In the last two months, Moira MacLean has stopped eating out, paused making bigger purchases, and started searching for a part-time job.

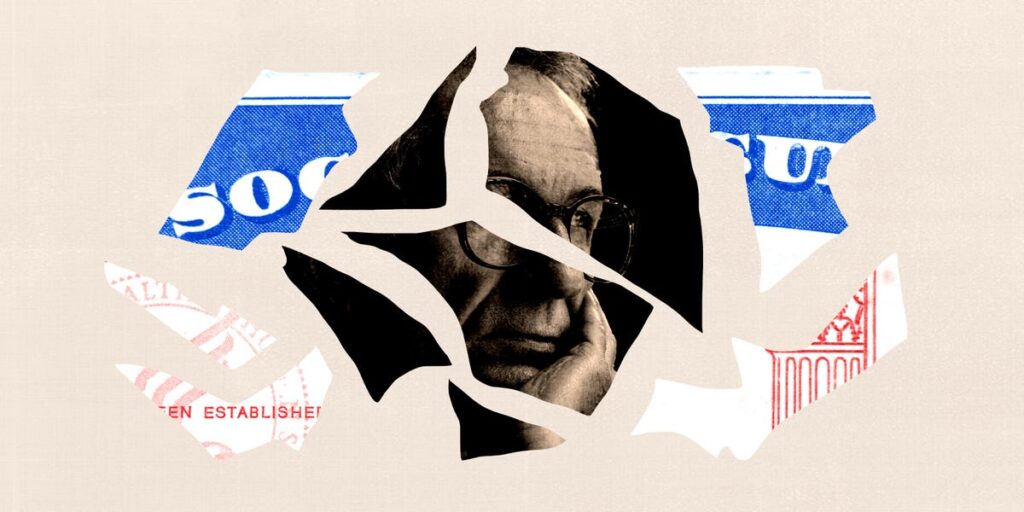

MacLean, 69, is one of many older Americans who are scared about what announced cuts to the Social Security Administration could mean for their benefits and access to resources. Several told Business Insider they’re making plans and adjusting their spending, just in case.

“All I can do is cross my fingers and hope,” MacLean said. The Washington resident added that her savings are dwindling and she relies on her $2,280 monthly in Social Security after Medicare deductions. “It’s really nerve-racking.”

The SSA said it would cut about 7,000 staff members and close six of its 10 regional offices as the Trump administration and DOGE have announced widespread federal cost-cutting measures. President Donald Trump said that Social Security benefits would not be touched amid these changes, but 11 older Americans told Business Insider they’re worried the cuts could result in delayed payments or inadequate assistance.

Since these changes were announced, the SSA website has had lengthy outages that have locked customers out of their accounts, and wait times for the 800 number have skyrocketed. The older Americans BI spoke with said they’re concerned that if a payment is late or if they receive the incorrect amount, they won’t be able to get the necessary help due to these issues.

“Any American receiving Social Security benefits will continue to receive them,” Karoline Leavitt, White House Press Secretary, told Business Insider in a statement. The SSA didn’t respond to a request for comment.

Rob Williams, managing director of financial planning, retirement income, and wealth management at Charles Schwab, said older Americans should not make major financial decisions based solely on emotions.

“There are always news events, market dips, concerns about healthcare costs, and other issues that come up and that worry older Americans,” Williams said.

Some are reducing spending and looking for more income

MacLean has dealt with Social Security frustrations over the last few months, including being unable to log into her benefits account and struggling to get customer assistance. She retired two years ago but in light of the recent changes to the SSA, she’s looking to reenter the workforce.

Dinah Buck, 67, is also casually looking at the job market. She retired seven years ago on disability from a three-decade career as a pharmaceutical sales representative. She receives over $3,000 in Social Security monthly after Medicare deductions and a retirement annuity but isn’t panicking.

“I’ve started to feel more confident in my ability to manage my financial life after going through so many ups and downs the last few years,” said Buck, referring to an expensive divorce and selling a home at a loss.

Diana Bill Jordan, 77, said there’s little she can do to safeguard her finances other than limiting spending and continuing to work making and selling perfume. She added any shifts to her benefits could be disastrous for her family — she’s already at risk of losing her home.

Bill Jordan, who lives in Texas, gets $670 monthly in Social Security, while her husband receives about $1,200.

“We’re already in deep trouble, and if our Social Security is delayed, we’d be the faceless homeless folks in the woods,” Bill Jordan said.

Some are putting dreams on pause

For some older Americans, the discourse surrounding Social Security is pushing them to delay large purchases or seek family assistance.

Kathy Heller, 67, said her dreams of moving from her studio apartment to a duplex may be crushed. While she’s concerned about her Social Security checks, she’s also worried that falling stock prices and rising home values could set her back.

“I’ve been wanting to move for the last couple of years, and I just can’t now,” said Heller, who works as a real estate agent and lives in Pennsylvania. “Everything’s changed.”

Heller, who also receives Social Security survivor benefits, added that, in February, she waited four hours to speak with an SSA representative. Last year, she said she barely waited.

“I am worried about May, June, and July,” Heller said, referring to her finances if Social Security is disrupted. She doesn’t have much in savings, as she used most of her retirement money caring for her sick husband.

Donna Barton Gifford, 79, declared bankruptcy a few weeks ago and is moving in with her daughter.

“That’s one reason I’m moving in with family so that I don’t have to live in my car,” said Barton Gifford, who worked in IT and was the sole breadwinner of her family for many years. “If the checks don’t come when they’re supposed to, everything in my life is blown.”

Barton Gifford, who receives about $3,600 monthly in Social Security benefits, said she’s “never been this scared” about her future and doubts she’ll have enough for a long-term care facility if she can only stay with her daughter temporarily.

Some aren’t worried — and even applauding cuts

Some older Americans feel calm about what the changes to Social Security could mean for them.

Michelle Husberg, 62, said she and her husband aren’t panicked — the couple, who live in Utah, have saved over $3 million. Husberg, who retired from nursing two years ago, doesn’t plan to draw from Social Security until she’s 67 but her husband is collecting Social Security.

“I’m not too worried about it personally, but I do worry that cutting staff could make it difficult for people needing help,” Husberg said. “I think that something has to change to Social Security before it goes bankrupt, but I don’t think anything should change for those currently receiving it.”

Cheryl Wagner, 78, said she’s comfortable living on her income and isn’t too worried about any potential shifts to Social Security benefits. Wagner backs Trump and is “so glad to see him doing what I agree needs done,” she said.

A few weeks ago, she bought a new car and has recently started a new business selling her artwork at craft shows to help fund work on her house.

“The expenses could hurt me but I’m willing to take that chance,” Wagner said.

Read the full article here