- BYD is chasing down Tesla on EV sales, but the Chinese giant is much more than just a car company.

- As well as cheap EVs, BYD also makes batteries, buses, trains and even some iPhones and iPads.

- BYD is following in the footsteps of Elon Musk’s company, which also has lucrative side hustles.

BYD has fast become one of the world’s biggest electric-vehicle makers — but the Chinese giant is much more than just a car company.

Like its rival Tesla, BYD, which was founded in 1995 as a battery manufacturer, makes and sells a variety of products alongside its car business, from solar panels to buses.

The EV giant’s manufacturing expertise allows it to make nearly all of the components of its vehicles in-house, cutting down costs and enabling BYD to sell EVs for as little as $10,000.

That versatility has proven a crucial advantage, helping BYD to expand rapidly in China’s cut-throat EV industry and even briefly overtake Elon Musk’s automaker and become world’s largest producer of EVs by sales last year.

Here are all of BYD’s side hustles.

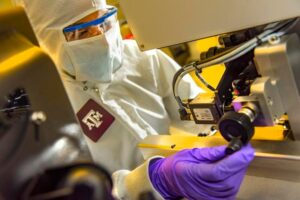

iPads and iPhones

Apple has long turned to China to assemble its tablets and smartphones, and it is reportedly increasingly relying on BYD.

The EV maker’s manufacturing arm, BYD Electronic, now assembles more than 30% of Apple’s iPad tablets and is part of the supply chain for the iPhone, according to industry executives and analysts cited by The Wall Street Journal earlier this month.

Apple CEO Tim Cook praised its partnership with BYD during a visit to China in March, and Apple isn’t the only company that relies on BYD Electronic.

EV rivals Xiaomi as well as other smartphone manufacturers Huawei and Samsung are also customers.

Batteries

China dominates the global battery industry, and BYD is one of its biggest success stories.

The automaker is the world’s second-largest battery producer, behind fellow Chinese firm CATL, per data released in September by Korean market research SNE Research.

In 2020, BYD rolled out its Blade battery, which the company said had “maximum safety, while offering outstanding strength, range, longevity and power.”

The Blade battery is now incorporated into all BYD vehicles, and the automaker also sells it to rivals such as Toyota, which uses BYD’s batteries in its cars sold in China.

In October, Bloomberg reported Apple had worked with BYD on designing long-range batteries for its project to build its own car, which it ultimately scrapped.

Energy storage

Just like its rival Tesla, BYD has been able to turn its battery know-how into a lucrative side hustle in energy storage.

Tesla’s energy business includes solar panels and its megapack and powerwall batteries, which provide a backup power supply for homes and businesses.

BYD also sells solar panels and its battery-box system — a stack of Lithium Iron Phosphate (LFP) batteries that the company markets for home and commercial usage.

BYD’s energy storage business has grown rapidly in recent years, but the automaker may be about to face more competition from Musk with Tesla set to begin megapack production at its factory in Shanghai early next year.

Buses

BYD may not sell its cars in the US market thanks to tariffs — but the company has been making buses and commercial vehicles in its Lancaster, California factory since 2013.

BYD’s commercial vehicle business, which makes everything from school buses to forklifts, has often entered new markets before the company’s automotive arm.

BYD has also been contracted to provide London’s famous red double-decker buses and has struck a deal to provide Mexico City with a fleet of electric buses.

The company’s November figures showed it had sold around 16,400 commercial vehicles, including around 4,200 buses, in 2024 so far.

Monorails

In addition to buses, BYD has also branched out into mass transit with its “Skyrail” monorail.

The company unveiled its first single-track electric train in the Chinese city of Yinchuan in 2017. The company said the Skyrail is cheaper and easier to build than traditional subway systems.

BYD has a contract to build a Metro system in the Brazilian city of São Paulo, and it is also part of a consortium developing a proposal for a monorail system in Los Angeles.

Read the full article here