Question: How would you feel if you owned Meta Platforms stock and its value dropped 50%, or even 70%, over the next few months? It may sound extreme, but it has happened before – and it could happen again. Meta has shown greater stability so far this year, maintaining share prices similar to those in January, while the NASDAQ index has fallen by approximately 10%. Recently, the stock faced pressure after President Trump’s comments opened the possibility of a recession, thereby increasing investor uncertainty. Furthermore, worries have grown with the introduction of Manus, a new AI assistant from China that is intensifying competition in the sector.

Rising economic concerns in the United States, spurred by President Trump’s tariff implementation, are creating an unfavorable market environment. We believe META stock could decline further to levels as low as $200 per share. Here’s why investors should be concerned.

The key point is this: during a downturn, META stock could suffer significant losses. Evidence from as recently as 2022 shows that META stock lost over 70% of its value in just a few quarters. So, could META’s roughly $600 share price drop to below $200 if 2022 were to repeat itself? Naturally, individual stocks tend to be more volatile than diversified portfolios – so if you are seeking upside with less volatility than a single stock, consider the High-Quality portfolio, which has outperformed the S&P 500 and achieved returns exceeding 91% since its inception.

Why Is It Relevant Now?

Although META’s AI investments are yielding higher user engagement, investors were disappointed by the company’s quarterly forecast. Meta continues to make substantial infrastructure investments to support its AI initiatives, with 2025 capital expenditures projected at $60-65 billion. Despite DeepSeek’s AI model potentially reducing computing requirements, Meta’s leadership maintains that significant resources are still necessary to run AI models—justifying continued heavy infrastructure spending. Nevertheless, DeepSeek’s advancements and the recent launch of Manus suggest that powerful AI models might be developed at lower costs, intensifying competition and pressuring Meta to evolve its AI technologies such as Llama.

From a macroeconomic standpoint, President Trump’s trade policies may negatively impact META. The administration has doubled Chinese import tariffs from 10% to 20% on top of existing levies, and Trump recently proposed a “25% or higher” tariff on all imported semiconductor chips. These policies could further escalate Meta’s already significant AI infrastructure costs. Moreover, reduced consumer spending due to tariff-induced price hikes might hurt advertising-dependent businesses, potentially undermining Meta’s revenue streams.

How resilient is META stock during a downturn?

META stock has fared worse than the benchmark S&P 500 index during some recent downturns. Although investors are hopeful for a soft landing of the U.S. economy, how severe could the impact be if another recession occurs? Our dashboard How Low Can Stocks Go During A Market Crash illustrates how key stocks performed during and after the last six market crashes.

Inflation Shock (2022)

• META stock dropped 73.7% from a high of $338.54 on 3 January 2022 to $88.91 on 3 November 2022, compared to a peak-to-trough decline of 25.4% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 20 November 2023

• Subsequently, the stock climbed to a high of $736.67 on 17 February 2025 and is currently trading at around $6o0

COVID-19 Pandemic (2020)

• META stock declined by 32.9% from a high of $217.49 on 19 February 2020 to $146.01 on 16 March 2020, compared to a peak-to-trough decline of 33.9% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 20 May 2020

Premium Valuation

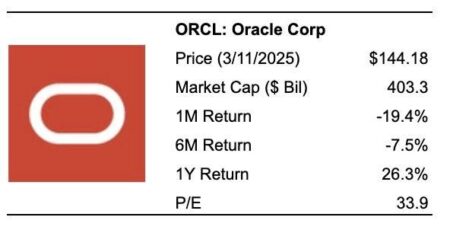

In conclusion, the situation is compounded by the fact that META stock remains expensive; it currently trades at almost 25x trailing earnings, compared to the stock’s average price-to-earnings ratio of 21x over the last three years. While Meta Platforms’ Revenues have grown considerably over recent years—rising at an average rate of 12.2% over the last 3 years (versus 9.8% for the S&P 500)—this growth could quickly fade if the economy turns for the worse.

Considering this slowdown in growth and the broader economic uncertainties, ask yourself the question: do you want to hold onto your META stock now, or will you panic and sell if it begins dropping to $400, $300, or even lower levels? Holding onto a declining stock is never easy. Trefis collaborates with Empirical Asset Management—a Boston-area wealth manager—whose asset allocation strategies yielded positive returns during the 2008-09 period when the S&P lost more than 40%. Empirical has integrated the Trefis HQ Portfolio in this asset allocation framework to provide clients better returns with less risk compared to the benchmark index; offering a less turbulent ride, as demonstrated by the HQ Portfolio performance metrics.

Invest with Trefis

Market Beating Portfolios | Rules-Based Wealth

Read the full article here