Uber is an attractive growth investment opportunity and recently received backing by Bill Ackman

By Blue Chip Portfolios

Shares of Uber Technologies, Inc (UBER, Financial) have proved a disappointing investment over the past year. Uber shares have delivered a total return of roughly 4% while the S&P 500 has delivered a total return of roughly 22% over the same time period.

While the company has delivered solid results including impressive revenue growth and significant margin improvement, investors have become skeptical of the long-term prospects of the company due to the threat of autonomous vehicles. However, I believe the company is poised to benefit from autonomous vehicles over the long-run. Investing guru Bill Ackman appears to agree with this view and recently initiated a $2.3 billion position in the stock.

Uber shares currently trade at an above-market forward price to earnings ratio of 30x based on consensus full year 2025 earnings per share estimates. However, I believe the stock is undervalued given its strong growth prospects.

Company overview

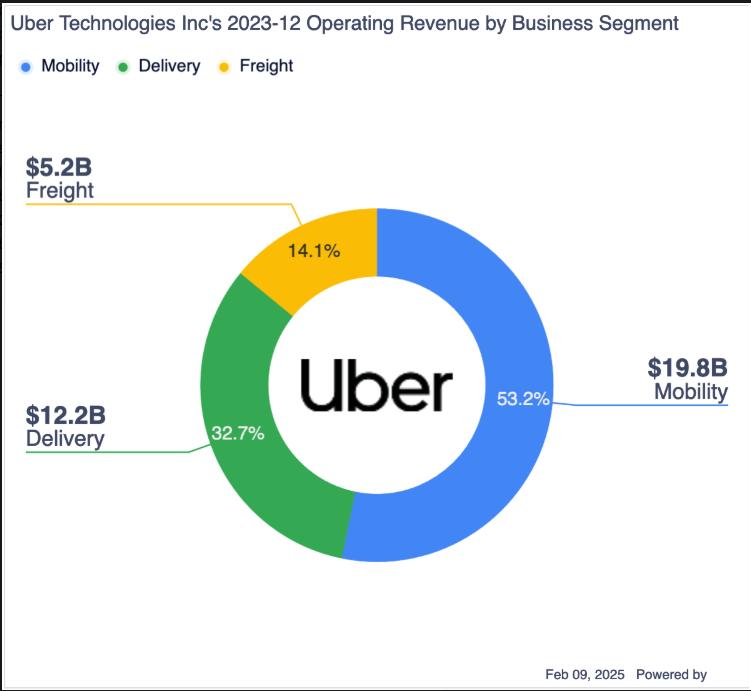

Uber is a technology company which operates platforms that connect consumers with providers of services. The company’s largest business is its mobility business which accounts for roughly 52% of revenue. Uber’s other key business is its delivery business which accounts for roughly 33% of revenue. Uber’s freight business, which has struggled to generate profitability, accounts for the remaining share of revenue.

The company has operations in roughly 70 countries globally and derives roughly 50% of its revenue from the U.S. While Uber has been around since 2009 the company historically struggled to generate profitability. That has changed over the past year as Uber reported net income of nearly $10 billion compared to net income of just under $2 billion of net income for 2023. It is important to note is the $10 billion figure includes a $6.4 billion benefit related to a one-time tax revaluation. Even after backing out the $6.4 billion benefit, Uber’s profit growth remains impressive.

Attractive growth prospects

Over the past five years, Uber has grown its revenues at a roughly 28% compound annual growth rate. Growth has been strong in both the company’s mobility and delivery segments. I expect this trend to continue going forward as the company is set to expand by increasing market penetration outside of the U.S. and in smaller cities within the U.S.

In addition to increasing market penetration in both its mobility and delivery business, I believe that Uber is also poised to see significant benefits from the adoption of autonomous vehicles. Currently, Uber has an operating partnership with Waymo in Phoenix and has announced plans to expand this partnership to Austin and Atlanta in 2025. One thing to note is that Waymo has been operating on its own, without a partnership with Uber, in Los Angeles and San Francisco. The fact that Waymo has decided to partner with Uber in new markets after operating previously without Uber in certain markets suggests that the benefits of being an option on the Uber platform exceed the costs related to sharing a portion of profits from each ride with Uber. For Uber, Waymo represents a significant growth opportunity as it will lead to additional supply of vehicles. Currently, limited supply of new drivers has proved a growth headwind for the company. In addition to providing additional supply, autonomous vehicles are likely to result in a lower cost to serve as autonomous vehicles do not require a human driver.

Another reason why I believe autonomous vehicles operators are likely to partner with Uber is the fact that there are likely to be multiple different autonomous vehicles options in the future. Elon Musk has said that Tesla plans to launch its own autonomous vehicles later in 2025. Amazon backed Zoox also plans to launch autonomous vehicles in the near future. Thus, it appears likely that multiple autonomous vehicles will be available in the next few years. The existence of multiple autonomous vehicle options on the market favors Uber because the company is uniquely positioned to be an aggregation platform where consumers can quickly and easily evaluate different options including traditional vehicle options with a driver. Uber is a highly valuable partner for autonomous vehicle providers as the scale of Uber’s customer base results in more efficiency for autonomous vehicle operations that would be the case if they were operating on their own with a smaller customer base.

Uber CEO Dara Khosrowshahi commented on benefits that autonomous vehicle operates experience from being available through Uber during the Q4 earnings call:

Our very, very early experience in Phoenix suggests that — and some of the other deployments that we’ve got suggests that the Uber network is able to drive significantly higher utilization versus any kind of first-party network could just because of the scale and the variability in terms of supply and demand in a particular market. And the other pattern that we see is customers love the product. So the opt-in rate for customers the second time that they are offered an AV is significantly higher than the opt-in rate the first time. So it is a great product, and you see that in terms of pricing. You can actually price the product at a premium too, which is terrific.

Uber also recently announced a partnership with Nvidia to share data from its platform to help accelerate autonomous mobility. Currently, consensus estimates call for Uber to report revenue growth of 15%, 15%, and 14% for full years 2025- 2027. Consensus estimates for full year 2025 earnings per share call for a decline of 46% as full year 2024 earnings per share included a one-time positive impact of $6.4 billion due to a tax revaluation. Consensus earnings per share estimates for full years 2026-2028 call for the company to deliver earnings per share growth of 36%, 24%, and 19% respectively.

Bill Ackman backing

Bill Ackman recently announced that his Pershing Square Capital Management has acquired a stake of more than $2.3 billion in Uber. Ackman noted that he believes that Uber is a high- quality business that can currently be purchased at a massive discount to intrinsic value. Additionally, Ackman noted that he believes autonomous vehicles represent a major positive catalyst for the company rather than a disruptive force.

While I believe investors should always do their own work and come to their own conclusion, Ackman’s backing is a clear positive. This is especially true given the fact that Ackman has a strong history of finding attractive growth at a reasonable price investments. Some of Ackman’s notable successful growth investments include Chipotle Mexican Grill and Hilton Worldwide. Moreover, at more than $2.3 billion Ackman’s Uber bet is now his largest position which suggests he has a high degree of conviction in the investment.

Valuation is attractive

Uber currently trades at 30x consensus full year 2025 earnings per share and 22x consensus full year 2026 earnings per share. While this valuation represents a moderate premium to the S&P 500, Uber has much strong near-term growth prospects than the broader market.

Uber’s closest publicly traded peers are Lyft and DoorDash which trade at 13x and 42x consensus full year 2025 earnings per share. Lyft trades at a significant discount due to its relatively small size and focus on the mobility business which is viewed as less attractive than the delivery business. Uber generates roughly 32% of its revenue from its delivery business with the bulk of the remainder coming from its mobility segment. Based on a blended peer multiple assuming a 32% weight on DoorDash’s valuation and 68% on Lyft, Uber’s peer valuation would be roughly 22x consensus full year 2025 earnings. While Uber’s current valuation of 30x represents a premium to its blended peer valuation, I believe this premium is well deserved given the fact that Uber has larger scale than these rivals. Moreover, I also believe that in the long-run Uber will benefit from additional cross selling and economies of scale given its large presence in both the mobility and delivery markets. For example, Uber’s R&D spend can be leveraged to benefit both its mobility and deliver businesses.

Uber’s valuation also appears attractive vs other companies poised to benefit from the autonomous vehicle trend such as Tesla which trades at 124x consensus full year 2025 consensus earnings per share.

Risks to the bull case

The biggest risk to the Uber bull case is that autonomous vehicle providers decide to circumvent Uber and go direct to consumer with large scale offerings. While I view this as highly unlikely given recent developments with Waymo and the fact that Uber has a massive customer base, it is not impossible. Such a development would be more likely to occur in the event that only one autonomous vehicle wins out in the end. Comparably, if there are autonomous vehicles offered by multiple players then Uber should be well position to be the platform of choice for consumers as it easily allows users to compare options.

Another risk to the Uber bull case would be if Lyft were to be acquired by a stronger player. For example, Amazon or DoorDash would appear to be a suitable buyer for Lyft and could create a platform with greater scale than is currently the case. Such a combination could result in more competition for Uber and thus lead to margin pressures in the future.

Conclusion

Uber shares have not kept pace with the broader market rally over the past year. The company has a strong history of delivering consistent revenue growth and has recently started delivering very strong earnings growth. The company is well positioned to benefit from secular growth trends going forward and has the potential to be a major beneficiary of autonomous vehicles.

The stock trades at a reasonable valuation relative to the broader market and peers. Moreover, the company has the backing of investing guru Bill Ackman, I believe the stock represents a compelling growth at a reasonable price investment opportunity.

Read the full article here