China’s economy is still stuck in a yearslong slump marked by a property crisis, weak consumer demand, and deflation — but its biggest companies are raking in cash abroad, according to a new Goldman Sachs report.

As the domestic market stagnates, Chinese firms are turning abroad for customers and finding fatter profits once they get there.

Gone are the days when China was simply exporting more goods at rock-bottom prices. It’s now exporting services, technology, intellectual property, and culture.

It has also strategically increased its overseas direct investment in recent years, particularly to emerging markets and Belt and Road Initiative countries.

“This strategy enables Chinese companies to diversify supply chains, build production capacity closer to end markets, and enhance business resilience,” wrote analysts from Goldman Sachs in a note republished on Sunday.

Chinese listed companies now earn about 16% of their total revenue overseas, up from 14% in 2018, per Goldman’s analysis. That’s well below the roughly 50% average for developed-market firms, but it’s rising fast.

The bank expects that share to keep climbing by about 0.6 percentage points a year.

Beyond ‘Made in China’

The shift marks a clear break from China’s old growth model. For decades, “Made in China” meant low-cost manufacturing for Western consumers.

Now, the country’s exports are moving up the value chain. The offerings span broad categories, from toys and furniture to electric vehicles, lithium-ion batteries, and solar panels.

Chinese products also remain competitively priced at a discount of 15% to 60% compared with global rivals, according to Goldman’s analysts.

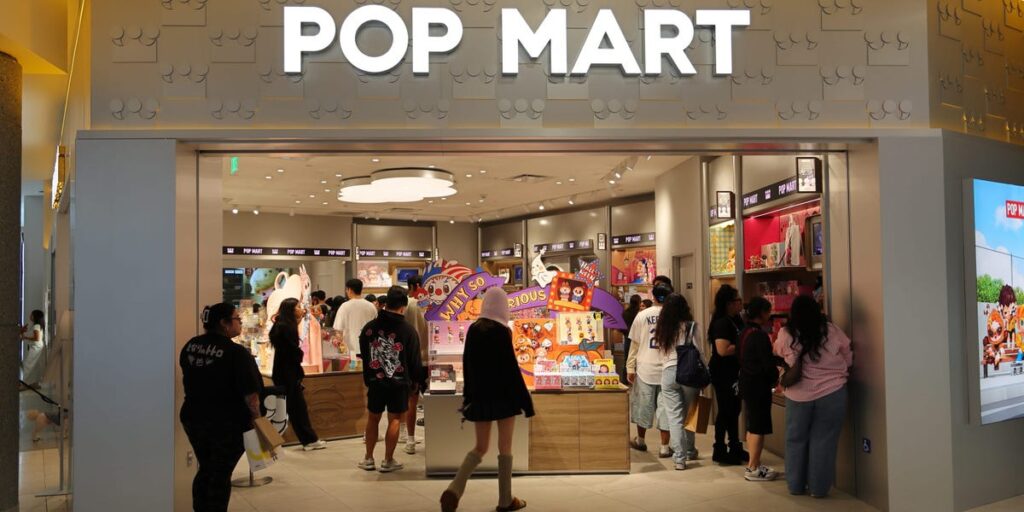

In the US, consumers have become increasingly familiar with Chinese upstarts like Labubu-maker Pop Mart, Luckin Coffee, and Temu, which are exporting not just products but China’s digital business models abroad.

Tariffs haven’t slowed the companies’ momentum either. Goldman estimates that a 100% tariff on Chinese exports to the US would cut corporate earnings by only around 10% in the short term, since many firms have diversified supply chains and reduced US exposure to roughly 4% of sales.

The success of Chinese firms overseas is fueled by weakness at home.

A “nexus of overcapacity, intense competition, and disinflation,” Goldman notes, has caused damaging price wars that have squeezed profit margins across many industries.

A global growth shift

The global push could have broader economic effects.

As more profits flow from overseas subsidiaries, a measure of total income earned by a country’s citizens and companies worldwide. China’s gross national product, or GNP, may eventually outpace its GDP, much like Japan after its asset bubble burst in the 1990s, according to Goldman.

That shift could affect markets as Chinese corporate earnings become less tied to domestic demand and more dependent on global consumption trends.

Goldman highlights a group of 25 leading companies across 12 industries that already earn about 34% of their revenue abroad. On average, those stocks — including Alibaba, BYD, and PDD Holdings — are up nearly 40% year-to-date.

“These trends could extend, supported by Chinese companies’ comparative cost advantages and product quality upgrade,” wrote Goldman’s analysts, referring to firms’ overseas growth momentum.

Read the full article here