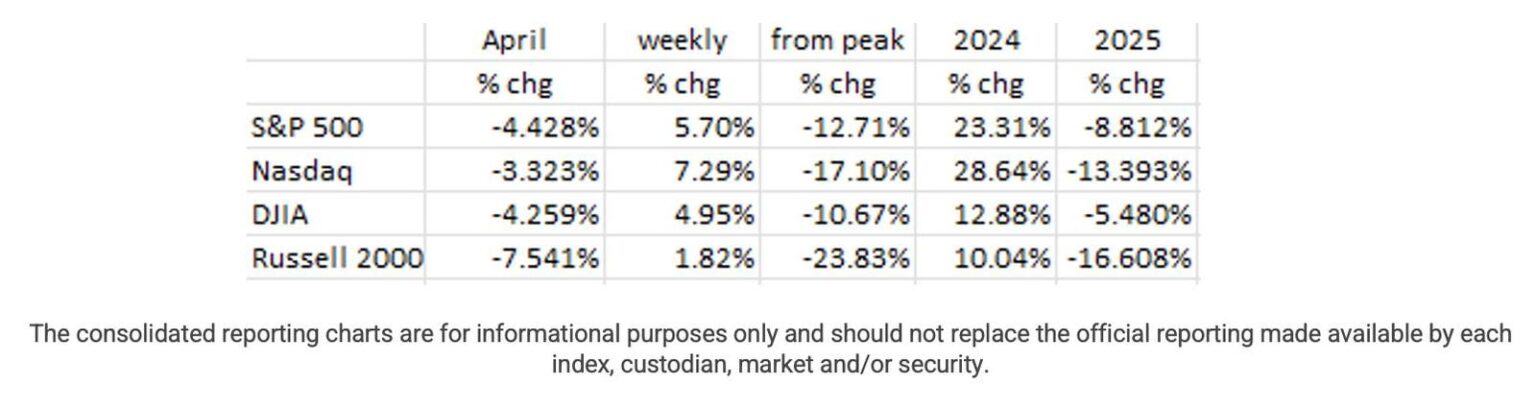

The tariff file has caused a high level of uncertainty both for consumers and businesses. As a result, all it took was the lifting of that uncertainty, via the 90-day suspension of higher tariffs, for the equity market to surge on Wednesday, April 9th. That day, the DJIA rose +7.9%, Nasdaq +12.2%, the S&P 500 +9.5%, and even the small cap Russell 2000 +8.7%.1 For the week as a whole, all four indexes were positive, led by the tech heavy Nasdaq as shown in the third column of the table. Still, equity markets remain negative for the month and year to date.1

In addition, it appears that the markets haven’t yet priced in a slowing economy (the latest Atlanta Fed Q1 GDP growth forecast is -2.4%).2 Another quarter of negative growth, as seems likely, will trigger the rule of thumb Recession call (i.e., two negative GDP growth quarters in a row) and would likely cause the National Bureau of Economic Research (NBER) to officially declare that the economy had entered a Recession.2

Evidence of a Slowdown and Rising Inflation Expectations

As further evidence of a slowing economy, the Challenger Gray and Christmas layoff data for March showed up at +275,240, the highest number for any March on record.3 Admittedly, much of this is due to DOGE’s layoffs of federal employees. But we also note that Retail lost -57,000 jobs in March (vs. -12,000 in March 2024), and that hiring was down -37.5% from a year ago.3

The ISM Services Index fell in March to 50.8 from 53.5 in February (50 is the demarcation line between expansion and contraction).4 While still showing minimal expansion, the large March pullback does not bode well for the April reading.4

The National Federation of Independent Business’ (NFIB) monthly business index fell to 97.4 in March from 100.7 in February.5 As the table shows, this index had a similar level at the beginning of the last six Recessions.

Note that the recent 97.4 level fits right into the table.

The University of Michigan’s (UM) Consumer Sentiment Index fell to 50.8 in April from 57.0 in March, quite the fall.10 Just for comparative purposes, this is the lowest level since June ’22 (Covid) and the second lowest reading on record dating back to 1952! Worse, the Trump tariffs have convinced the public that they will usher in more inflation as UM’s one-year inflation expectations index soared to 6.7% in April from March’s already high 5.0% reading.6The 5-year inflation expectations reading rose to 4.4% (from 4.1% in March), the highest reading for this index since 1991!

With such public expectations, the Fed has little choice but to forgo any rate reductions at its upcoming May meeting set.

The Tariffs

Despite the 90-day “pause” in the tariff file for most countries, the risk of Recession is rising due to the 145% tariff on imports from China in addition to the high and rising level of uncertainty.7 Tariffs normally have a negative impact on profit margins. When uncertainty rises, business growth expectations fall, and they tend to delay any expansion plans. In addition, consumers become more cautionary and tend to spend less and save more.1 The following chart indicates that this process has already begun.

With nominal income growth in the U.S. now showing weakness (i.e. the strong possibility of an oncoming Recession), that means either business profit margin compression or lower demand (or some combination of the two).9

During a Recession, the average equity market pullback is nearly -30%, normally over a 6 – 12-month period. And bond market yields fall by about 150 basis points (1.5 percentage points).11

The Fed

Fed Chair Powell says the Fed is waiting for the softening survey data to translate into hard data before moving toward lower interest rates. This, even though his own Atlanta Fed has pegged Q1 GDP growth at -2.4%.2 (As noted, there already are many economic signs that the economy is cooling both on the business side and on the consumer side.) Because of the long lags between changes in monetary policy and their impact on the economy, it appears that the Fed should be lowering rates now when the soft data show a weakening economy, to adjust for those long lags.11

Despite the timing of policy changes, it is clear that the next move in monetary policy is to continue to lower rates. The Fed has told markets that the “neutral” rate (known as R*) for the Federal Funds rate, is 3%. Right now, that Federal Funds rate is pegged between 4.25% and 4.50%. So, there’s 125 to 150 basis points (i.e., 1.25 to 1.50 percentage points) of rate reduction just to get to neutral.11 But, as noted above, because of the recent rise in inflation expectations, it is unlikely that the Fed will lower rates at its May meeting, and is likely to wait for Powell’s “hard data” requirement (despite the negative growth rate of Q1 GDP).11

If a Recession actually develops, the Fed will have to take that Fed Funds rate below neutral (3%), how far depends on the severity of the economic slowdown. (We note that the major investment banks have significantly increased their odds of a Recession occurring in 2025.)

Falling interest rates mean rising bond prices with the prices of longer-term bonds benefitting most. A note of caution here. China’s holdings of U.S. Treasury securities peaked at $1.3 trillion in 2014. Today, they stand at $700 billion.12 13 That still is a significant amount. The dumping of those securities could easily cause a spike in interest rates. In fact, we’ve recently seen a small spike in rates making us wonder if the selling has already begun.14

Final Thoughts

The 90-day tariff suspension lifted uncertainty (on Wall Street, 90-days is “long-term”) causing large-cap equities to bounce 5% – 7% for the week (small cap stocks were positive too, but to a lesser extent (+1.8%)). Nevertheless, it still appears that markets have not yet priced in a slowing economy and the rising probability of Recession.15

We continue to see evidence of an economic slowdown. Q1 GDP growth will be negative according to the Atlanta Fed (-2.4%). We see no catalyst to turn that around.

Layoff data were the highest for any March on record, which will soon translate into a higher unemployment rate.7

Other survey data, like the NFIB’s monthly business index and the University of Michigan’s Consumer Sentiment Index are also giving Recession signals.5 6

Tariffs, especially the large 145% rate on China, are bound to have negative impacts on business profit margins as well as a reduction in consumer demand as prices rise.7

The sudden rise in consumer inflation expectations, no doubt due to the tariffs, is bound to keep the Fed on the sidelines despite Q1’s negative GDP reading. Chair Powell sees the softening survey data but insists that the Fed will wait for the hard data before it acts. In our view, because of the lag time between when the Fed acts and its impact on the economy, that’s a mistake.11

(Joshua Barone and Eugene Hoover contributed to this blog.)

Read the full article here