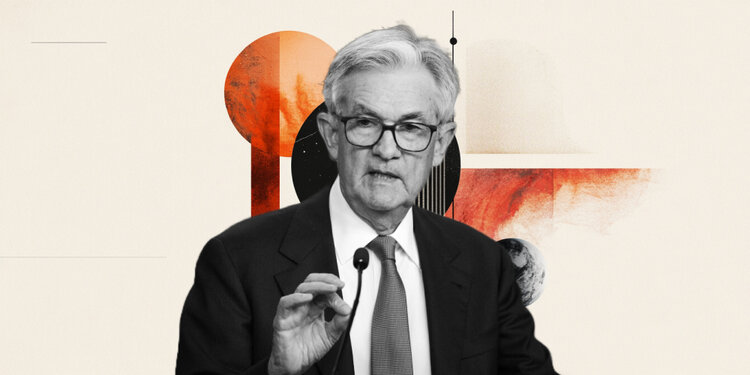

Federal Reserve (Fed) Chair Jerome Powell added further comments during his testimony before the congressional budget committee on Tuesday, building out his case for holding off on rate cuts, likely until sometime in the fourth quarter.

Key highlights

When the time is right, expect rate cuts to continue.

Data suggests at least some of tariff will hit consumer.

I think we’ll start to see more tariff inflation starting in June.

We will be learning as we go through the summer.

I’m perfectly open to the idea that tariff-inflation pass through will be less than we think.

We don’t need to be in any rush.

If it turns out inflation pressures are contained, we will get to a place where we cut rates.

I won’t point to a particular month.

The Fed just trying to be careful and cautious with inflation.

It’s uncertainty about the size and potential persistence of inflation from tariffs.

The economy is slowing this year. Immigration is one reason.

Shock absorber from US oil industry is in question now.

The Fed would look at the overall situation if oil prices surge.

The dollar is going to be the reserve currency for a long time.

I don’t think MBS runoff has a large impact on housing cost.

Once we get there, we can react more strongly to downturns in the economy.

I think the Fed is on right track in shrinking balance sheet.

The Fed has some shrinking left to do on balance sheet.

Credit conditions for small business a little bit tight.

We would expect to see meaningful tariff inflation effects in June, July or August.

If we don’t see that, that would lead to cutting earlier.

Right now, we’re in watch and wait mode.

Overall, the inflation picture is actually pretty positive.

Read the full article here