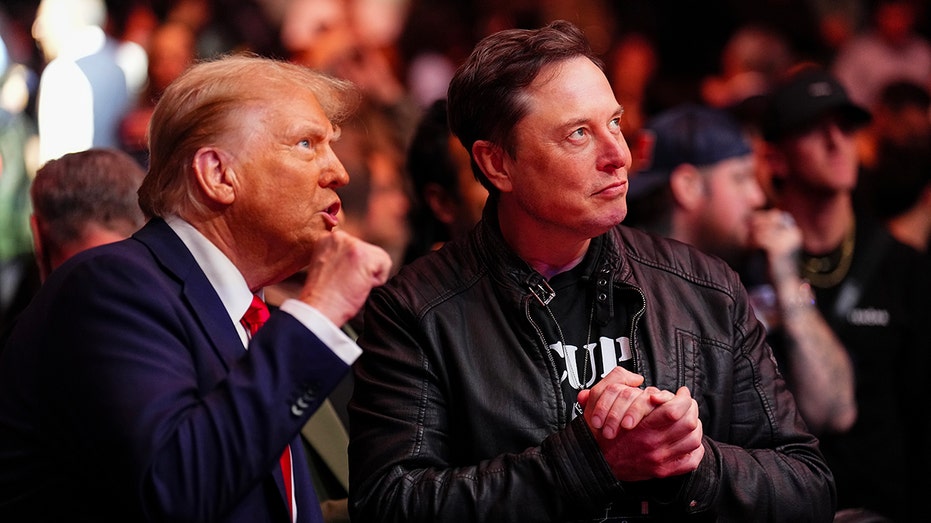

Elon Musk’s Department of Government Efficiency (DOGE) is working to cut the federal workforce through layoffs and buyouts, as well as canceling contracts to save money, which has raised the question of whether the cuts could push unemployment higher and create a headwind for the U.S. economy.

President Donald Trump’s administration has tasked Musk and DOGE with finding ways to reduce costs and increase the efficiency of federal agencies. The administration extended buyout offers to federal workers shortly after taking office, while various agencies have announced layoffs of probationary employees and placed some workers on administrative leave ahead of a potential layoff.

Those actions could create new challenges for the U.S. economy in terms of the labor market if large numbers of federal workers or contractors end up out of work and unable to find other jobs.

Dante DeAntonio, labor economist for Moody’s Analytics, told FOX Business that the firm expects federal workforce reductions to continue over the course of the year and that while some of the displaced workers could find private sector jobs, the magnitude and timing of further cutbacks will determine whether the broader labor market starts to falter.

CONSUMER CONFIDENCE SLUMPS IN FEBRUARY WITH BIGGEST MONTHLY DROP IN NEARLY 4 YEARS

“We estimate that about 100,000 federal workers have already been laid off or have accepted the deferred buyout offered by the Trump administration,” DeAntonio explained. “The approximately 75,000 workers who agreed to the deferred buyout are supposed to be paid through September, so their impact on the labor market will be delayed. About 25,000 federal workers have been laid off or put on administrative leave, with a layoff likely to follow.”

“These numbers are almost certain to grow in the coming weeks and months, and we will start to see the impact of these layoffs, first in unemployment insurance claims data, and later, they will result in slower payroll employment growth,” he added.

AMERICA’S WEALTHIEST HOUSEHOLDS DRIVING NEARLY HALF OF CONSUMER SPENDING: MOODY’S

DeAntonio noted that the federal government has about 3 million workers, excluding the military, as of the start of 2025. Federal workers account for about 1.9% of U.S. payrolls, and he said that the “private sector should be able to absorb some of these workers.”

“The biggest risk is that the layoffs we have seen so far are just the tip of the iceberg. The magnitude and timing of future layoffs will determine whether the labor market can stay on the rails,” DeAntonio explained. “We currently expect that the size of the federal workforce will shrink by about 400,000 throughout 2025 due to a combination of the ongoing hiring freeze, deferred resignations, and DOGE-initiated layoffs.”

DOGE CLAIMS $65B IN TOTAL ESTIMATED SAVINGS AS ‘AGENCY EFFICIENCY LEADERBOARD’ IS LAUNCHED

Torsten Slok, a partner and chief economist at Apollo Global Management, wrote in a post published on Saturday that “we are starting to worry about the downside risks to the economy and markets” and cited “the impact of DOGE layoffs and contract cuts on jobless claims” as one of those factors along with elevated policy uncertainty.

Slok wrote that the “consensus expects total DOGE-related job cuts to be 300,000” and noted that while unemployment claims have been rising in Washington, D.C., they have not increased when combining Washington, D.C., with Maryland and Virginia, where large numbers of federal employees work.

“Total employment in the United States is 160 million, with 7 million unemployed. Also, about 5 million people change jobs every month. In that context, 300,000 federal jobs lost is not much,” Slok explained. “However, studies show that for every federal employee, there are two contractors. As a result, layoffs could potentially be closer to 1 million.”

“Any increase in layoffs will push jobless claims higher over the coming weeks, and such a rise in the unemployment rate is likely to have consequences for rates, equities, and credit,” Slok added.

Read the full article here