As the price of oil finally breaks upward after a long (3 or 4 months) period of consolidation, some stocks in the petroleum group are following it higher, some to new highs, others to 6-month highs. This is not true for the majors like Chevron and Exxon Mobil which remain far off their 2024 peaks.

These four stocks are not large caps but they’ve been moving better lately than those big names.

4 Oil Stocks Hitting New Highs

United States Oil Fund (NYSE: USO)

First, the price chart shows how oil just broke above that red-dotted downtrend line that connected the early July high with the early October high. It’s quite a move since early December with a jump above both the 50-day and 200-day moving averages. It’s the sort of phenomenon that big Wall Street algorithms notice. The United States Oil Fund is designed to reflect the movements of West Texas Intermediate Crude.

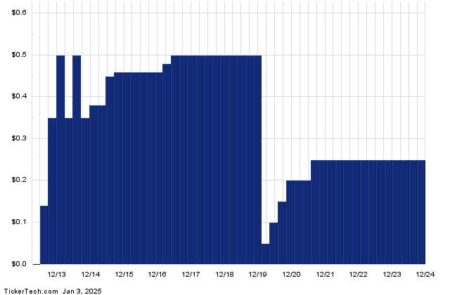

Dorchester Minerals (Nasdaq: DMLP)

This Dallas-based oil and gas exploration and production company took out the November high and with heavy volume considering it’s a holiday week and volume is generally less than spectacular. Note how the 50-day moving average crossed above the 200-day moving average in October, a signal of the strength to come.

Dorchester trades with a price-earnings ratio of 12 and at about four times book value. The debt-t0-equity ratio is 0.00. Market capitalization is $1.61 billion.

Golar (Nasdaq GLNG)

The Bermuda oil and gas midstream firm is headquartered in Bermuda. With heavier volume than usual for holiday week trading, the stock just managed a higher-then-December high. Golar continues to trade well above the 50-day and the 200-day moving average.

The price-earnings ratio is 40 and the stock trades at 2.22 times book. Golar pays a 2.32% dividend. Market cap is $4.51 billion.

Gulfport Energy (NYSE: GPOR)

You can see in the tiny red circle where the 50-day moving average in mid-November had no trouble crossing above the 200-day moving average. This week, the stock popped to a higher than November high (the red dotted line) designated within the large red circle.

Gulfport is a Russell 2000 component and has a market cap of $3.27 billion. The p/e is 16 and it trading at 1.6 times book value.

ProPetro Holdings (NYSE: PUMP)

The stock just climbed to a higher price than the May high (where the red dotted line is placed). It appears as if the 50-day moving average is about to cross above the 200-day moving average.

This oil equipment and services company has a market cap of $1.01 billion. It’s a Russell 2000 component. JP Morgan in early December upgraded ProPetro from “underweight” to “neutral” with a price target of $10.

Stats courtesy of FinViz.com. Charts courtesy of Stockcharts.com.

More analysis and commentary at johnnavin.substack.com.

Read the full article here