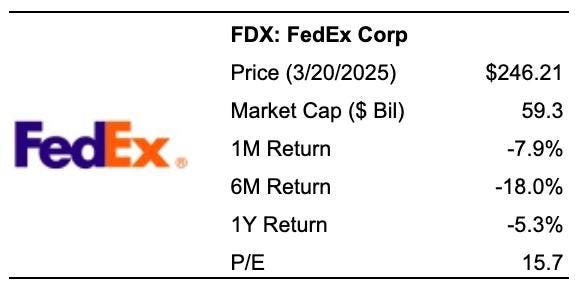

FedEx stock (NYSE: FDX) recently released its financial results for the third quarter of fiscal year 2025, ending in February. The company reported earnings per share of $4.51 on revenues of $22.2 billion. While this represented a year-over-year increase of 2.3% in sales and 16.8% in earnings, FedEx’s performance fell short of Wall Street’s projections, which anticipated $4.57 in earnings per share on $21.9 billion in revenue. Furthermore, FedEx lowered its full-year adjusted EPS forecast to a range of $18.00–$18.60 from its prior estimate of $19.00–$20.00. This didn’t bode well for its stock post the earnings announcement.

Looking beyond just earnings, the current period presents broader market anxieties that pose additional difficulties for FedEx. Prevailing economic uncertainties in the United States are creating a less favorable environment for markets overall. FedEx stock is particularly susceptible due to its close ties to industrial growth. In fact, we anticipate that FDX stock could potentially fall to $150 per share.

Here’s the thing, in a downturn, FDX can lose – no – there is evidence, from the recent economic downturns, that FDX stock lost as much as 45% of its value over a span of just a few quarters. Now, of course, individual stocks are more volatile than a portfolio – and in this environment if you seek upside with less volatility than a single stock, consider the High-Quality portfolio, which has outperformed the S&P 500 and achieved returns greater than 91% since inception.

Why This Matters Now

While FedEx’s recent performance did show some encouraging signs, with sales surpassing analysts’ expectations due to increased volume, significant macroeconomic challenges remain a key concern. Though inflation concerns have diminished, they haven’t disappeared. The current administration’s aggressive tariff and immigration policies have rekindled inflation anxieties, potentially signaling economic turbulence ahead.

Risk Factors to Consider

The heightened geopolitical uncertainty stemming from the new administration’s bold policy initiatives presents additional challenges. With ongoing conflicts in Ukraine-Russia, renewed tensions with Israel-Gaza, trade uncertainties, and strained negotiations with long-standing allies including Canada, Mexico, and Europe, the risk landscape has grown increasingly complex.

Concerning Performance Metrics

Notably, FDX stock has seen an impact worse than the benchmark S&P 500 index during some of the recent downturns —a critical consideration for investors evaluating their risk tolerance in today’s volatile environment.

While investors have their fingers crossed for a soft landing by the U.S. economy, how bad can things get if there is another recession? Our dashboard How Low Can Stocks Go During A Market Crash captures how key stocks fared during and after the last six market crashes.

How Resilient Is FDX Stock During A Downturn?

Inflation Shock (2022)

• FDX stock fell 46.1% from a high of $264.91 on 4 January 2022 to $142.90 on 26 September 2022, vs. a peak-to-trough decline of 25.4% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 26 July 2023

• Since then, the stock has increased to a high of $313.52 on 16 July 2024 and currently trades at around $245

Covid Pandemic (2020)

• FDX stock fell 45.1% from a high of $164.91 on 20 February 2020 to $90.49 on 16 March 2020, vs. a peak-to-trough decline of 33.9% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 16 July 2020

Global Financial Crisis (2008)

• FDX stock fell 68.1% from a high of $107.51 on 14 October 2007 to $34.28 on 9 March 2009, vs. a peak-to-trough decline of 56.8% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 5 March 2013

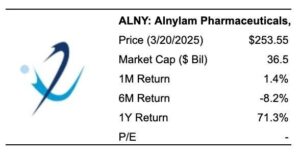

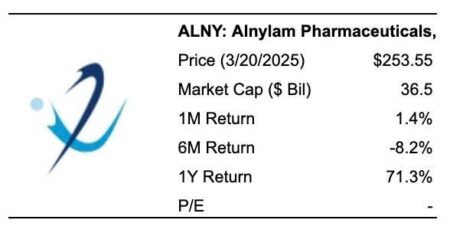

FedEx’s stock has declined 12% year-to-date (as of March 20), reflecting investor concerns about the company’s decreased e-commerce activity post-pandemic peak, ongoing inflationary pressures, and weakened international shipping demand. This downward trend could potentially continue with the macroeconomic uncertainty.

FedEx’s revenue growth has been notably weak, averaging just 1.7% annually over the last three years – significantly lagging behind the S&P 500’s 6.3% growth during the same timeframe. Moreover, its adjusted earnings have actually decreased by 15% since 2022. Despite this underperformance in both revenue and earnings, the company’s stock price maintains a price-to-earnings (P/E) ratio of 14.0, slightly above its three-year average of 13.0. So ask yourself the question: if you want to hold on to your FDX stock, will you panic and sell if it starts dropping to $200, or $150, or even lower levels?

Holding on to a falling stock is not always easy. Trefis works with Empirical Asset – a Boston area wealth manager, whose asset allocation strategies yielded positive returns during 2008/2009 timeframe, when the S&P lost more than 40%.

Empirical has incorporated the Trefis HQ Portfolio in this asset allocation framework to provide clients better returns with less risk versus the benchmark index; less of a roller-coaster ride, as evident in HQ Portfolio performance metrics.

While investors have their fingers crossed for a soft landing by the U.S. economy, how bad can things get if there is another recession? See the last six market crashes compared.

Invest with Trefis

Market Beating Portfolios | Rules-Based Wealth

Read the full article here