The U.S. economy, not about to collapse, is also far from stable, strong, and worry-free, as various indicators and signs have shown. Now it’s time to add another.

Moody’s Investors Service, while currently maintaining the top credit rating of the country, has changed its outlook to negative. Moody’s is the last of the major credit rating agencies to keep the U.S. at its highest possible position.

Previous Downgrades

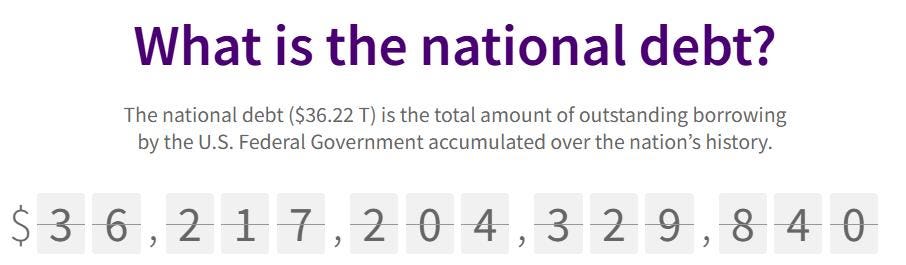

The first time the U.S. got a rating below AAA (or other variations like Aaa) was in August 2011. Standard & Poor’s downgraded the U.S. to AA+ after having put the country on a credit watch in July, CNN reported at the time. To avoid a downgrade, S&P had wanted to see the debt ceiling raised (which affects previous spending, not future) and a “credible” plan to deal with the long-term debt.

Fitch Ratings downgraded U.S. debt from AAA to AA+ in August 2023, according to CNN. The change happened after a last-minute agreement to raise the debt ceiling, citing “a steady deterioration in standards of governance.” Fitch cited the January 6th insurrection as a significant concern.

Other Troubling Signs

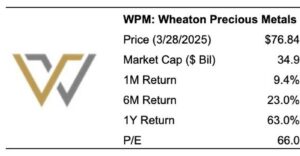

Recent events and circumstances suggest the U.S. still hasn’t learned to deal effectively with its financial problems. Unpredictable tariff disruptions are jarring markets. Inflation remains too high, and the most recent Core Personal Consumption Expenditures measure of inflation — the Federal Reserve’s preferred metric — came in unexpectedly hot on Friday, March 28. The Fed has cut its GDP growth projections.

The labor market shows strain, although unemployment remains relatively low. The nonpartisan Congressional Budget Office’s most optimistic projection of budget deficits shows the public debt growing from its current $36.2 trillion to $57.3 trillion by 2034, assuming additional problems don’t worsen it. Trump’s DOGE squad, which is supposed to cut the debt, spends a lot of time looking at cutting workers when they represent less than 5% of the spending compared to corporations, in which labor costs run 50% to 60%.

There is still no agreement on a final budget nor on a debt limit. Treasury Secretary Scott Bessent wrote Congress on March 14 to make clear that the government was using so-called extraordinary measures to keep working capital available. The Bipartisan Policy Center projected that between mid-July and early October, the Treasury would “no longer be able to meet its financial obligations in full and on time,” meaning the U.S. would go into default.

Moody’s Latest Take

Moody’s latest view is that the nation’s “formidable credit strengths continue to preserve the sovereign’s credit profile,” and that “the downside risks … may no longer be fully offset by the sovereign’s unique credit strengths.”

The credit issues all come down to debt affordability. The U.S. has a strong currency, favored status as the largest global reserve currency, and a continued appetite around the world for buying debt in the form of Treasury bills, notes, and bonds.

But every question increases investor worry. If another downgrade happened, that could nudge investors toward demanding higher yields for a risk premium on Treasurys, in turn making debt service more expensive and worsening the overall fiscal picture.

Moody’s expects the country’s deficits to remain huge and, as a result, expensive. “Continued political polarization within U.S. Congress raises the risk that successive governments will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability,” they wrote.

Read the full article here