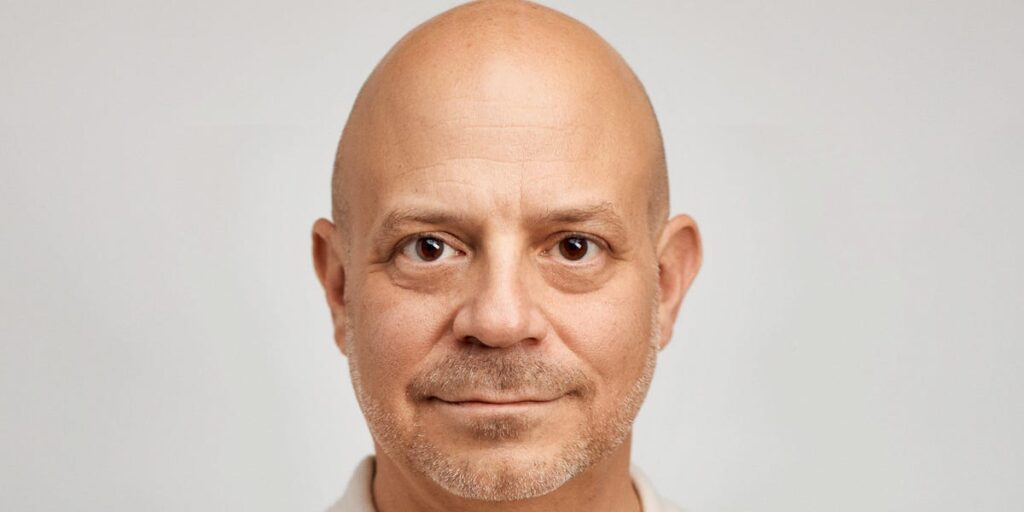

This as-told-to essay is based on a conversation with Casey Cohen, the 53-year-old chief marketing officer of The Estate Registry in Las Vegas. It has been edited for length and clarity.

I’m the chief marketing officer of The Estate Registry, where I lead efforts to streamline the management and protection of family wealth across generations.

I worked at the Hippodrome Casino, RedRock Casino Resort & Spa, and Phillips & Cohen Associates, Ltd. before becoming the COO of The Estate Registry in 2023. I’ve been the CMO since August.

Even though this is my line of work, it’s important for everyone to speak to their children about their estate plans, regardless of their circumstances.

While I’m not a legal estate planner, I’m a subject-matter expert

I completed my estate planning documentation prior to joining the firm in 2020, which brought up emotions of responsibility, especially as a father. I realized I was doing one of the most selflessly loving things I could do for my family.

My wife and I first talked to our daughter about this when she was in elementary school. We decided to introduce estate planning to her so she would understand from an early age that planning for the future is responsible and necessary.

She was confused at first about why we were starting the conversation at the dinner table, but my wife and I knew that rather than making it a one-time, heavy discussion, we had to normalize it.

We tried to introduce estate planning in a way that wasn’t morbid or scary

We wanted to explain to her that this decision expanded on our love for her and our need, as parents, to protect her. We explained that this was our way of ensuring that she was taken care of no matter what.

She didn’t fully grasp the complex topics of guardianship and total estate documentation, but as time passed, knowing we had a plan in place eased her mind.

One of the most eye-opening moments was when we discussed who would be next in line to take care of her if my wife and I passed. She proceeded to ask, “But what if something happens to that person, too?”

It was a great question and it made us realize that we needed to establish a backup plan for our backup plan. This takeaway applies to any parent — don’t stop at just “telling” your child what will happen. If your child is having doubts or certain fears regarding estate planning and their future, ensure that you take actionable steps that provide peace of mind.

She sometimes now even brings up questions at the dinner table, which shows us she has become more comfortable with the idea.

Take the time to truly understand your own estate plan so you can confidently talk to your kids about it

Well-structured estate plans include a will, trust, beneficiary designations, power of attorney, healthcare directives, and if you have children, this also includes guardianship designations.

Parents must explain what’s in the estate plan and why certain decisions were made so their child feels informed. This involves updating their estate plan every few years or whenever there’s a major life event (e.g., marriage, divorce, birth of a child, major financial changes) and ensuring their finances, from mortgage payments to credit card debt, are included.

Even if your kids aren’t involved in the decision-making process, they should still understand the intricacies of the plan and what to expect, but I made sure my daughter had a say in potential guardianship arrangements.

When your child turns 18, have another conversation as your parental rights to access information, such as financial and medical records, change significantly and legally.

Parents often make the mistake of not informing their children where their plan is stored and what’s included

Parents need to tell their children where their estate planning documents are stored. It’s shocking how many people create a will or a trust but then don’t communicate where to find them or how to get into their safe.

For my family, it’s documented not only in legal paperwork but also on an online digital estate management platform that securely stores our information. We use LegacyNow, an Estate Registry product that safely stores our account information for all our asset and liability accounts.

Everyone should know that estate planning isn’t just for the wealthy

Estate planning is essential for anyone who wants to protect their loved ones or has any wishes they want to be honored. Everyone has something to add to a plan, whether that be an old car they bought years ago, insurance plans, or mortgage payments.

Another piece of advice is that expecting parents should make an estate plan before their child is born. Use the time during pregnancy to draft a basic will, set up a guardianship plan, and ensure life insurance and financial accounts have the correct beneficiary designations. The sooner this is in place, the more secure your child’s future will be.

My wife and I created an estate plan for our daughter while still expecting, and this gave us peace of mind from knowing that we had a plan in place to protect our daughter from day one.

Ultimately, if you plan earlier, you will likely face fewer uncertainties

One of the biggest pitfalls of not having an estate plan is that your assets could end up in probate — a long, expensive, and often frustrating legal process. With tech and digital estate management platforms on the rise, the process is becoming more streamlined.

Estate planning is about peace of mind. It ensures that your loved ones are protected, that your wishes are carried out, and that difficult decisions are made before they become urgent and emotional.

Start early, keep the conversation open, and update your plan regularly because having a plan in place is one of the most important gifts you can leave behind for your loved ones.

Read the full article here