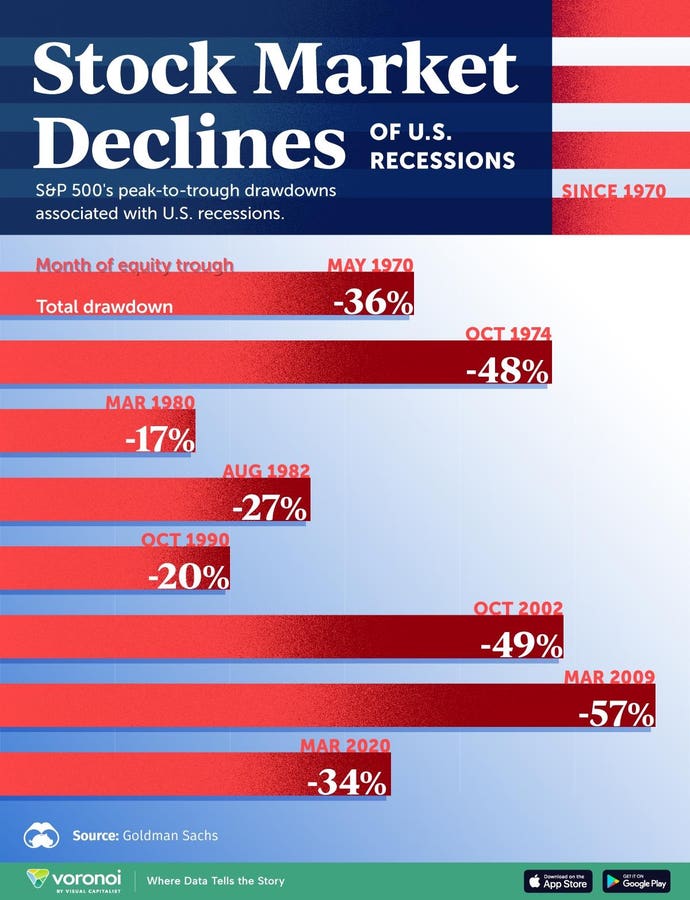

Picture this. The S&P 500 dropped about 15% in 1973 and then another 25% in 1974. That’s a loss of almost 40% over two years. In fact, the peak-to-trough decline was close to 50% over just a couple of years! (Market crashes compared). Now consider this: If you had invested $1 million in the S&P 500 on December 31, 1972 – right before two of the worst years for the benchmark index – what would that have turned into by the end of 2024? Here’s a request: write down your answer before reading ahead.

At first, your million dollars would have turned to about $600K over the first two years of your investment. That would feel bad. No, it would be horrifying! But here’s what would have happened to your money next: over the next 50 years or so, your $1 million would have turned to $200+ million by the end of 2024! A solid 200x, even after accounting for the massive 40% upfront drop in the first two years! Let that sink in.

In our earlier analysis on the same topic – S&P to Crash More than 40% – the first part, we detailed how the 3 pillars of the Trump administration’s plan: 1. Tariffs. 2. Taxes. and 3. Deportation – in combination, has the potential to stoke inflation and bring about a deep market drop similar to what we saw in 1973/74. In this part II of the analysis, we use a completely different lens to consider the “so what” of large drops – especially now in 2025.

Problem Worth Solving

Around the holidays, we were talking to Pete Martin, former head of distribution for a $1 trillion investment manager. At one point the conversation turned up a simple question: What’s a problem worth solving in the investment space?

Pete’s response: Humans are just hard-wired to invest at exactly the time when they should be scared, and in fact end up not investing when they should be keen to invest.

The problem worth solving is simple: it is for all of us to focus on the long term. Each day, keep our eyes on our long-term investment goals, even as – and especially when – we see the screen right in front of us flash green and red. Resist reacting. That’s it.

The 1,000x At Stake!

Hard numbers support Pete’s claim. Consider another related broad question: if you earned a 15%, or even a humble 10% annual return on a $1 million investment over, say, 50 years, what would that turn into? For context, the Trefis HQ portfolio strategy beat the S&P 500, won big, and clocked about 18% annual return since its inception in September 2020. HQ performance metrics here. The thing is 10-15% return is doable.

Here’s another thing, most people find a 2x return over the next 1-2 years more attractive1. Contrast that with a 1,000x upside – literally. Your $1 million investment, at a 15% annual return over 50 years would turn you into a billionaire. Even a 10% return is a nice $100 million you can sign off to. Not that humble after all! The point is simple: If you want 2x wealth, focus on the near term. However, if you’re serious about creating a 1,000x return, think long-term!

And yes, be boring – actively – in the near term. So what do you do – what does “actively boring” mean? Does focusing on the long term imply, doing nothing right now? Of course not. Quite the contrary. It’s in fact all about being active and data-driven.

Here are two example actions.

Action #1: Add a calendar reminder

Add an alert for the next Fed meeting, currently scheduled for Jan 29. Markets might move a lot. Add an entry to review this perspective of past crashes. Seriously, a calendar reminder to review an analysis that gets an entry only when things crash – historically once in 10-20 years – and helps remind us that even in those situations, a remarkable recovery followed each time. Almost everyone who reviews this analysis, says: huh, that “large” 1-day movement, was really just a blip in the bigger scheme of things. Why react to blips?

Want more food for thought? Review Buy or Fear analyses, and consider a possible scenario for a large drop in S&P, or our Investing and AI analysis, with the HQ outperformance journey.

Far from sitting idle, being actively boring is all about seeking data, asking questions – asking the “why” – in good times and bad. Suppressing reaction, and channeling that energy to learn. So being “actively boring” is really about thinking ahead. It is about planning. And, if you want to do this right, there is another dimension to planning it right.

Action #2: Trust a team

Even better than planning for one event like the next Fed meeting, go ahead and schedule a chat with Glenn Caldicott, CIO of Empirical. Indeed, we’ve built a team of math/AI experts – MIT’s Sandy Pentland and Ankur Moitra, more on the team here, right alongside market practitioners like Pete Martin and Glenn Caldicott who’ve invested 30+ years helping create wealth. In fact, feel free to ask Glenn about our long-term strategies and process. Ask him about the markets, alternatives to S&P, and why the Trefis HQ strategy that has outperformed S&P has worked. But also ask about the asset allocation strategies that he’s used with ultra-high net worth clients, and with smaller clients, helping them create wealth by preserving wealth in bad times like the 2008 crisis and the inflation spike of 2022.

The point is: don’t go solo. We’ve found that if you want to curb impulses and want to be less reactive, it helps to work with a team. A team to help develop and set achievable long-term goals. If nothing else, for most people even teaming up with a trusted partner, spouse, or friend helps. Ideally, you do more than that – and work with a team of experts. Experts who’ll help you be data-driven. Be long-term biased.

To be clear, being actively boring is not the usual index fund type of boring. It implies resisting reaction, while you’re curious. Seek data – seek to be data-driven, only data-driven. Seek to be an active investing citizen. Because this is exactly how you can execute against being boring for the next 50 years2. For the last many years, we’ve been building these principles right into our thinkHub million analyst aspirational system – highlighted in active citizenship of investing.

Stepping Back – Emotional Reaction

We’ve synthesized here 3 concrete examples of market situations that traditionally spark emotional responses. They seem simple – but become way easier to respond to in practice if you operate in a team.

Example 1: Strong, steady success. The S&P 500 has had a solid run in the last few years. However, the simple 30-stock-only Trefis HQ portfolio strategy outperformed S&P – the newer Trefis RV strategy is doing even better. See: the broader HQ and Trefis story

Question: So then is it time to double down on S&P or HQ? What about taking profits?

As drab as it sounds – you guessed it, long-term focus implies not jumping to an answer. Slow down to go fast – start with setting your goals. Writing them down is key – otherwise, it doesn’t count. Then, by all means, if you have extra investable cash, go ahead – allocate it in a manner consistent with your goals.

Example 2: Big Moves. Long-term focus also means not selling when the market and our favorite fund or ETF drops 10% or even 30% for that matter. The flip side is also true: let’s not stretch too thin, take out big loans to go after the hot run of a momentum stock.

Example 3: Comparisons. Repressing the urge to switch is difficult – wait, “Nasdaq is outperforming the S&P”, or “Trefis Ten-Stock strategy is outperforming the HQ”: “Should I switch?” No. Switching might actually make you move at exactly the wrong time. Instead, seek data. Seek to understand the “why” of performance – compare it against your written-down long-term objectives and the plan you’ve developed with your team of experts. If it makes sense, sure, gradually build a position.

If this all sounds simple, why is it then so hard to think long term, and look beyond what’s blinking on the screen in front of us? We’re going to be living for several decades – not minutes or hours – we all know that.

Why then do we often act like we have the lifespan of a fruit fly?

Why feel the urge to react to a 1% or even a 10% movement – why stress about each small bump in the road? It’s the biological fight or flight – the survival instinct that’s ingrained in humans – according to Pete Martin, and MIT professor Andrew Lo, who’s studied behavioral finance extensively. The flashing red and green spark emotion and appeal to the hard-wired, intuitive, reactive part of us. To clarify, the blinking red on a stock or finance app is definitely not designed with the mindset: ok this will make investors rational, and long-term focused. They are designed to engage you right now – the red and green have no interest in being boring. You want to be boring in the near-term, and exciting in the long run when it comes to your finances

Want to be wealthy? Focus on the long-term and choose to be boring! Purposefully boring. Actively boring.

Read the full article here