Question: How would you feel if you owned Visa stock (NYSE: V) and its value dropped by 35% or more in the coming months? Although such a drastic move might appear extreme, it has happened before and could occur again. Visa stock has shown mixed performance recently. It has risen by roughly 8% since early January this year, even as the S&P 500 has fallen by 4% over the same period. Visa benefited from stronger-than-expected Q1 FY’25 results (Sept. year), driven by rising payment volume and increased cross-border activity. However, several near-term challenges remain. The overall market is experiencing a significant sell-off, spurred by growing worries about a U.S. recession after tariffs were imposed by President Donald Trump on major trading partners. This situation could notably affect Visa, as its business is closely linked to consumer spending and international travel volumes.

Here’s the point: The main takeaway is that in a downturn, Visa stock might suffer substantial losses. Data from 2020 shows that V stock lost about 35% of its value in only a few quarters, and it experienced a peak-to-trough decline of around 25% during the 2022 inflation shock—performing slightly worse than the S&P 500. This raises the question: Could the stock drop further and hit as low as $220 if a similar scenario unfolds? Naturally, individual stocks tend to be more volatile than diversified portfolios. Therefore, if you are searching for growth with lower volatility, you might consider the High-Quality portfolio, which has outperformed the S&P 500 by generating returns of over 91% since its inception.

Why Is It Relevant Now?

President Donald Trump’s aggressive tariff policies – including a 20% tariff on Chinese imports and 25% on imports from Canada and Mexico, along with stricter immigration controls – have raised fears that inflation could return. All of these factors suggest that the U.S. economy might face serious challenges and even a recession – as discussed in our analysis here on the macro picture. In fact, during a recent interview, the President did not rule out that additional tariffs might spark a recession. When considering the increased uncertainty stemming from the Trump administration’s policies, these risks become even more significant. Additionally, the ongoing Ukraine–Russia conflict and global trade tensions further cloud the economic outlook. Tariffs lead to higher import costs, which in turn drive up prices, reduce disposable income, and weaken consumer spending.

These factors could affect Visa in several ways. Higher prices might force consumers to cut back on non-essential purchases, potentially reducing transaction volumes on Visa’s network. If a recession follows, job losses and lower incomes could further depress spending and payment volumes. Businesses, facing increased costs, may also reduce their budgets, leading to lower corporate spending and fewer business transactions. Furthermore, if economic uncertainty curbs travel, Visa’s high-margin cross-border payments could suffer, adversely affecting its revenues and profit margins.

How resilient is V stock during a downturn?

Visa stock has been more resilient than the S&P 500 index during some recent downturns. Although investors are hoping for a soft landing for the U.S. economy, one wonders how severe the situation could become if another recession occurs. Our dashboard How Low Can Stocks Go During A Market Crash shows how key stocks performed during and after the last six market crashes.

Inflation Shock (2022)

• Visa stock fell 24.5% from a high of $235.42 on 2 February 2022 to $177.65 on 2 October 2022, compared to a peak-to-trough decline of 25.4% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 30 June 2023

• Since then, the stock has climbed to a high of $362.71 on 2 March 2025 and is currently trading at around $340

Covid Pandemic (2020)

• Visa stock dropped 36.4% from a high of $213.31 on 19 February 2020 to $135.74 on 23 March 2020, versus a peak-to-trough decline of 33.9% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 28 August 2020

Global Financial Crisis (2008)

• Visa stock declined 52.1% from a high of $22.12 on 7 May 2008 to $10.61 on 20 January 2009, in contrast to a peak-to-trough drop of 56.8% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 18 December 2009

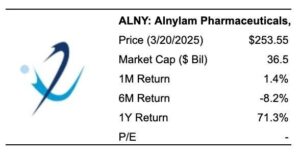

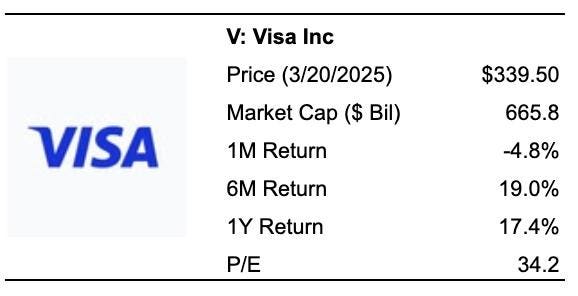

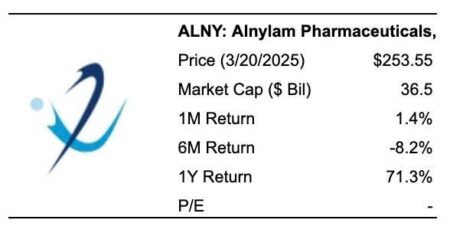

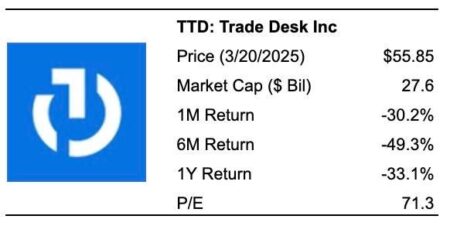

Premium Valuation

At its current price of approximately $340 per share, V is trading at around 31x consensus 2025 earnings, which appears somewhat high. The company’s revenue growth is also modest, with consensus estimates forecasting growth of about 10% per year over FY’25 and FY’26. Moreover, Visa has recently come under scrutiny from antitrust authorities. Last year, the U.S. Justice Department accused Visa of illegally operating a monopoly in the U.S. debit market by unfairly limiting competition. This issue also presents a risk for Visa stock.

Given this potential slowdown in growth and broader economic uncertainties, ask yourself the question: Will you continue holding your Visa stock now, or will you panic and sell if it begins falling to $150, $125, or even lower? Holding onto a declining stock is never easy. Trefis works with Empirical Asset Management—a wealth manager based in the Boston area—whose asset allocation strategies delivered positive returns during the 2008-09 period when the S&P lost more than 40%. Empirical has incorporated the Trefis HQ Portfolio into its framework to provide clients with improved returns and lower risk compared to the benchmark index—a smoother ride, as demonstrated by the HQ Portfolio performance metrics.

Invest with Trefis

Market Beating Portfolios | Rules-Based Wealth

Read the full article here