Amazon’s phenomenal success was built on its reputation for having the lowest prices and the most frictionless customer experience in the retail industry. For 2024, the company is projected to chalk up e-commerce sales of better than $450 billion, with profits of about $27 billion. (Amazon’s annual earnings report is due next week.)

An apparent 5% to 6% profit margin is nothing to brag about in traditional retail, but not bad considering how competitive Amazon is with pricing. But true retailing — buying and selling merchandise — is not how Amazon pays the rent. (Amazon’s most profitable business is cloud computing, which contributes the bulk of its earnings.)

Thirty years after the company was founded as an online retailer of books, Amazon’s e-commerce business has morphed into an advertising company. In fact, by some estimates, its actual retail business may be a money loser.

In a recent blog post, digital commerce analyst Russ Dieringer estimates that the company’s retail media network—sponsored ads by brands — generates an operating margin of about 40% with insiders claiming that number could be as high as 80%. That means advertising contributes most of the company’s e-commerce profits.

“In other words,” Dieringer says, “After three decades of refining its model and generating three-quarters of a trillion in global gross merchandise volume … Amazon barely ekes out a profit.”

Major bricks-and-mortar retailers have been eating Amazon’s e-commerce dust for years, but that’s been quietly changing in a big way. Walmart, Target, Instacart, eBay, Etsy, Home Depot, and Kroger are just a few of the 200 or so retailers that are building their own retail media networks on their e-commerce platforms. Much the same as a consumer shopping for lipstick on Amazon will be served ads from major brands that link to brand-specific web pages, Walmart shoppers are being served links to brands that may or may not be found in the company’s retail locations.

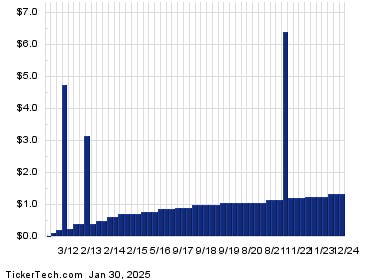

Amazon’s competitor retail media networks are growing fast and are equally profitable, with Walmart leading the pack. In its third quarter (ended September 30), advertising on its Walmart Connect network was almost a third of the company’s overall operating income of $6.7 billion.

One of Amazon’s big advantages has been its Prime membership, which includes a massive library of streaming video content. It’s estimated that there are 200 million Amazon Prime members and that, on average, members spend $1,400 on e-commerce purchases. But that edge may also be eroding.

Last year Walmart made a deal to buy “smart” television maker Vizio, which is also a video content streaming service. Vizio sets are WiFi enabled, allowing customers to access a much broader array of content than Amazon and thus a vast canvas of advertising space.

Amazon faces another major dilemma up against physical retail competitors. It must walk a fine line between promoting its highly profitable private label merchandise versus running ads for competing brands. Amazon may claim its search results are brand neutral, but it has a clear incentive to favor its own ad business which gives other brands a legitimate reason to avoid the e-commerce giant’s platform.

All of these developments beg an even bigger question that deserves a deep dive in a future column: at one point does all this advertising — including social media — turn consumers off. There are already signs of ad fatigue showing up in surveys of Facebook and other platform users. The more times people see the same or similar ad, the less likely they are to do business with that advertiser.

In the end, e-commerce is a marvelous retailing channel, but consumers will always prefer to do their disposable income purchases the old-fashioned way, in a real store. At least it appears that way for now. And if so, it does give retailers with store a distinct competitive advantage to engage their customers in unique ways.

Read the full article here