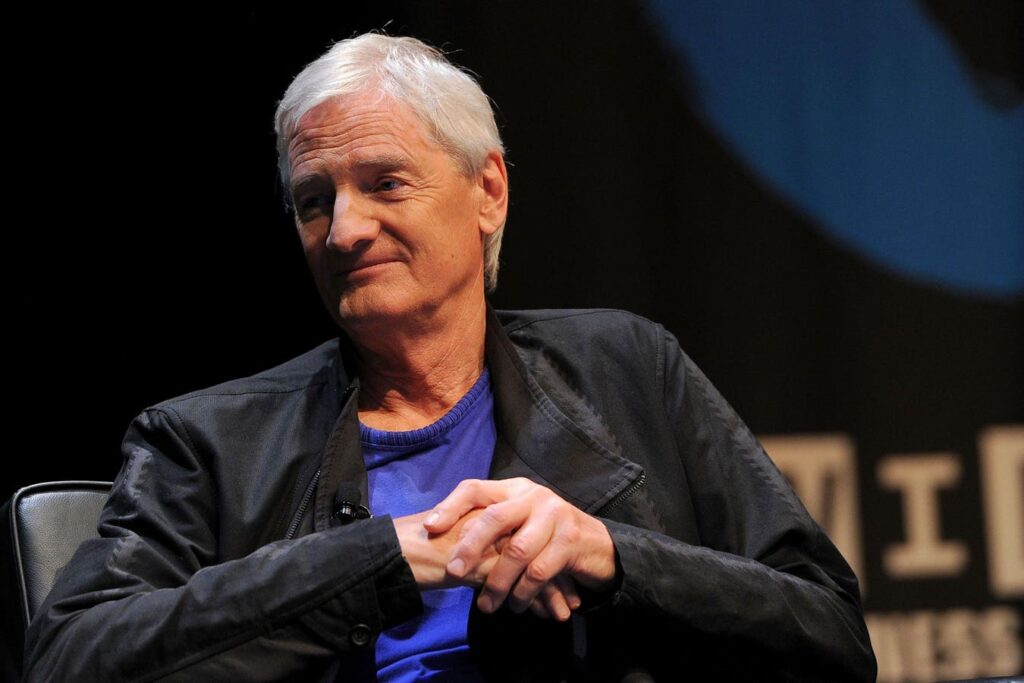

James Dyson, one of Britain’s best-known entrepreneurs, is accusing the Labour government of destroying family businesses and untold billions in tax revenues with its recent changes to the nation’s tax regime.

Dyson said in a letter to The Times on Monday that the Chancellor of the Exchequer Rachel Reeves is “killing the geese that lay the golden eggs.”

Reeves decreed in her Autumn budget that family businesses will cease to be exempt from inheritance tax beginning in April next year, a move that promises to raise £500 million ($624 million) for the government’s coffers.

Family businesses and farmers with more than £1 million worth of assets will be required to pay an inheritance tax of 20%, half of the 40% charged to other estates.

But Dyson argues that family businesses will actually pay 40% because they’ll “be forced to generate the tax payment via dividends, upon which more tax is levied.”

“It is only British family businesses that are being fleeced and decimated like this—private equity and publicly quoted businesses are not touched. Why this vindictiveness only towards British families?” Dyson asked in his letter.

Reeves is facing mounting pressure as higher borrowing costs and weak economic growth threaten to derail her fiscal plans. Labour had said it needed to raise taxes to shore up public finances and fund stretched frontline services.

The chancellor says that growth is the government’s number one priority, but the economy has effectively stagnated since Labour came to power in early July.

Reeves had pledged during the general election that she wouldn’t increase the rates of income tax, national insurance or VAT, which may have reassured voters, but now leaves her with fewer options to raise revenue.

The budget Reeves delivered on October 30 hit the private sector particularly hard with tax rises that many business leaders said were likely to undermine growth.

Dyson had earlier described the budget as “an egregious act of self-harm” on the economy.

The billionaire said in a letter to The Telegraph in early December that the increase to national insurance payroll tax combined with changes to the inheritance tax on family businesses “will kill entrepreneurship, snuff out wealth creation and stunt growth” in the economy.

“It will be ordinary working people–through their jobs and their wages–and the Exchequer who will pay the price for the chancellor’s ideologically driven attack on family businesses,” Dyson wrote in the letter.

Dyson is best known for his eponymous business that develops high-tech reinventions of gadgets like vacuum cleaners, hand dryers and fans. Dyson employs around 14,000 people and operates in more than 80 countries.

Forbes estimates his current net worth at $13.2 billion, making him the third-wealthiest person from the U.K. on the World’s Real-Time Billionaires ranking.

MORE FROM FORBES

Read the full article here