,

The quantum computing company – Rigetti Computing (NASDAQ:RGTI) is set to report its earnings on Monday, May 12, 2025. Historically, RGTI stock has shown a slightly higher probability of a negative one-day return following its earnings announcements. Over the past three years or so, the stock experienced a negative one-day return in 54% of instances, with a median decline of -4.9% and a maximum single-day drop of -9.4%.

While the market’s reaction to the upcoming results will heavily depend on how they compare to consensus estimates, event-driven traders can potentially leverage these historical patterns. Two primary strategies exist: first, understanding these historical probabilities to position before the earnings release; second, analyzing the correlation between immediate and medium-term returns after the announcement to inform subsequent trades.

From a fundamental perspective, RGTI currently has a market capitalization of $2.1 billion. Its trailing twelve-month revenue stands at $11 million, and the company has reported operational losses of $-69 million and a net income of $-201 million. However, given that quantum computing is still in its early stages of development, investors in companies like Rigetti are likely to focus more on progress within the quantum field, management’s insights, and any new partnerships rather than solely on the company’s current financial performance.

That said, if you seek upside with lower volatility than individual stocks, the Trefis High Quality portfolio presents an alternative – having outperformed the S&P 500 and generated returns exceeding 91% since its inception.

See earnings reaction history of all stocks

Rigetti Stock’s Historical Odds Of Positive Post-Earnings Return

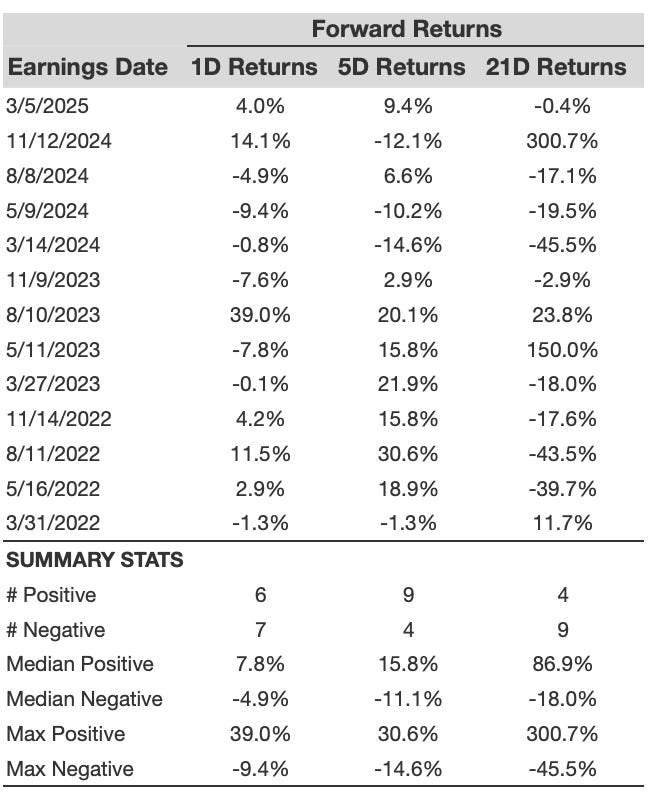

Some observations on one-day (1D) post-earnings returns:

- There are 13 earnings data points recorded over the last three years, with 6 positive and 7 negative one-day (1D) returns observed. In summary, positive 1D returns were seen about 46% of the time.

- Notably, this percentage increases to 50% if we consider data for the last 3 years instead of 5.

- Median of the 6 positive returns = 7.8%, and median of the 7 negative returns = -4.9%

Additional data for observed 5-Day (5D), and 21-Day (21D) returns post earnings are summarized along with the statistics in the table below.

Rigetti Stock Correlation Between 1D, 5D, and 21D Historical Returns

A relatively less risky strategy (though not useful if the correlation is low) is to understand the correlation between short-term and medium-term returns post earnings, find a pair that has the highest correlation, and execute the appropriate trade. For example, if 1D and 5D show the highest correlation, a trader can position themselves “long” for the next 5 days if 1D post-earnings return is positive. Here is some correlation data based on 5-year and 3-year (more recent) history. Note that the correlation 1D_5D refers to the correlation between 1D post-earnings returns and subsequent 5D returns.

Learn more about Trefis RV strategy that has outperformed its all-cap stocks benchmark (combination of all 3, the S&P 500, S&P mid-cap, and Russell 2000), to produce strong returns for investors. Separately, if you want upside with a smoother ride than an individual stock like Rigetti Computing, consider the High Quality portfolio, which has outperformed the S&P, and clocked >91% returns since inception.

Read the full article here