- Bank of Canada’s Macklem may shift CAD outlook with comments on tariffs, inflation risks, and economic momentum.

- The Loonie remains vulnerable with monetary policy divergence in focus.

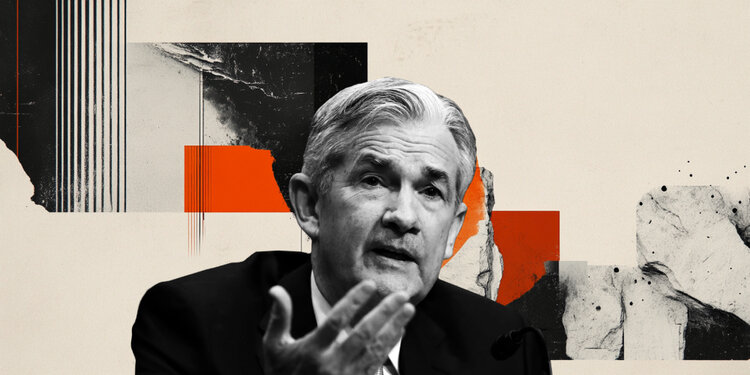

- Fed projections and Powell’s tone may influence the direction of the Greenback and bets on a September rate cut.

The Canadian Dollar (CAD) is trading flat against the US Dollar (USD) on Wednesday as markets adopt a cautious tone ahead of the Federal Reserve’s (Fed) Federal Open Market Committee (FOMC) Meeting.

At the time of writing, USD/CAD is holding steady at the 10-day Simple Moving Average (SMA) of 1.3651, with volatility expected to rise as traders digest the latest US economic data and await commentary from the Fed and the Bank of Canada (BoC).

Economic figures released earlier in the session point to a moderation in US growth momentum. May housing starts declined by 9.8% to 1.256 million, falling short of expectations. Initial Jobless Claims registered at 245,000 while continuing claims stood at 1.945 million, indicating a gradual softening in labor market conditions. These data points collectively reinforce the argument for a cautious policy approach from the Fed.

Fed to release updated projections, Powell’s tone key

The FOMC is expected to leave interest rates unchanged at 4.25%–4.50% when it announces its decision at 18:00 GMT.

However, investor attention will be on the updated Summary of Economic Projections (SEP) and revised dot plot, which will outline how Fed officials view the path for inflation, growth, and rates over the coming months.

According to the CME FedWatch Tool, markets currently assign a 58% probability to a rate cut in September, reflecting softer inflation and slowing demand.

Fed Chair Jerome Powell’s tone at the post-decision press conference will be critical. If Chair Powell expresses confidence that inflation is easing and downplays external risks, it could strengthen expectations for rate cuts, offering modest support to the Canadian Dollar.

However, if he highlights lingering tariff uncertainty and the potential inflationary impact of the Israel–Iran conflict, it may justify keeping rates higher for longer, supporting the US Dollar and driving USD/CAD higher.

BoC Governor Macklem’s speech may guide Canadian rate outlook

Attention will also turn to Bank of Canada Governor Tiff Macklem, who is scheduled to speak at the St. John’s Board of Trade at 15:30 GMT.

Governor Tiff Macklem’s speech is anticipated to address three core themes relevant to Canada’s economic outlook.

First, he is likely to revisit the risks posed by US-imposed tariffs, particularly their impact on Canadian exporters and trade-sensitive industries.

Second, Macklem is expected to assess the labor market and broader economic momentum, especially amid recent indicators of softening growth.

Finally, markets will closely monitor his commentary on inflation dynamics, specifically whether the recent easing in price pressure is sustainable or if additional monetary policy adjustments may be necessary.

This comes after Macklem delivered his “clear and present danger” warning during the BoC policy announcement and press conference on June 4.

Traders will be watching both Powell and Macklem for clues on the trajectory of interest rates. Their comments could cause the USD/CAD to shift sharply as policy divergence and global risks continue to be key drivers.

Central banks FAQs

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.

holding steady at the 10-day Simple Moving Average of

Read the full article here