Welcome back to our Sunday edition. Maybe it’s imposter syndrome, or maybe you’re bad at your job. Microsoft’s former vice president of HR shares three signs it’s the latter.

On the agenda today:

But first: Elon Musk’s robotaxi got lost on the way to Wall Street.

If this was forwarded to you, sign up here. Download Insider’s app here.

This week’s dispatch

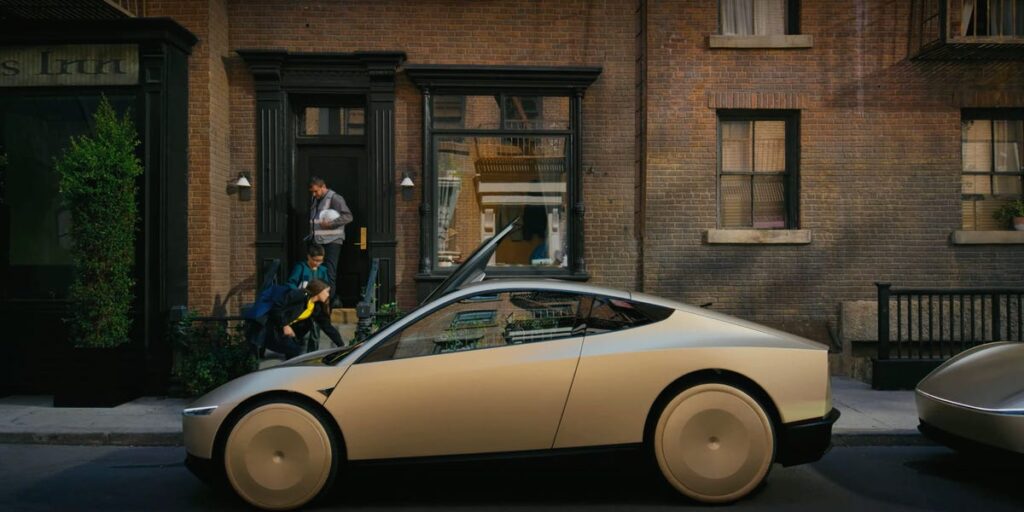

Robotaxi dreams meet Wall Street reality

Elon Musk unveiled Tesla’s robotaxi, along with a robovan and updates to its humanoid robot, at a flashy event in Los Angeles this week. Wall Street wasn’t buying it.

The billionaire took a ride in Tesla’s new Cybercab around Warner Bros. Discovery’s movie studio in Burbank, later saying it would be in production before 2027 and could sell for less than $30,000.

Investors didn’t seem convinced. Tesla’s stock finished Friday down almost 9%, leaving shares down 17% over the past year.

Musk has long promised a robotaxi, saying in 2019 that Tesla would have a million of them on the road by 2020. That prediction was later revised to 2023. Five years on from that first prediction, Tesla remains some distance away from fully autonomous driving, and doesn’t yet have permission to let driverless cars loose on open streets.

In the meantime, tech startups and old-guard Detroit automakers have developed their own versions of self-driving tech that can more or less match Tesla. You can already order a driverless Waymo in three major cities today.

It’s tough to bet against Elon Musk, as many on Wall Street have discovered. If Tesla does crack fully autonomous driving, it could herald a new era for the company. But for now, investors are skeptical about Tesla’s self-driving dreams.

Save our Citi

Last year, Anand Selva was named Citigroup’s COO. His mandate: oversee an unsexy yet crucial initiative to regain compliance with regulators. He’s been tasked with overseeing the “Transformation,” an aptly named initiative to overhaul the bank’s technology.

BI spoke with 14 current and former Citi employees who’ve worked under Selva to get a picture of the challenge facing him — and why he was put in charge of the bank’s No. 1 priority.

Inside Selva’s tenure so far.

Big Tech’s cash king

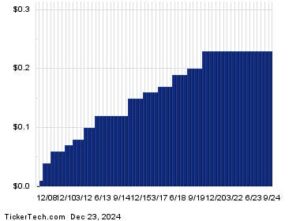

Amazon has long been famous for running on thin margins, reinvesting most of its profits, and holding relatively little cash compared with peers. By 2027, that’s expected to change, with the company’s cash balance estimated to hit $400 billion.

That number puts it on track to far outpace rivals Alphabet and Microsoft. Wall Street is taking note, and Amazon could soon face pressure to return some of its cash with buybacks or dividends.

Wall Street wants in on the action.

The boomer stuff avalanche

An old boomer habit is raining down on their children: There’s too much stuff, and not enough space.

Boomers have spent lifetimes acquiring things, and their Gen X, millennial, and Gen Z progeny are figuring out what to do with everything. Family dynamics can make it hard to say no, even if there’s no use or space for all that junk.

The “great stuff transfer.”

A solar panel fiasco

Business Insider’s Vishal Persaud spent months getting his solar panels installed and inspected. All that was left was to switch them on, but the solar panel company needed final approval from its partner, SunPower, to do so. Then, SunPower filed for bankruptcy protection.

Despite the ongoing climate crisis, much of the solar panel industry is cooling. Over the years, it’s faced high interest rates that have decimated demand, questionable financial engineering, and more than 100 bankruptcies across America in 2024 alone.

Now some customers are stuck in solar purgatory.

This week’s quote:

“When you move fast and break things in healthcare, you go to jail.”

— 27-year-old startup founder Ibrahim Rashid on the lessons learned from intrepid tech founders.

More of this week’s top reads:

Read the full article here