The last posting on March 6th analyzed the prospects for four of the Magnificent Seven or the “Fab” Seven as some commentators have renamed the group. Let us apply the same approach to Amazon, Microsoft, Alphabet (Google), and Tesla. (I added Netflix in the first posting, so we are analyzing the big eight.) The overall stock market is projected to be in a trading range this year. Cycles will be a useful guide in trading the tech heavyweights in 2025.

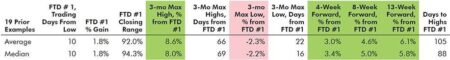

As we can see below, the Amazon cycle bottoms now. This cycle is synchronized with the Amazon seasonal cycle. From March 3rd through July 5th, this stock has risen over 80% of the time over the last 27 years. This stock is likely to outperform the technology index.

Amazon Monthly Cycle

Microsoft cycles are strong until June, but underperformance is likely in the second half of the year. The first half of any year has been bullish. Over the last 38 years, the stock has risen 74% of the time. The cycle is the weakest of the stocks that are under review in the second half of 2025, projecting a weak close to 2025.

Microsoft Monthly Cycle

The Alphabet monthly rhythm is different from that of most of the other stocks. It traces out a 2025 trading range. There is a low in May followed by a July peak. There is a late October low followed by a strong Q4. Trade the stock.

Alphabet Monthly Cycle

Tesla peaked before the overall technology stock decline. The stock followed its cycle down. The cycle falls into early June and then rallies for most of the rest of the year. June has been the single strongest month in any year, so the dynamic cycle low is reinforced by the low in the seasonal cycle.

Tesla Monthly Cycle

Read the full article here