Can professional analysts pick stocks?

Don’t laugh. Analysts perform many valuable functions. They ask probing questions to management, estimate earnings, and provide a wealth of information on companies and industries.

However, a study I’ve been conducting for a quarter of a century suggests they are no better at picking stocks than your Aunt Louise.

Each January, I make note of the four stocks analysts most adore, and the four they most despise. When the year is over, I compare how those two groups of stocks have done.

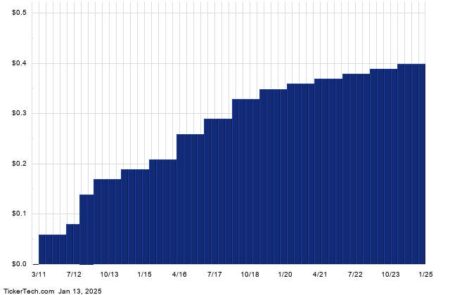

The results are not favorable to Wall Street. On average, over 26 years, the analysts’ darlings have returned 7.25%. The stocks they hate have averaged 6.89%. Neither group beats the Standard & Poor’s 500 Total Return Index, which rolled in at 12.57% per year.

My study covers every year from 1998 through 2024, except for 2008 when I was temporarily retired as a columnist. Figures are total returns, including dividends and capital gains or losses.

Latest Scores

A year ago, the most popular stock among analysts was Schlumberger Ltd. (SLB), which garnered 20 “buy” ratings with nary a “hold” or “sell” in sight. What did Schlumberger do for the year? It fell 24.4%.

Privia Health Group Inc. (PRVA), which was fourth on analysts’ most-loved list, also fell. It lost 15.1% of its value.

Better was S&P Global Inc. (SPGI), which returned 13.9%. And the analysts had one big winner: Targa Resources Corp. (TRGP) more than doubled, returning 110.1%. That pulled the analysts’ average up to 21.1% for 2024.

What about the stocks that analysts despised? They all had modest gains. Avista Corp. (AVA) was up 7.8%, Southern Copper Corp. (SCCO) up 8.3%, and Chenierre Energy Partners (CQP) up 14.3%. The best performer for the hated brigade was Moelis & Co. (MC), which returned 37.3%.

Collectively, the stocks that Wall Street wouldn’t touch achieved a 16.9% return, a little more than four percentage points below the analysts’ favorites.

Running Tally

In 26 outings, the analysts’ most-adored stocks have beaten their most-despised names 14 times. The despised brigade have won 11 times, and there was one tie.

Against the S&P 500, neither group distinguished itself. The analysts’ favorite have beaten the index only seven times out of 26, while the despised issues have beaten it 10 times.

Data for the study come from Zacks Investment Research, Bloomberg and Ned Davis Research.

Most Adored

The two stocks analysts most favor as 2025 begins are both airline stocks. United Airlines Holdings Inc. (UAL) get 22 buy ratings, with no sells or holds. The analytical corps is almost equally bullish on Delta Air Lines Inc. (DAL) with 21 unanimous recommendations.

It’s easy to see why the analysts have warmed up to airlines. Traffic has picked up for both business and leisure travel, and jet fuel is not too expensive these days. But let’s remember that Warren Buffett once said it would have been good for investors is someone had shot Orville and Wilbur Wright.

Third on the adored list is Arcelix Inc. (ACLX) with 19 recommendations and no dissents. Arcelix, based in Redwood, California, is a biotech company that says it is “reimagining cell therapy through the development of immunotherapies for patients with cancer and other incurable diseases.”

A worthy goal, to be sure. But Arcelix had revenue of just under $156 million in the past four quarters, while the market values the stock at $3.47 billion. Several company insiders have sold some of their stock in the past few months.

Rounding out the adored group is Axsome Therapeutics (AXSM) unanimously endorsed by 18 analysts. The company, based in New York City, is developing therapies for diseases of the central nervous system.

Most Hated

On the list of stocks that analysts can’t stand, ZIM Integrated Shipping Services Ltd. (ZIM) ranks first, with five out of seven analysts suggesting that people dump the stock. The stock sells for about $19, down from about $77 four years ago. ZIM has lost money in six of the past ten years.

Ginko Bioworks Holdings Inc. (DNA), a Boston-based bioengineering company, is ranked “sell” by four of the six analysts who cover it. Losses are narrowing, but analysts don’t expect a profit before 2027.

CNX Resources Corp. (CNX) gets eight sell ratings from the 13 analysts who follow it. Based in Canonsburg, Pennsylvania, it produces and transports natural gas in the Appalachian Basin.

Finally, AMC Networks Inc. (AMCX) is considered a “sell” by three of the five analysts who venture an opinion.

I have a hunch the analysts darlings can beat their pariahs in 2025. But it’s hard to be sure. And that is precisely the point.

Read the full article here