The Institute for Supply Management (ISM) is scheduled to release the September Services Purchasing Managers’ Index (PMI) this Friday. The report is a well-trusted measure of business performance in the sector, but it is usually published on the same date as the US Nonfarm Payrolls (NFP) report, which diminishes its relevance.

This time, however, things are different, as the NFP is unlikely to be published due to the ongoing United States (US) government shutdown. The US ran out of funding on Wednesday, not for the first time, nor the last. Among the immediate consequences of a shutdown are the delays and cancellations of data collection and publication, resulting in the country’s inability to provide fresh unemployment figures on Thursday.

As a result, market players are focusing on macro figures offered by independent organizations. The ISM Services PMI is expected at 51.7 in September, slightly lower than the 52 reported in August, although still indicating expansion in the sector.

What to expect from the ISM Services PMI report?

The August ISM Services PMI showed activity grew for the third consecutive month, expanding for the 13th time in the last fourteen months. The report also revealed that the New Orders Index remained in expansion in August, printing at 56, which is significantly better than the 50.3 recorded in July. The Employment Index, however, remained in contraction territory for the third consecutive month, with a reading of 46.5, slightly higher than the previous 46.4. Finally, it is worth noting that the Prices Index registered 69.2 in August, down from July’s reading of 69.9.

Earlier in the week, ISM reported that manufacturing output improved in September, albeit the index remained in contraction territory. The Manufacturing PMI printed at 49.1, following the 48.7 posted in August.

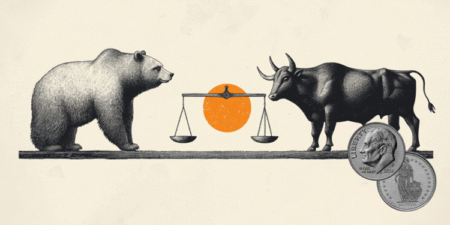

The poor performance of the manufacturing sector is a well-known issue that has persisted since the COVID-19 pandemic. Services businesses, on the other hand, had flourished ever since, balancing the private sector’s overall activity.

Beyond the headline figure, market participants will closely monitor the employment and inflation indexes. The fact that the employment sub-component indicates contraction, as price pressures ease, is a reason for the Federal Reserve (Fed) to keep cutting interest rates. The latest figures reinforced the idea, as the ADP Employment Change survey showed that the private sector lost 32,000 jobs in September and another 3,000 in August.

When will the ISM Services PMI report be released, and how could it affect EUR/USD?

The ISM Services PMI report is scheduled for release at 14:00 GMT on Friday. Ahead of the data release, the EUR/USD pair trades below a weekly peak of 1.1778, struggling to retain the 1.1700 level.”

Valeria Bednarik, FXStreet Chief Analyst, notes: “The EUR/USD pair is in wait-and-see mode, unable to attract investors. The positive momentum has been eroding ever since the pair peaked at 1.1918 in mid-September, while the bearish potential remains well-limited. Given the ongoing uncertainty, the market’s reaction could be limited. An upbeat report won’t be a surprise, providing limited support to the USD. An unexpected discouraging reading, on the contrary, could push EUR/USD initially towards the 1.1770 region, with the next near-term resistance levels at 1.1830 and the aforementioned 1.1918.”

Bednarik warns: “The EUR/USD pair can turn south on a clear break below the 1.1690 mark, the next relevant support is 1.1645, the September 25 low.”

Economic Indicator

ISM Services Prices Paid

The ISM Non-Manufacturing PMI released by the Institute for Supply Management (ISM) shows business conditions in the US non-manufacturing sector, taking into account expectations for future production, new orders, inventories, employment and deliveries. It is a significant indicator of the overall economic condition in the US. The ISM Prices Paid represents business sentiment regarding future inflation. A high reading is seen as positive for the USD, while a low reading is seen as negative.

Read more.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Read the full article here