GBP/USD has fallen into a sluggish steady-state on Tuesday.Cable continues to grind it out near the 1.3300 handle amid a lack of momentum.US PMI data soured on Tuesday, trimming risk appetite.GBP/USD continues to chalk in a middling pattern through the week as investor sentiment takes a breather following a sharp…

Headlines

See AllUS Dollar Index posts modest gains around 98.80 in Wednesday’s Asian session.Trump took Scott Bessent off his shortlist to replace Jerome Powell as the next Fed chair. Traders have priced in higher chances of an imminent Fed rate cut. The US Dollar Index (DXY), an index of the value of the US Dollar (USD) measured against a basket of six world currencies, trades with mild gains near 98.80 during the Asian trading hours on Wednesday. Traders brace for the speeches from the…

The makers of CELSIUS energy drinks are taking advantage of the publicity the beverages have…

GBP/USD gains ground to around 1.3305 in Wednesday’s Asian session. Trump said he will decide on…

Most Popular

Finance news

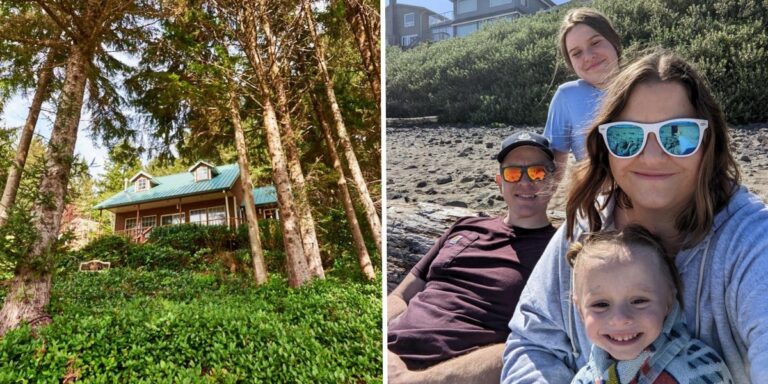

View MoreEvery year, my family takes a 14-hour road trip from our home base in Utah to a house in Netarts Bay, Oregon.Though it’s just an Airbnb rental, it’s become our home away from home. I stumbled upon it four years ago and loved that it faced the bay, had a…

Business

View MoreTraders on the prediction market platform Kalshi place the odds of President Donald Trump selecting Kevin Hassett to succeed Federal Reserve Chairman Jerome Powell at 48%, a 27 percentage point increase this week. Kevin Warsh follows as the next most likely contender, with Kalshi bettors assigning him a 29% chance…

Markets

View MoreSitting at my desk with a cat on my lap, I slowly typed each credit card number into Le Labo’s website.Buying a sample of the brand’s Santal 33 fragrance made me feel like I was entering a club I’ve long been an outsider to. The perfume, which can cost up…

Investing

View MoreThe Federal Market Open Market Committee expects interest rates to move down in 2025. Fixed income markets see two cuts coming, taking rates to 3.75% to 4% by December as the most likely outcome, down from 4% to 4.25% today. However, for quite some time the labor market has held…