While it was created with good intentions 13 years ago, the Federal Open Market Committee’s dot plot does not serve its primary purpose: providing transparency on FOMC members’ thoughts about future rates. Today, the dot plot has devolved into a chart that investors and analysts price in as the expected, forecasted outcome.

I have three reasons why this is a problem: the dot plot doesn’t have a good track record, its dispersion among FOMC members is not reflective of actual votes and it can contradict the message the FOMC is trying to send.

In my opinion, the FOMC should put a stop to the dots—it causes more confusion and volatility than benefits.

What Is The Dot Plot?

For those unfamiliar, the Federal Reserve first released the dot plot as part of its quarterly Summary of Economic Projections in 2012 as part of an effort to become more transparent around its decision-making process.

The dot plot is a graphical representation of where every member of the FOMC, both voting and non-voting, believes the fed funds rate will be at the end of each of the next three or four years in addition to a longer-term projection. As the years have gone on, market analysts have interpreted this information as the FOMC’s forecast for where policy rates are headed.

Reason #1: The Dot Plot Has A Poor Forecasting Record

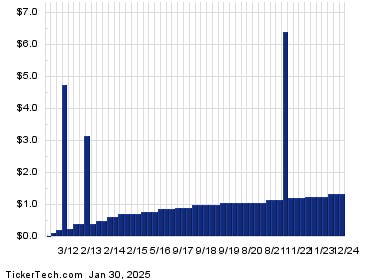

If the local meteorologist were as accurate at forecasting as the dot plot, residents would be extremely unhappy. The dot plot’s ability to forecast the fed funds rate one year in advance is roughly 50%. The most significant error differences (yellow) between the actual effective fed funds rate (green) and one year out forecast (black) are depicted in the chart below.

It should be no surprise to investors that the members of the FOMC do not have a crystal ball into the future. They do not possess any special insight that allows them to anticipate exogenous events that will affect their mandates of promoting maximum employment and stable prices.

Reason #2: The Dot Plot’s Dispersion Among FOMC Members Is Not Reflective Of Actual Votes

The distribution of the dots would also suggest that there is substantial disagreement among the members, but when it comes to the actual vote, a majority have been unanimous.

As an example, the dot plot released in December 2023 (below) showed a range of participants expectations from a low of 3.875%, a high of 5.37% and a median of 4.625% for year-end 2024 forecast. The actual effective fed funds rate at the end of 2024 was 4.33% and there was only one dissenting vote.

Since 2021, a majority of the FOMC decisions have been unanimous, with a single dissenting vote occurring only four times—very little disagreement despite what the dots would have suggested.

Reason #3: The Dot Plot Can Contradict The FOMC’s Intended Message

There have been many instances where members of the FOMC have invoked the “data dependency” of future rate changes. Yet an analysis of the dot plot at that time would suggest that there is a bias towards future actions.

For example, during the July 2024 press conference, Chair Powell reiterated a data dependency stance, yet the dot plot at the time showed a majority of participants were looking for a reduction in rates for the year and in years ahead.

Honorary Mentions

The survey time periods, which only allow for year-end data, is perplexing. Instead of a six-month or 12-month outlook, they choose to focus on year-end values. That makes little sense if you are looking for transparency about the next meeting’s decision.

Additionally, the dot survey is conducted on a quarterly basis, which does not sync with FOMC’s meetings approximately every six weeks.

What Has The Fed Said About The Dot Plot?

Since the genesis of the dot plot, the FOMC has been clear that it is not the endorsed view of the committee but rather the viewpoint of individual members. In her March 2014 press conference, then-Fed Chair Janet Yellen commented, “I think that one should not look to the dot plot, so to speak, as the primary way in which the Committee wants to or is speaking about policy to the public at large.”

Chair Jerome Powell offered a similar assessment in December 2024, saying, “These projections, however, are not a Committee plan or decision.” Despite the repeated warnings, market analysts continue to see the dot plot as the Fed’s forecast.

Even FOMC members have gone so far as to question its usefulness. “It’s not a decision-making document, and it shouldn’t be viewed as such,” said Raphael Bostic, president and chief executive officer of the Atlanta Federal Reserve.

Chair Powell said it best in December 2019: “I do like to say, if you focus too much on the dots, you can—you can miss the broader picture.”

The Bottom Line: The Dot Plot Is More Of A Hinderance Than A Help

In my opinion, the FOMC should discontinue the dot plot as it simply adds more uncertainty and confusion to the markets, which can lead to increases in volatility. The dots do little in adding to the Fed’s goal of increased transparency in messaging and decision making. There is no attempt at consensus, there is no debate or discussion. It’s simply a survey of participants. It’s time to put the dot plot to rest.

Read the full article here