AI is often associated with certain aspects of hiring, like reviewing résumés. But Walmart’s chief people officer, Donna Morris, has used it for another part of the process: identifying potential candidates.Morris often interviews leaders looking to join Walmart or transition within the company, such as tech and HR executives. She said she has…

Headlines

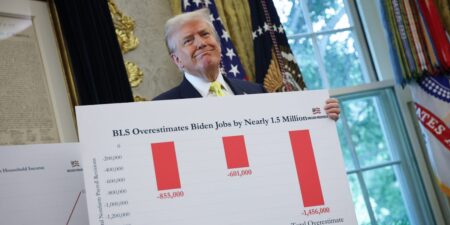

See AllErika McEntarfer, the former commissioner of the Bureau of Labor Statistics, raised the alarm on political meddling in economic data collection.”Economic data must be free from partisan influence,” McEntarfer said in her first public remarks since her sudden ousting by President Donald Trump last month. McEntarfer made the comments at an event on Tuesday at her alma mater, Bard College.She compared BLS data to “traffic lights” and said that any manipulation of these reports could…

Are you a jerk? Don’t expect to ask your chatbot and get an honest answer.Anyone…

The Euro (EUR) is strong, up 0.4% against the US Dollar (USD) and outperforming all…

Most Popular

Finance news

View MoreNavies are facing an old problem in a new form, defense and warfare experts argue.Cheap sea drones armed to sink ships now allow foes to execute long-range naval attacks on warships at anchor, reviving a serious threat not really seen since World War II, a sweeping new CSIS report on…

Business

View MoreThe suspect accused of assassinating conservative activist Charlie Kirk appeared to confess to others in an online chat before surrendering to authorities, according to a report in the Washington Post. The suspect, 22-year-old Tyler Robinson, wrote to friends on the online platform Discord, “Hey guys, I have bad news for…

Markets

View More2025-09-16T20:09:27Z Share Facebook Email X LinkedIn Reddit Bluesky WhatsApp Copy link lighning bolt icon An icon in the shape of a lightning bolt. Impact Link Save Saved Read in app This story is available exclusively to Business Insider subscribers. Become an Insider and start reading now. Have an account? Log…