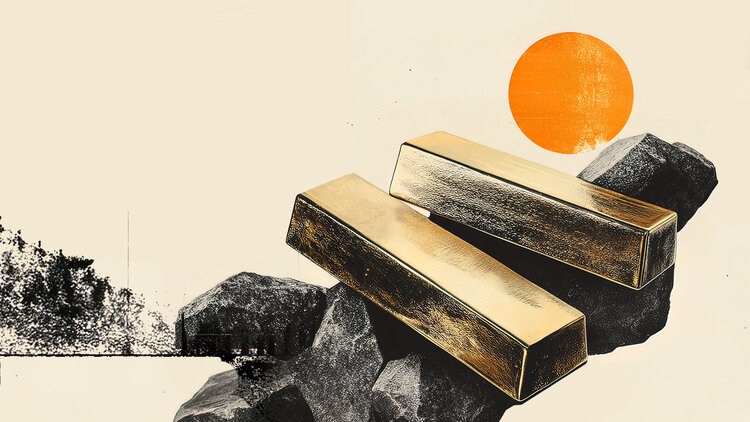

- Gold benefits from a weaker Greenback amid thin liquidity on US Independence Day.

- Tariff uncertainty and Trump’s ‘Big Beautiful Bill’ lift demand for safe-haven bullion.

- XAU/USD whipsaws between key moving averages as the price hovers above $3,330.

Gold (XAU/USD) is trading higher on Friday as news about United States (US) President Donald Trump’s passage of the “Big, Beautiful, Bill” filters through markets. With markets closed in the US in celebration of Independence Day, XAU/USD is trading above $3,330 at the time of writing.

Liquidity is expected to remain light in the US following the holiday weekend, which could make bullion sensitive to developments that may influence risk sentiment.

Risk appetite improved this week, following reports that the US was making progress in trade talks ahead of the July 9 deadline. However, the mood has shifted slightly on Friday as tariff uncertainty and President Trump’s threats to send letters to nations dictating the amount that they will pay to do business with the US.

On Friday, Trump stated that “We’re probably going to be sending some letters out, starting probably tomorrow, maybe 10 a day to various countries saying what they’re going to pay to do business with the US,” according to Reuters.

“They’ll range in value from maybe 60% or 70% tariffs to 10% and 20% tariffs,” was the range that Trump gave Bloomberg reporters.

Looking ahead, market focus will shift to ongoing trade negotiations, which could introduce fresh volatility. If trade talks deteriorate or geopolitical tensions rise, investors may rotate into safe-haven assets like Gold.

Additionally, the proposed “Big, Beautiful, Bill” was passed by the House of Representatives late Thursday following the release of crucial economic data from the US.

Daily digest market movers: Concerns over debt sustainability limit Gold’s declines

- A Truth Social post on Thursday by President Trump stated: “The Republicans in the House of Representatives have just passed the ‘ONE BIG BEAUTIFUL BILL ACT.’ Our Party is UNITED like never before, and our Country is ‘HOT.’… We are going to have a Signing Celebration at the White House tomorrow, at 4 P.M. EST.”

- The primary objective of the GOP Megabill is to extend tax cuts for individuals and businesses introduced in the 2017 version of Trump’s Tax and Jobs Act. The bill also includes initiatives to address illegal immigration while expanding the scope of projects, such as the “Golden Dome” defense plan. While the spending and tax bill clamps down on Medicaid and green energy initiatives, this has raised concerns over the fiscal and sustainability of the US debt

- The law raises the debt ceiling by $5 trillion. This is the upper limit on what the government can borrow. Meanwhile, the Congressional Budget Office (CBO) estimates it will increase the national deficit by $3.3 trillion over the next decade.

- Over time, a rising deficit and mounting debt burden can undermine confidence in the US Dollar (USD). Since Gold is priced in Dollars, this could lift XAU/USD by making it more affordable for foreign investors.

- However, interest rate expectations, which are favouring a rate cut by the Federal Reserve (Fed) in September, have tempered short-term gains after Thursday’s data appeared to reduce pressure on the Fed to cut rates in July, which provided some support to US yields.

- The June Nonfarm Payrolls (NFP) report showed 147K jobs added to the US economy, exceeding the 110K estimate. Additionally, the unemployment rate dropped to 4.1% from 4.2%. Weekly Initial Jobless Claims also declined to 233K from 237K.

- The Institute of Supply Management (ISM) Services Purchasing Managers’ Index (PMI) rose to 50.8 in June, reflecting an increase in economic activity in the service sector.

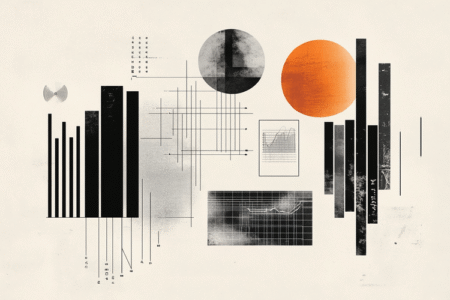

Gold technical analysis: XAU/USD price compression signals breakout potential above $3,400

Gold (XAU/USD) is currently consolidating within a symmetrical triangle pattern, signaling potential breakout as price action tightens.

The yellow metal is trading between support at the 50-day Simple Moving Average (SMA) near $3,321 and resistance at the 20-day SMA of $3,350, indicating short-term indecision.

Above the 50-day SMA, key resistance sits near the 23.6% Fibonacci retracement of the April low to the April high move at $3,371. If bulls recover, the next big level of psychological resistance sits at $3,400.

Gold (XAU/USD) daily chart

In contrast, below the 20-day SMA, immediate support lies at the $3,300 psychological level, followed by the 50% Fibonacci level at $3,328.

The Relative Strength Index (RSI) is flattening around the neutral 50 mark, signalling a lack of momentum and reinforcing the range-bound behavior.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Read the full article here