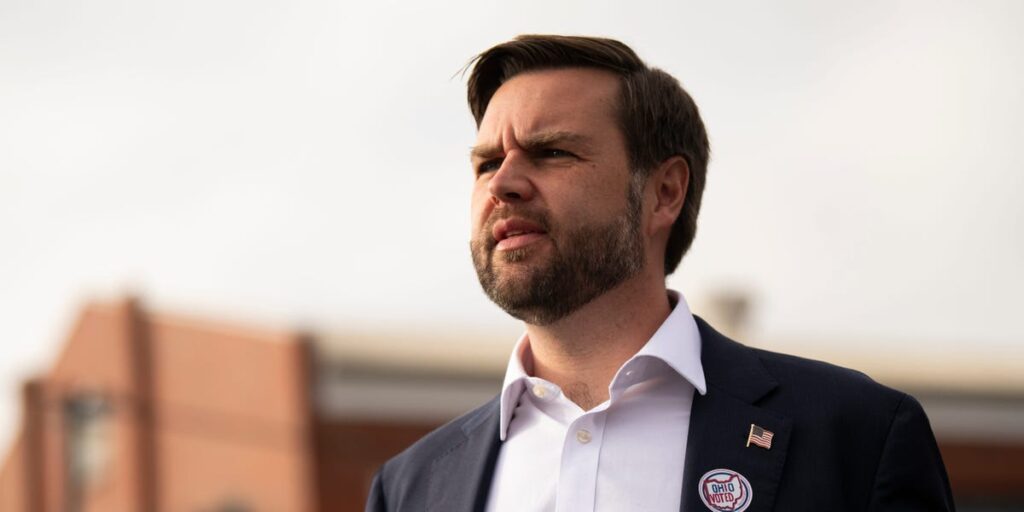

- Before he was the vice president-elect or a senator, JD Vance was a venture capitalist.

- He maintains ownership stakes in several funds, according to his disclosure forms.

- Here are some companies that Vance is an investor in, and how they may interact with the government.

JD Vance is a man of many careers: attorney, author, senator, vice president-elect, and, perhaps less well-known, venture capitalist.

For about six years between graduating from law school and becoming a United States senator from Ohio, Vance held various positions in the space before eventually starting his own fund, Narya Capital.

Over his career, Vance has been involved in investments across a broad range of business areas. Through Narya, he continues to hold a portfolio of investments in several startups, though he gave up his role as a partner there in 2022 and doesn’t actively run or advise any of the companies.

Vance’s early VC career

After a brief stint at a now-defunct biotech startup, Vance got a job at his benefactor Peter Thiel’s venture fund Mithril Capital.

He went on to work as a managing partner at Rise of the Rest, part of Steve Case’s Revolution venture firm. The fund’s mission is to invest in companies outside major tech hubs — New York, Silicon Valley, Boston — and Vance, whose outsider persona was cemented by his memoir “Hillbilly Elegy”, was seen as a perfect fit for the fund.

Vance was active in a number of deals for the firm, including leading investments in storage-sharing startup Neighbor, agtech company AppHarvest, and AI outfit Pryon, Rise of the Rest confirmed.

Vance co-founded Narya Capital in 2019

After two years, Vance broke out on his own, cofounding Narya Capital in 2019 with investments from Thiel, former Google CEO Eric Schmidt, and VC veteran Marc Andreessen.

Vance still owns pieces of the funds that he helped advise. According to his vice president and senate disclosure forms, he has a stake in Narya Capital Fund I, Narya Capital Fund II, and Rise of the Rest Seed Fund.

His stake in Narya Capital Fund I is worth between $500,001 and $1 million. His holdings through Narya’s Capital Fund II and the Rise of the Rest’s Seed Fund are smaller, worth as much as $15,000 and $250,000, respectively, according to his disclosure forms.

Through all three funds, he holds a portfolio of investments in dozens of startups. He doesn’t actively run or advise any of the companies, and gave up his role as a partner in Narya in December 2022 after winning his senate seat, according to disclosure forms.

It’s not entirely clear which Rise of the Rest companies Vance has a stake in. The fund has two $150 million investment vehicles and did not disclose which portfolio companies are in which fund.

Narya, meanwhile, has only completed one fundraise so far — its $120 million Fund I. The fund has a dozen active investments, according to its website, and because Vance has a stake in the fund, he technically owns a stake in each.

The companies vary in their mission: One is a gene therapy company founded by Vivek Ramaswamy’s brother, while another is a Catholic meditation and prayer app. Thiel, one of Vance’s mentors, is listed as a separate investor in many of the companies, per PitchBook.

Some are the type of companies that could work with the government.

True Anomaly, an aerospace company for which Narya participated in two rounds of funding, won a $30 million government contract from the US Space Force in April. ValueBase, a property valuation software, lists local governments among its customer base on its website.

Nayra has had two exits: Rumble, the conservative-leaning social video platform that went public in 2022, and AppHarvest, which went public in 2021.

Criminal conflict of interest laws do not apply to the president and vice president.

Luke Schroeder, a spokesperson for the vice president-elect, said that Vance has complied with all required disclosures and is not directly involved in the funds.

Here are Narya’s current portfolio companies

Deal details, unless noted with a comment from the company, come from PitchBook.

Read the full article here