The Pound Sterling (GBP) snaps a six-day losing streak against the US Dollar (USD) on Monday, and rises to near 1.3335 during the European trading session. The GBP/USD pair gains as the British currency capitalizes on upbeat United Kingdom (UK) Retail Sales and positive flash S&P Global Purchasing Managers’ Index (PMI) data released on Friday.

The Office for National Statistics (ONS) reported that Retail Sales, a key measure of consumer spending, surprisingly rose by 0.5% on a monthly basis, while these were expected to decline by 0.2%. Also, the UK’s private sector business activity expanded at a faster pace due to a strong rebound in the manufacturing sector. The Manufacturing PMI rose to 49.6 from estimates of 46.6. Still, despite the increase, the data continued to suggest a contraction in factory activity as the figure remained below the 50.0 threshold. The overall composite PMI, however, increased to 51.1..

Upbeat consumer spending and business activity growth should provide some relief to Bank of England (BoE) officials. However, the report also showed that jobs continue to be cut amid a backdrop of business confidence that remains subdued by historical standards, which remained a key concern for policymakers.

In mid-October, traders raised BoE dovish bets after the release of weak employment data for the three months ending in August. The labor market report showed that the ILO Unemployment Rate rose to 4.8%, the highest rate since mid-2021.

Daily digest market movers: US Dollar falls on firm Fed dovish bets

- The recovery move in the GBP/USD pair is also driven by a slight downside move in the US Dollar. The US currency falls due to intensified speculation that the Federal Reserve (Fed) will cut interest rates in the monetary policy announcement on Wednesday.

- At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades 0.1% lower to near 98.80.

- According to the CME FedWatch tool, traders have almost priced in a 25-basis-point (bps) reduction in interest rates to 3.75%-4.00%. This would be the second straight interest-rate cut by the Fed.

- Meanwhile, slowing US inflation has also provided room for the Fed to focus more on improving job demand. The Consumer Price Index (CPI) report for September showed on Friday that monthly headline and core inflation – which excludes volatile food and energy items – rose at a moderate pace of 0.3% and 0.2%, respectively.

- On the global front, accelerating hopes of a trade deal between the US and China are providing support to the US Dollar. US President Donald Trump has expressed confidence, during Monday’s Asian trading session, that Washington and Beijing will reach a deal after his meeting with Chinese leader Xi Jinping later this week. “I think we’ll come away with a deal from Xi meeting,” Trump said to reporters at Air Force One.

- Earlier, US Treasury Secretary Scott Bessent also signaled that Washington and Beijing will reach a deal soon after his meeting with Chinese Vice Premier He Lifeng at the sidelines of the Association of Southeast Asian Nations (ASEAN) summit in Malaysia over the weekend. Bessent stated that 100% additional tariffs imposed on Beijing won’t proceed, and export controls by them on rare earth minerals would be deferred.

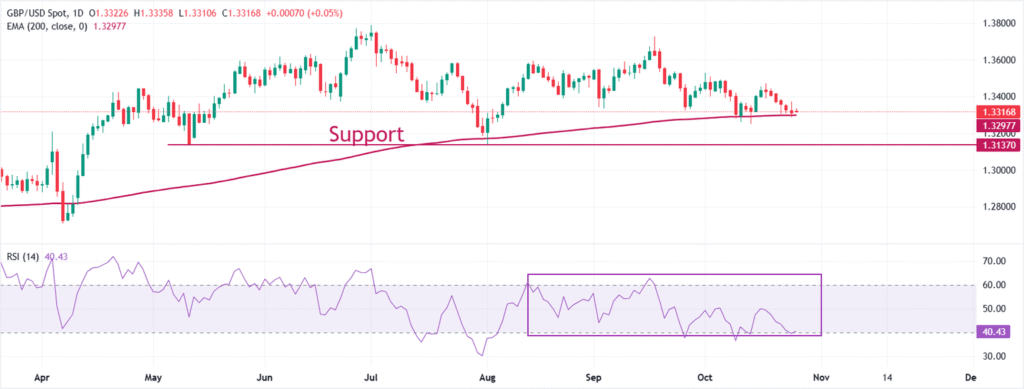

Technical Analysis: Pound Sterling is at make or a break around 200-day EMA

The Pound Sterling struggles to gain ground against the US Dollar near the 12-day low around 1.3310 on Monday. The overall trend of the GBP/USD pair is uncertain as it wobbles near the 200-day Exponential Moving Average (EMA), which trades around 1.3300.

The 14-day Relative Strength Index (RSI) stays near 40.00. A fresh bearish momentum would emerge if the RSI drops below that level.

Looking down, the August 1 low of 1.3140 will act as a key support zone. On the upside, the psychological level of 1.3500 will act as a key barrier.

Economic Indicator

S&P Global Composite PMI

The Composite Purchasing Managers Index (PMI), released on a monthly basis by S&P Global, is a leading indicator gauging private-business activity in UK for both the manufacturing and services sectors. The data is derived from surveys to senior executives. Each response is weighted according to the size of the company and its contribution to total manufacturing or services output accounted for by the sub-sector to which that company belongs. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation.The index varies between 0 and 100, with levels of 50.0 signaling no change over the previous month. A reading above 50 indicates that the UK private economy is generally expanding, a bullish sign for the Pound Sterling (GBP). Meanwhile, a reading below 50 signals that activity is generally declining, which is seen as bearish for GBP.

Read more.

Last release:

Fri Oct 24, 2025 08:30 (Prel)

Frequency:

Monthly

Actual:

51.1

Consensus:

50.6

Previous:

50.1

Source:

S&P Global

Read the full article here