Key Takeaways

- Stocks Struggle Amid Economic Uncertainty And Tariff Concerns This Week

- Investors Flee To Gold And Bonds As Markets Decline

- Orderly Selling Continues, But Panic Selling May Still Come

After four consecutive weeks of losses, stocks are trying to end this week higher. On Thursday, however, most of the major indices closed fractionally lower. The combination of tariffs and economic uncertainty has cast a cloud over markets with a lot of questions about what happens next as investors seek out some sort of price equilibrium.

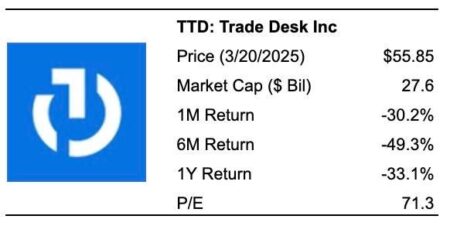

The market weakness is widespread as of now. We can see that in the number of stocks trading about their 50 and 200-day moving averages. Only 37% of stocks are above their 50-day and 42% are above their 200-day. If we dig a little deeper, a lot of the carnage has taken place in tech where stocks like Amazon, Apple and Meta Platforms are all down roughly 20% from recent highs. What I find interesting about this is, these are not the first names that come to mind when discussing tariffs. Therefore, I think what we’re seeing is more than just worries about tariffs. I believe this is reflective of a broad economic slowdown.

Supporting my thesis about the broader economy concerns are gold prices and bond yields. Gold is still trading well above $3,000 and bond yields have been steadily falling. Both gold and bonds are considered flight to quality assets and as investors are dumping stocks, it appears they are moving into these safe havens. In addition to gold and bonds, we heard from Jerome Powell this week, following the more recent Federal Reserve Open Market Committee meeting. In the post meeting press conference, Powell expressed uncertainty as to what will happen next in the broader economy and that seemed indicative of what we’re seeing from both investors and individual companies as they report earnings.

Turning to earnings for a minute, after the close Thursday we heard from FedEx, Nike and Micron Technology. With the exception of Micron, who forecast a strong outlook, both Nike and FedEx issued somewhat pessimistic outlooks based on economic uncertainty. We have been hearing the consistent drumbeat of consumer uncertainty, which leads to spending cuts, and these stocks continue to support that narrative. In premarket, all three stocks are trading lower with FedEx down the most at 8%.

There is one aspect to this selloff that stands out for me and one I think investors need to consider as well. The selling we’re seeing thus far has been orderly. What I mean by that is, despite the weakness we’re seeing, volatility hasn’t been much of an issue. The VIX has yet to break above and hold 30, which is something that tends to happen when we see panic selling. However, at some point, if markets continue stair stepping lower, I expect to see some sort of panic selling take place. If that should happen, I’ll be looking for opportunities in stocks that either close higher or remain relatively unchanged.

For today, it is a triple witching which means options, futures, and options on futures all expire. These quarterly expiration days can bring an added level of volatility, so I will be on the lookout for that. I’m also watching stocks that have already been badly beaten down in certain sectors. Companies like Oklo Inc. that supply nuclear energy to data centers and Regetti Computing, which is a quantum computing company, are both stocks that could be part of the next “economic era.” Both companies are down around 50% from recent highs. As always, I would stick with your investing strategy and long-term objectives.

tastytrade, Inc. commentary for educational purposes only. This content is not, nor is intended to be, trading or investment advice or a recommendation that any investment product or strategy is suitable for any person.

Read the full article here