European natural gas prices fell to fresh lows last week, with the TTF benchmark sliding more than 3% ahead of the Trump-Putin summit. The decline has widened the JKM premium over European prices, raising the likelihood of LNG cargoes being redirected to Asia, while Europe still faces the challenge of…

Headlines

See AllThe US Dollar’s recovery against the Yen has lost steam at 148.50, with all eyes on Ukraine’s summit.USD/JPY is lacking a clear bias, with market volatility subdued. Higher hopes of further BoJ tightening have created a JPY-supportive monetary policy divergence.The US Dollar bounced up against the Japanese Yen on Friday, but upside attempts have been capped below 148.50 on Monday, with trading volumes at low levels, as investors await the outcome of a meeting between…

Gold price trades higher as investors turn cautious ahead of Trump-Zelenskyy meeting.US President Trump and…

Updated 2025-08-18T13:28:01Z Share Facebook Email X LinkedIn Reddit Bluesky WhatsApp Copy link lighning bolt icon…

Most Popular

Finance news

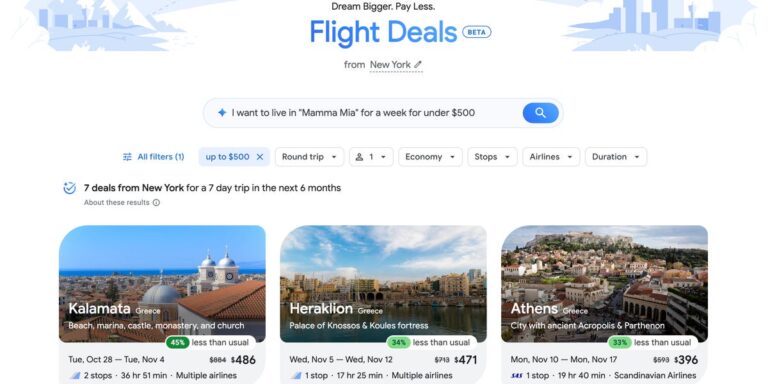

View MoreGoogle’s new AI tool is more than willing to help me live out my “Mamma Mia!” fantasies.On Thursday, Google debuted Flight Deals, its AI assistant for travel booking. The tool, which is still in beta, allows users to input general prompts and receive affordable flight plans.After toying with Flight Plans…

Business

View MoreA new study says that most Millennials and Gen Z feel that friendships are getting too expensive. The study, called “The Friendship Tab” and commissioned by Ally Bank, found that 44% of Gen Z and Millennials say they have skipped major social events because of cost.The study found that almost…

Markets

View MoreClaude isn’t here for your toxic conversations.In a blog post on Saturday, Anthropic said it recently gave some of its AI models — Opus 4 and 4.1 — the ability to end a “rare subset” of conversations.The startup said this applies only to “extreme cases,” such as requests for sexual…

Investing

View MoreThe Federal Market Open Market Committee expects interest rates to move down in 2025. Fixed income markets see two cuts coming, taking rates to 3.75% to 4% by December as the most likely outcome, down from 4% to 4.25% today. However, for quite some time the labor market has held…