As of the date of this writing, Dec. 29, the folks at the Financial Crimes Enforcement Network (known as FinCEN) are enjoined from enforcing the Beneficial Ownership Information (BOI) reporting requirements under the provisions of the Corporate Transparency Act (CTA) passed by Congress in 2021. And, yes, you know you are dealing with the government when everything has an acronym.

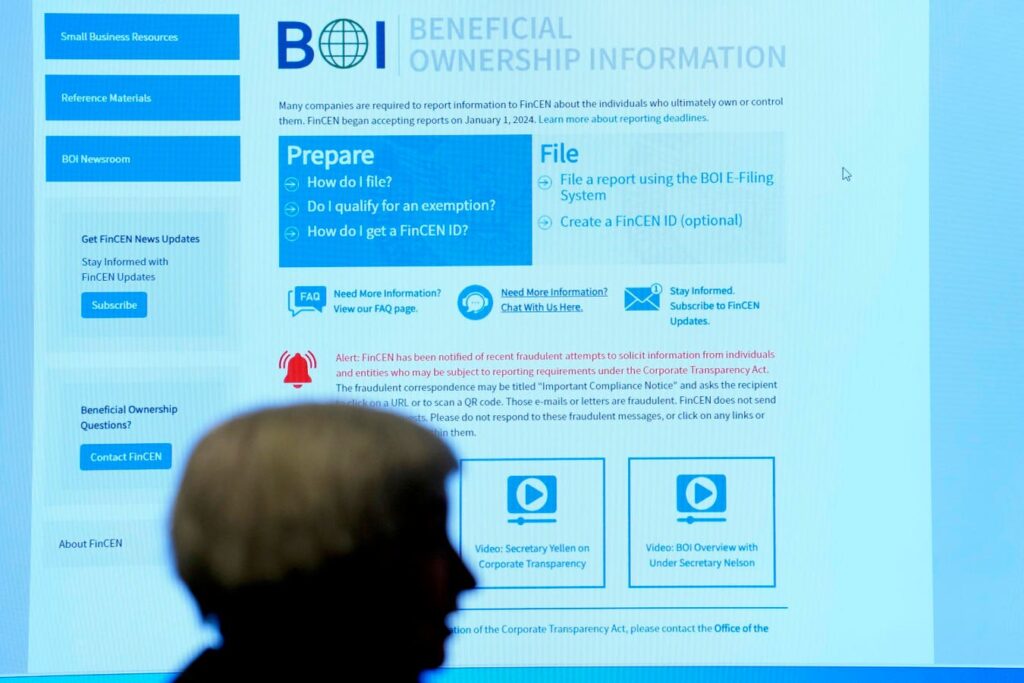

The BOI reporting mandate applies to the beneficial owners and controlling persons of certain business entities. These entities include nearly all business entities such as corporations, limited liability companies, limited partnerships and the like. In the vast majority of situations, BOI filing through the FinCEN website is quick and easy — and, really, no more onerous than one arranging an international flight.

Before I get stuck into this article, let me recommend a critically important article on BOI reporting, “Impossible Things: Compliance with the Corporate Transparency Act When Beneficial Owners or Company Applicants Are Nonresponsive,” by Robert R. Keatinge and Thomas E. Rutledge, in the Dec. 16 issue of Business Law Today. Probably nobody is following the BOI reporting issues closer than Keatinge and Rutledge, who are both winners of the prestigious Lubaroff Award for the nation’s outstanding LLC and partnership lawyers. I closely follow their writing in this area and you should, too. You can also catch their up-to-the-minute posts on the message board of the American Bar Association’s LLCs, Partnerships and Unincorporated Entities Committee, where all the serious LLC attorneys are found.

For our purposes here, the most important thing to understand is that the BOI requirements are fundamentally those of Congress when it passed the CTA. The BOI requirements are not those of some Treasury bureaucrats run amok, but instead evinces the policy of the duly-elected representatives of the people. More on this in a moment.

Here is what has happened in our previous episodes:

Dec. 3, 2024 ― A U.S. District Court in the case of Texas Top Cop Shop v. Garland entered a nationwide preliminary injunction that barred FinCEN from enforcing the CTA (and thus FinCEN’s BOI filing requirements) on the grounds that Congress had exceeded its powers under the U.S. Constitution’s Commerce Clause in enacting the CTA. After that, FinCEN updated its BOI page to indicate that reporting was not mandatory.

Dec. 23, 2024 ― Several judges (known as a “panel”) of the U.S. Fifth Circuit Court of Appeals held that Congress did not exceed its Commerce Clause powers in enacting the CTA and dissolved the injunction. This panel is known as the “motions panel” because it hears certain motions filed by parties before the Fifth Circuit which motions do not go to the substantive merits of the appeal. The motions panel, as here, takes up emergency motions requiring immediate resolution. Later, a merits panel (described below) will be chosen for the particular appeal. After this, FinCEN again updated its website to indicate that BOI reporting was again mandatory, but extended the filing deadline to January 13, 2025.

Dec. 26, 2024 ― A different panel of the Fifth Circuit vacated the order of the motions panel until it could consider the substantive issues of the appeal. This panel is known as the “merits panel” because this group of judges have been chosen to decide the legal issues before the Fifth Circuit. It is not unusual for a merits panel once they have been appointed to reconsider decisions of the motions panel. By vacating the order of the motions panel, the merits panel essentially reinstated the preliminary injunction that prohibited FinCEN from enforcing the CTA. This caused FinCEN to again update its BOI webpage to indicate that filings are no longer mandatory.

None of this would be unusual as a matter of ordinary federal appellate litigation in most cases. Been there, done that.

What is unusual in this case is that the merits panel would so quickly vacate the order of the motions panel lifting the injunction, instead of just taking a few days to resolve the appeal.

Because the preliminary injunction issued by the U.S. District Court was just that ― preliminary ― there is no large record for the merits panel to review on appeal. There is also just one issue, being whether the reporting requirement of the CTA exceeded the power of Congress under the Commerce Clause. As to this singular issue, it is crystal-clear under existing opinions of the U.S. Supreme Court that Congress did not exceed its powers under the Commerce Clause as regards the CTA. Note that two other district courts considering the same question have already issued rulings to that effect.

Where things become less clear is whether the U.S. Supreme Court itself will consider the CTA a valid exercise of Congress’ powers under the Commerce Clause. The Supreme Court as presently constituted has been giving indications that it may dial back the historically broad powers of Congress under the Commerce Clause. Be that as it may, however, it is not the duty of the Fifth Circuit or any other appeals court to dig out its Ouija board and attempt to discern via séance what the Supreme Court may or may not do in the future. Rather, the Fifth Circuit may properly base its decision only and exclusively upon the existing opinions of the Supreme Court. These opinions, which are the existing law, clearly support the instant exercise by Congress of its power under the Commerce Clause in enacting the CTA and in its reporting requirements.

In other words, the merits panel should simply (and quickly) have held that the reporting requirements of the CTA are within the scope of Congress’ powers under the Commerce Clause and reversed the decision of the District Court. Those challenging the CTA could then have taken an emergency appeal to the U.S. Supreme Court allowing the U.S. Supreme Court to itself determine whether the gravity of the challenge to the CTA warranted the imposition of a preliminary injunction to stay enforcement of the BOI reporting requirement. That is how all of this should have gone down.

My personal opinion of all this is that it represents an incredibly lazy act of the merits panel to not resolve this issue one way or another within a few days. Guess that somebody did not want their holidays messed up even if later it may create a great hardship upon tens of millions of Americans who may suddenly find that they do have to make their BOI filings and then have what will probably only be a short period of time to do so. This delay will also result in those who have already made their BOI reports unjustifiably questioning the competency of their professional advisers who told them to go ahead and file and get it out of the way. It is a bad look all around — and all for a legal issue that, if it appeared as a hypothetical on the bar examination, could be fully resolved by most applicants within five minutes.

Instead, the Fifth Circuit has created a big mess for literally tens of millions of Americans who are confused about these on again, off again antics. For its part, FinCEN has tried to help (before this last Fifth Circuit order) by extending the BOI reporting deadline to Jan. 13, 2025. Even this extended deadline, however, has itself been rendered a nullity by the Fifth Circuit. As mentioned above, as we sit here today any compliance with the BOI reporting requirement is strictly voluntary.

There is something else to mention here, which is that the District Court should not have entered the injunction in the first place with the reporting deadline so near. Injunctions are equitable in nature, and equity does not favor those who have slept on their rights national preliminary injunctions that are entered in the 11th hour before legislation goes into effect are particularly disfavored. The Texas litigants who are challenging the CTA knew about its existence years ago when it was passed and the pending Jan. 1, 2025 deadline was set in September 20222. These litigants did not, however, file their lawsuit until the end of May this year and should have not have been rewarded for their own intentional delay in bringing their challenges.

But here we are. Thank you for the mess. Happy New Year, sort of.

Read the full article here