Key News

Asian equities were mostly higher overnight as Mainland China and Hong Kong outperformed and Indonesia and Thailand underperformed.

Markets in China shrugged off tariffs overnight with strong gains, led by growth and technology stocks. The anticipation is that Trump will make a deal with China on fentanyl, agricultural purchases, and possibly more.

Shares in the world’s largest electric vehicle maker BYD surged +12% overnight on strong deliveries in 2024 and anticipation for its Intelligent Strategy Launch Event coming up next week. BYD and other China electric vehicle companies are well positioned to benefit from DeepSeek AI’s advancements in the space, which could have a bearing on the ability of China-based carmakers to more efficiently produce autonomous driving technology.

Kingsoft Cloud, ZTE and other cloud and data names continued their rise on DeepSeek AI’s efficient, open source AI chat bot. Alibaba also gained overnight as its AI chat bot is said to be more efficient than DeepSeek. Alibaba’s Qwen visual-language model has demonstrated better comprehension of visual text and images than competitors, according to the company. It has also landed over 300,000 enterprise clients. Alibaba’s CEO Eddie Wu said during their last earnings call: “As China’s market-leading cloud service provider for AI, we will continue to invest in advanced technology and AI infrastructure while optimizing operational efficiency. This will enable us to provide customers across industries with more reliable and cost-effective AI technologies and products. We believe that as AI adoption grows, Alibaba Cloud’s cloud computing and AI-related products will become the foundational infrastructure supporting development across industries.” The company should be considered an AI and cloud play too, in our opinion.

Robotics firms also gained overnight on AI optimism.

Health care was the top-performing sector in Hong Kong overnight. WuXi Biologics gained +5.22%. The contract research organization has had a few developments so far this year, including the sale of some facilities and a partnership with Candid Therapeutics. Also, the US’ Biosecure Act was excluded from the continuing resolution to keep the government funded late last year, which means it is unlikely to become law anytime soon in its current form. The Act would have prevented WuXi and other pharmaceutical research companies from doing business with US entities that receive federal medicare and Medicaid funding.

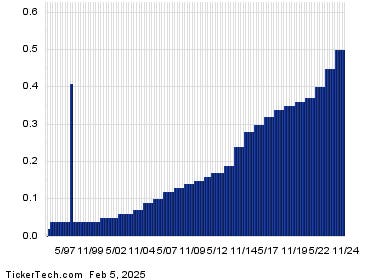

The Hang Seng and Hang Seng Tech indexes gained +1.43% and +2.62%, respectively, on volume that declined -7% from yesterday. Mainland investors bought a net $1.16 million worth of Hong Kong-listed stocks and ETFs via Southbound Stock Connect. The top-performing sectors were Health Care, which gained +3.91%, Information Technology, which gained +3.55, and Consumer Staples, which gained +2.14%. Meanwhile, the worst-performing sectors were Communication Services, which gained +0.65%, Financials, which gained +0.68%, and Real Estate, which gained +0.72%.

Shanghai, Shenzhen, and the STAR Board gained +1.27%, +2.34%, and +2.89%, respectively. The top-performing sectors were Consumer Discretionary, which gained +3.08%, Information Technology, which gained +2.81%, and Industrials, which gained +0.88%. Meanwhile, the worst-performing sectors were Energy, which fell -0.13%, Utilities, which fell -0.01%, and Materials, which gained +0.19%.

Live Webinar

Join us on Thursday, February 6, 2025 at 11 am EST:

2025 Outlook: Investing in AI’s Present and Future

Please click here to register

New Content

Read our latest article:

2025 China Outlook: A Recipe For Re-Rating

Please click here to read

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

Read the full article here