At about $117 a share, Nvidia (NASDAQ:NVDA) is still trading about 15% below its all-time highs seen in January 2025. Revenues grew more than 110% over the last year, while net profit margins exceeded 50%. With artificial intelligence tunes playing everywhere, do you think Nvidia stock is a good long-term bet at current levels? What about at a 30% discount at about $82 per share? Now we’re talking. So if you think $82 per share for the AI poster-child is a steal, and have some cash ready to go, here’s a clever trade.

The Trade: 12% yield at 30% margin of safety, by selling Put Options

NVDA stock is trading at about $117. You can sell a long-dated Put option expiring June 18, 2026, with a strike price of $82, and collect roughly $680 in premium per contract (each contract represents 100 shares).

That’s about an 8.3% yield on the $8,200 you’re setting aside for the possibility of buying the stock. Plus, don’t forget, this cash parked in a savings or money market account will earn an extra 4%. So we’re talking >12% yield overall.

And here’s the kicker. You’re agreeing to buy Nvidia at $82, a roughly 30% discount to the current market price, only if the stock drops below that level by the expiration date.

Think that’s too risky? Want a higher margin of safety – for example 40%? Use a $70 strike instead of $82 strike – your overall earnings will still be an impressive 9% instead of 12%, and you’ll enjoy more peace. The strategy is reliable because large institutions have tested the strategy at scale, and for the right long-term investors, may serve just right. As an aside, market leadership is in fact one of the factors we consider in constructing the market-beating Trefis High Quality portfolio (HQ) – a strategy of 30 stocks that targets long-term value creation. HQ has outperformed the S&P 500 and achieved returns greater than 91% since inception.

Sure, I see the 12% return, however, what if Nvidia drops more than 30%, isn’t there some risk?

Of course, there is risk. Because, there are two ways this could unfold:

- NVDA stays above $82 on June 18, 2026: You keep the full $680 premium. That’s 8.3% extra income over the next 400 days on cash that might otherwise earn you 4% or less. You never buy the stock and simply walk away with the cash.

- NVDA ends up below $82: You’ll be obligated to buy 100 shares at $82. But thanks to the $680 premium, your effective cost basis is just $75.20 per share – a roughly 35% discount from today’s level.

In short, you win either way, especially if you’re comfortable owning a quality company like Nvidia for the long haul.

Is that a good deal though?

It could very well be, if you consider three facts —

If you do end up owning NVDA stock, you’re not stuck with some speculative small-cap stock. You’re holding a company that is:

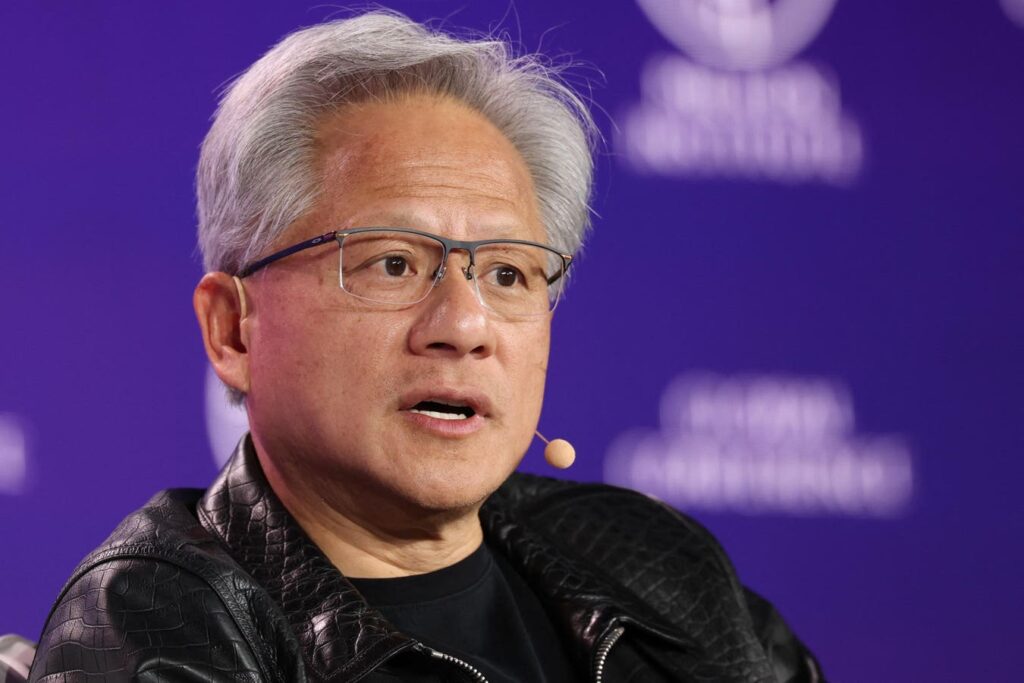

- The AI market leader: AI is everywhere today. Nvidia designs the GPU chips that power a majority of the large language models, including ChatGPT and Google’s Gemini. Demand could only heat up with models moving from just text toward speech, images, video, and 3D, requiring more compute capacity

- Massively profitable: Nvidia generated about $60 billion in free cash flow last year, among the highest of any tech company. Net profit margins exceed 50%, making it one of the most profitable large-cap companies in the world.

- Fast growing: NVDA grew sales by over 100% last year and consensus points to over 50% growth for FY’26. This is multiple times faster than the S&P 500 median of < 5%.

And The Risk of a Crash Is Lower Than You Think

Selling puts is only as good as the business you’re willing to own. With Nvidia, that bar is high. Here’s why:

- Over $43 billion in cash

- 50%+ net margins, sustained over multiple quarters, with revenue doubling in just a year

- NVDA’s valuation is reasonable, with the stock trading at 26x forward earnings. Low for a company on track to grow revenues by over 50% this year.

The Bottom Line – Margin of Safety

This trade offers an asymmetric risk-reward setup, with a built-in 30% discount.

- If the stock drops, you’ll own Nvidia at about $75 effectively, a level not seen in over a year. You won’t mind holding this quality name for a few years, or until it grows to $120 levels or more, if you’re an investor with a long-term mindset

- And if it doesn’t? You walk away with >12% yield (8.3% on the options sold + 4% on the cash set aside)

Either way, you come out ahead.

These are the kinds of margin-of-safety setups and asymmetric risk-reward tradeoffs that we seek in the Trefis HQ portfolio, which is focused on long-term value creation. With a collection of 30 stocks, it has a track record of comfortably outperforming the S&P 500 over the last 4-year period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride, as evident in HQ Portfolio performance metrics.

Read the full article here