After the Trump administration signaled a new executive order could be forthcoming that would clarify the United States’ stance on whether gold imports should face tariffs, the president himself took the issue into his own hands with an announcement Monday that gold ‘will not be Tariffed.”

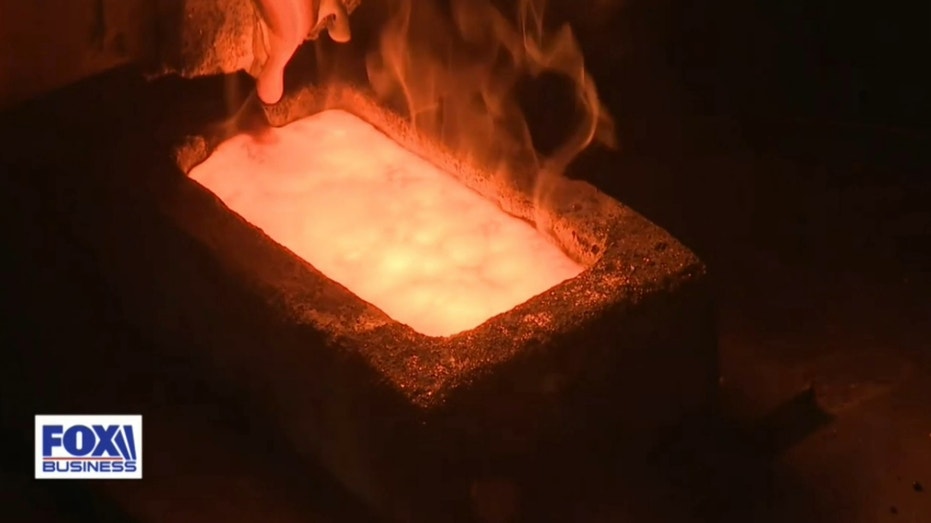

Trump’s announcement follows a ruling by the U.S. Customs and Border Patrol’s website, which said gold would be subject to reciprocal tariffs after a Switzerland-based precious metals broker asked for clarification on the matter. The ruling said that a 39% rate would be imposed on one kilogram and 100-ounce gold bars imported from Switzerland.

Reports that the Trump administration would be placing tariffs on U.S. gold imports were slammed as “misinformation” by the White House, which reiterated Monday that it intends to “to issue an executive order in the near future clarifying misinformation about the tariffing of gold bars and other specialty products.”

TRUMP CALLS TARIFF WINDFALL ‘SO BEAUTIFUL TO SEE’ AS CASH SAILS IN

While the contents of the executive order are not known, Trump’s announcement explicitly said “Gold will not be Tariffed!” with the post being introduced as “A Statement from Donald J. Trump, President of the United States of America.”

News of the potential tariffs late last week caused gold prices to go up, but following responses from the White House suggesting this would not be the case, they began declining.

“In the early hours of trading [on Friday], global markets were shaken by the announcement by the Trump administration of a 39% tariff on imported gold bars weighing 100 ounces or more. U.S. December gold futures reached an all-time high price of $3,534.10 per ounce shortly after the declaration was made,” American Institute for Economic Reform director Peter C. Earle wrote in a dispatch for the Gold Anti-Trust Action Committee.

U.S. BUDGET DEFICIT HAS WIDENED BY $109B FROM A YEAR AGO DESPITE INFLUX OF TARIFF REVENUE

“This sudden move injected uncertainty into the bullion market, unsettling dealers, refiners, and institutional investors trading in larger ‘exchange delivery’ formats,” he continued.

“While gold is rarely targeted by protectionist measures — unlike base metals, agriculture, or manufactured goods — this decision warrants close attention, both for its immediate market impact and potential implications for future monetary policy.”

Read the full article here