abel, insurance chief Ajit Jain, investment managers Todd Combs and Ted Weschler, and his son Howard. His job will be to preserve Berkshire’s culture as chairman once Buffett is no longer around.

The billionaire philanthropist has also detailed that upon his death, his Berkshire stock will be placed in a trust for his children to allocate toward good causes. The move should help prevent an activist investor scooping up his shares once he’s gone and seeking to dismantle the company he built.

Successful leaders prepare their companies for when they step down, Bret Bero, an assistant professor of practice in management at Babson College, told Business Insider.

Buffett has done plenty to prepare for this transition, but ultimately its “success will be measured” by how Berkshire performs under Abel, Bero said.

Softening the blow

Buffett knew his resignation news could spook investors — Berkshire stock fell 5% on Monday — so he took pains to reassure his shareholders.

He plans to remain CEO until the new year, and continue as Berkshire’s chairman beyond that, indicating he’ll still be overseeing Berkshire and guiding Abel for a while yet.

Buffett pledged not to sell a single share of his near-14% stake in Berkshire, a position worth more than $160 billion. He championed Abel in the process, describing the move as an “economic decision” because he expected the company to fare better under his successor.

Spilling the beans on his retirement to stockholders without first telling Abel or Berkshire’s board (apart from two of his children who are directors) also sent the message that he truly values their trust in him and acts in their interests.

“It’s basically a thank you to all those long-time shareholders who have stuck with the company,” Jason Schloetzer, an associate professor at Georgetown University’s McDonough School of Business, told BI.

Zooming out, Buffett may have felt that personally selecting Abel to succeed him would help win over Berkshire shareholders. That approach eschewed the corporate norm of hiring a consulting firm to search the world for external candidates, said Larry Cunningham. He is the director of the University of Delaware’s Weinberg Center on Corporate Governance and the author of several books about Buffett and Berkshire.

“Here we have an excellent succession plan created by deep and long thought,” he told BI, adding that the “best practice for one company is not the best practice for all.”

Putting on a show

Buffett may have readied Berkshire shareholders for his retirement, but he couldn’t resist breaking the news in dramatic style.

He kept the decision a secret, giving no advance warning to either non-family board members or Abel, who sat next to him on stage. That limited the risk his big surprise would be leaked or spoiled and ensured it had maximum impact.

He fielded questions for nearly five hours before dropping the bombshell in his closing comments and leaving to a standing ovation, throwing out the planned agenda. That made it the climax of his Q&A session and the entire weekend.

Keeping tight-lipped avoided “speculation or fanfare” beforehand, freeing Buffett to focus on answering questions and to “enjoy the engagement with shareholders without the succession overhang,” Macrae Sykes, a portfolio manager at Gabelli Funds, told BI.

“He has always created great, positive Berkshire theatre and this deserved another Oscar as well as consideration for a lifetime award,” Sykes added.

Buffett is a “great showman,” Steve Hanke, a professor of applied economics at Johns Hopkins University who’s been teaching Buffett-style valuation for decades, told BI.

“He knows that either you run the show or the show runs you,” Hanke said, nodding to the fact that if Buffett had let slip the news early, the crowd reaction and media frenzy would have overwhelmed anything he said afterward.

Schloetzer also hailed Buffett’s icon status and marketing flair, saying that a “unique leader gets to design his surprise finale.”

“No Form 8-K or email blast could pull off such a memorable moment,” he added.

Read the full article here