The title of Kenneth Rogoff’s 2009 bestselling book, This Time Is Different, was meant to be ironic. During every financial bubble a narrative emerges to explain why lofty valuations are justified and “this time” there won’t be a crash. Then the crash comes.

Now Rogoff’s new book – Our Dollar, Your Problem – has arrived during a crisis that may indeed be different.

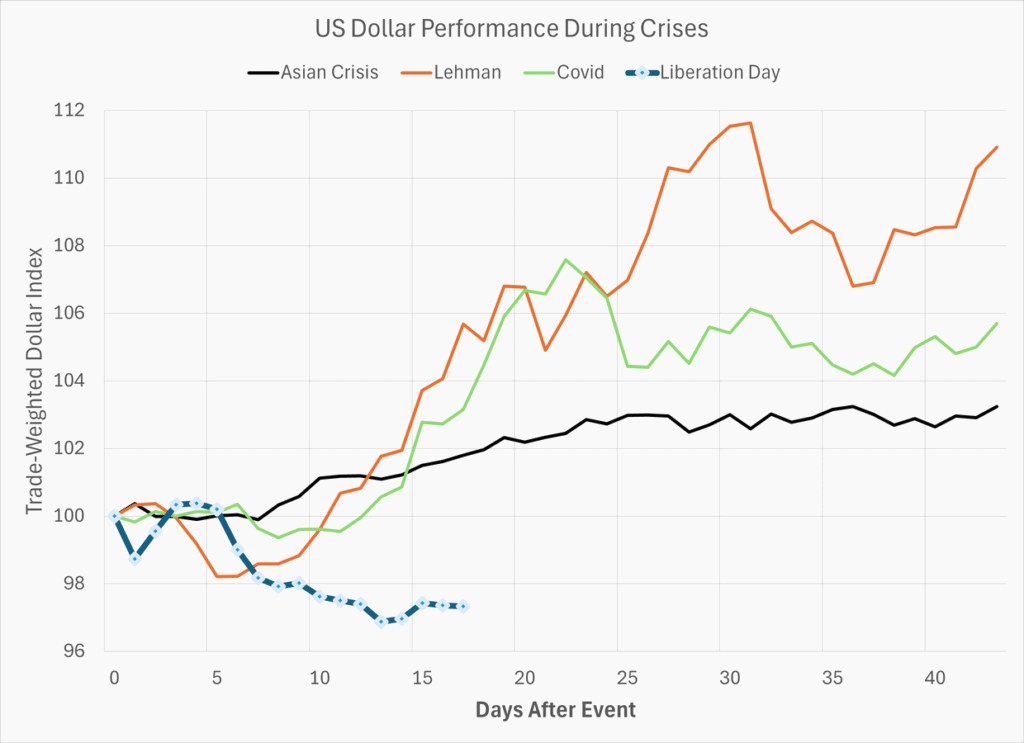

The US dollar is the world’s dominant currency and one of the most important benefits of that status is that demand to hold it rises in a crisis. This matters, because it means the US government can borrow during bad times – to fight a financial crash like in 2008 or offset a sudden economic stoppage like in 2020.

But this time has been different. During the Liberation Day crisis, markets ran from the dollar, not to it. A simple measure of this is plotted below.

This could be due to factors that have nothing to do with a change in the dollar’s long-term status. Since 2023 high US short-term rates have attracted flows into the dollar from carry trades. When volatility spikes these trades lose money and are scaled back, which means money flows back out. The chaos and incompetence of the tariff rollout has led to collapsing sentiment. The dollar’s fall could therefore also be due to an expectation of a US recession – with rate cuts that will narrow the interest differential with other countries.

Still, I suspect that is only part of the story. There are ‘hard’ reasons for dollar dominance. Dollar assets make up sixty percent of central bank reserves. The global financial architecture – payment protocols, correspondent banking networks – is built around the dollar. Oil and commodity trades are mostly dollar denominated. Nothing comes close to replicating the liquidity of the US Treasury market and, as I wrote last year, the vast S&P 500 ecosystem functions as a global insurance marketplace for risk assets. These advantages remain.

But, there are other drivers of dollar dominance, softer in nature and yet equally important. Rogoff lists some: the US economy’s openness to trade, an established rule of law that is favorable to creditors, a university system open to foreign students whose families accumulate dollars to support and an economy that is the largest destination for immigrants. To me, all those things have been seriously, and permanently, undermined. Am I overreacting? I asked Rogoff during my interview with him on the Ideas Lab podcast:

You’re not overreacting. So, just to be clear, the dollar is not going to go from its giant share to nothing overnight because there’s not any substitute…but you listed the reasons why it’s going to go faster.

Rule of law – it’s certainly under assault in a way we haven’t seen. I don’t want to blame just Trump…the Democrats, in having all these cases they brought against him, in New York, that they probably wouldn’t have done if he wasn’t running for president, is really showing you the weaponization of law.

This matters a lot for creditors…With finance you’re not just trusting the moment, you’re trusting the system. And when you undermine that, naturally it reduces foreign investors’ appetite for US assets.

The Danger Within

The biggest threat that Rogoff sees to the dollar’s future is the lack of appetite to reverse the growth in US debt. As one of the world’s most cited economists, Rogoff “is treated very well” when he submits a paper for publication. Unless it is about debt – “then there is no interest”. That mirrors the political climate, where both parties pursue policies that relentlessly raise debt levels – to the point where gross US debt now exceeds that of all other advanced economies combined.

The dollar’s dominance confers a huge advantage to the US in terms of managing debt because it keeps interest rates lower than they otherwise would be. Rogoff estimates that losing this will cause long-term rates to be 0.5-1.0% higher.

Most current market participants consider the “bond vigilantes”, who would sell US bonds and force rates higher, to be like White Walkers – nothing more than mythical creatures. Rogoff not only believes in them, he thinks they might be the only force capable of triggering change in US borrowing habits. He expects the 10-year Treasury yield to trade at over 5% sometime in the next few years.

How To Deal With Debt

The tools available to deal with high debt are well known – default, inflation or financial repression.

US government default used to be unthinkable. Rogoff isn’t expecting default, but acknowledges it must now be considered a possibility

Inflation is the typical way debt burdens are mitigated. But 22% of US debt matures in less than one year and over 70% matures within five years. When inflation rises, so do interest rates. Expiring debt must then be rolled over at higher rates, meaning that it would take a prolonged period of high inflation to erode its value. This dynamic is one reason Rogoff thinks we’ll see another episode of Covid-level inflation in the coming years.

That leaves ‘financial repression’ – forcing US citizens or their agents (pension funds, insurance companies, banks) to hold US Treasuries. This forced demand keeps rates below where they otherwise would be, but it’s a stealth tax on bond holders as returns on their capital are low. Rogoff points to Japan as the obvious example of this strategy.

Japan’s debt/GDP is 250%, more than double the US. They’ve avoided an acute crisis because their debt is mostly owned by domestic institutions. But Rogoff believes this has starved the economy of risk capital and eroded its economic growth. He notes that Japan’s per capita GDP was at one time 80% of the US level, now it’s 62%, below Italy and Spain. Financial repression can stop a wayward economic ship from crashing into the rocks, but at the cost of a slow sinking.

As always, this write-up only scratches the surface. There are important sections on the future of China’s RMB and stablecoins plus more detail on the perks and drawbacks of dollar dominance. It’s an important book, accessible and entertaining. If this time is different, it will help you understand why.

Read the full article here