U.S. stock futures experienced declines following Israel’s airstrike on Iran, with S&P 500 futures dropping approximately 1.6%. This immediate market response reflects the index’s sensitivity to geopolitical developments that threaten global stability.

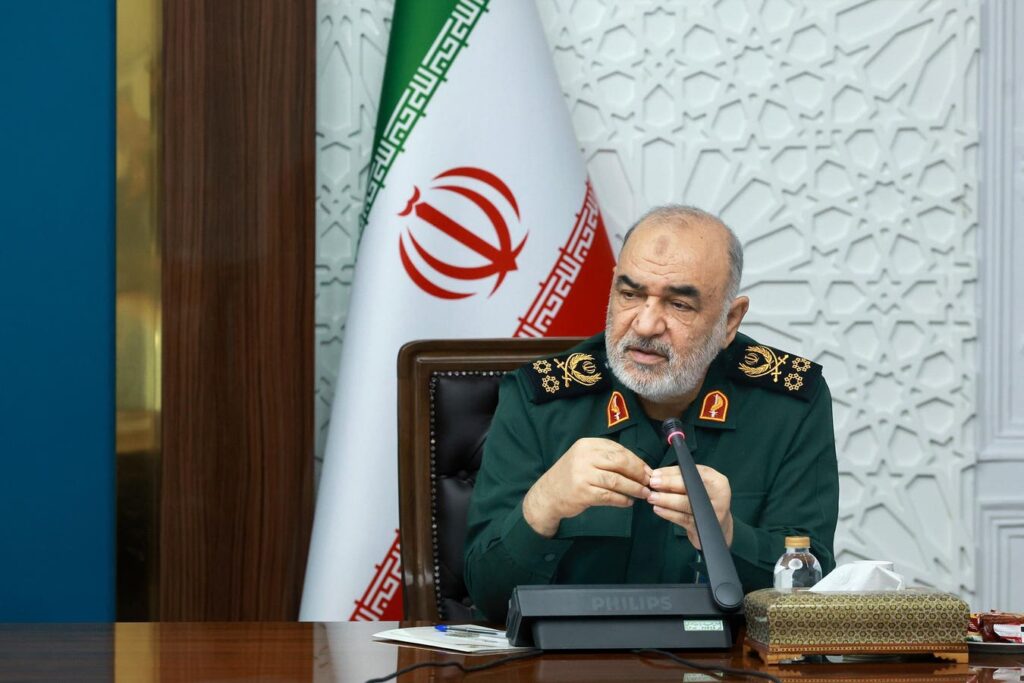

The attack prompted Israel’s defense minister to declare a special state of emergency, while Iran has vowed retaliation for the strike on its nuclear program. The Wall Street Journal reported that the head of Iran’s Islamic Revolutionary Guard was killed in the attack. These escalating tensions have created uncertainty that typically weighs heavily on equity markets. On a separate note, see – Boeing Stock Faces Fresh Crisis After 787 Dreamliner Crash.

The geopolitical crisis has triggered a flight to traditional safe-haven assets. Oil prices surged 9% following the attack, while gold prices also moved higher as investors sought refuge from equity market volatility. This pattern demonstrates how the S&P 500 and broader markets often move inversely to commodities during periods of heightened global tension.

The current situation could echo the market dynamics observed during Russia’s invasion of Ukraine in February 2022. Initially, the S&P 500 fell more than 7% in the days and weeks following that conflict’s onset, driven by widespread investor fear about geopolitical instability and its economic implications. However, the index demonstrated remarkable resilience. Despite the dramatic initial sell-off, the S&P 500 recovered to pre-invasion levels within a month, even as oil prices remained elevated. This recovery highlighted the market’s ability to absorb geopolitical shocks when direct economic exposure remains limited. Also, see the last six market crashes compared.

The S&P 500 is expected to face increased volatility and potential downward pressure in the immediate term. If Iran retaliates and tensions escalate further, the index could experience additional selling pressure as investors remain risk-averse.

- Sector Winners: Energy companies within the S&P 500 stand to benefit from rising oil prices, with major players like ExxonMobil and Chevron likely seeing improved profit margins as crude prices surge during geopolitical tensions.

- Sector Losers: Freight and logistics companies could face significant pressure from escalating fuel costs and potential supply chain disruptions through critical Middle East shipping routes, impacting major players like FedEx and UPS with higher operational expenses and delivery delays. See – How Low Can FedEx Stock Go – for more details.

However, historical precedent suggests the market’s capacity for recovery once initial uncertainty subsides. The S&P 500’s track record shows that while geopolitical events create short-term disruption, the index often normalizes as investors assess the actual economic impact versus perceived threats.

The key factor will be whether ongoing tensions in the Middle East remain contained or escalate into a broader regional conflict with more significant global economic implications.

So ask yourself the question: if you want to hold on to your positions, or will you panic and sell if the market falls 2%, or 5%, or see even lower levels?

Holding on to your stocks in a falling market is not always easy. Trefis works with Empirical Asset – a Boston area wealth manager, whose asset allocation strategies yielded positive returns even during the 2008-09 timeframe, when the S&P lost more than 40%.

Empirical has incorporated the Trefis HQ Portfolio in this asset allocation framework to provide clients better returns with less risk versus the benchmark index; less of a roller-coaster ride, as evident in HQ Portfolio performance metrics.

Read the full article here