The company is at the forefront of the quantum computing industry, but it has a speculative stock valuation

By Oliver Rodzianko

Summary

- Rigetti, a top superconducting-qubit pioneer, traded at ~250 P/S, far exceeding rational valuations despite potential 50%+ annual revenue growth.

- Stock plummeted ~50% after NVIDIA’s CEO stressed quantum’s 20-year horizon, illustrating risk in overpaying for unproven near-term earnings.

- Quantum’s long-term value is huge, but Rigetti’s valuation is speculative; prudent investors demand more tangible fundamentals or a far lower P/S multiple.

Rigetti Computing (RGTI) is at the forefront of the quantum computing industry and is also one of the only quantum computing companies with stock trading on the public market. Given the current broad media enthusiasm for quantum computing technologies following Google’s quantum Willow chip announcement, it is not surprising that Rigetti is being bought with speculative fervor. However, rational fundamentally-oriented value investors will have shrewdly avoided the stock at its recent price-to-sales ratio of around 250.

Writer’s note

Within 24 hours of writing this thesis, Rigetti’s stock price dropped by about 50%. The thesis below outlines the risks inherent in this speculative stock before the crash. CNBC attributed the crash to Jensen Huang, who stated that quantum computers at a commercially and industrially applicable scale are approximately 20 years away. This demonstrates that investing in Rigetti and other speculative quantum computing stocks at this time is somewhat reckless, even after such a significant price decline.

Operations & financials

Rigetti Computing is one of the world’s forefront full-stack quantum computing companies. It specializes in superconducting qubit technology and hybrid quantum-classical systems. The company operates the industry’s first dedicated quantum device manufacturing facility.

Rigetti’s business model is cleverly hinged on quantum computing-as-a-service (‘QCaaS’). The company offers cloud-based access to its quantum systems for enterprises, and this allows for stable recurring revenues from a subscription service. In addition to this, Rigetti also provides on-premises quantum systems for organizations, like national labs and academic institutions, that require localized infrastructure. The company’s revenue streams are further diversified through proprietary hardware and co-development projects with government agencies and industry leaders.

It’s important to understand that the company is still emerging, and hence the investment carries financial risks (most notably through its net loss of $14.8 million as of the latest quarter, Q3 2024). In addition, as far as value investing goes, the stock appears to be egregiously overvalued, trading at an EV-to-revenues ratio of 455 and a price-to-sales ratio of 242 at the time of analysis. In my opinion, and as I will discuss in more detail in my valuation section below, despite the operational strengths and quantum macro-trend exposure that Rigetti stock offers, the valuation makes it currently an asset for speculation rather than serious value or growth investing.

Rigetti stock is undeniably benefiting from the current increased commercial viability of quantum computing, where industries like artificial intelligence and cryptography are beginning to adopt quantum solutions. Quantum computing is now being viewed as the “next big thing” following the rise of AI, but sentiment appears to be both too soon and overextended, in my opinion. In addition, there are few publicly traded quantum computing companies, so Rigetti stock is benefiting from scarcity in the market. However, much of these sentiment trends are completely speculative, and it is much more shrewd to invest based on fundamentals for reliable annual returns over many years.

Valuation

Firstly, Rigetti stock should be scrutinized on its price-to-sales ratio, because as I mentioned, the company is not yet reporting a net income or free cash flow. Therefore, this is indeed one of the only reliable metrics at this time to assess the company’s present valuation with. Alongside it on the following chart, I have placed the company’s price-to-book ratio, which was 28 at the time of analysis.

There are very few companies trading at equivalent multiples, and the current sentiment is based on future growth potential, as it is possible that the company could achieve nearly a 50% annual revenue growth rate over the next three years. It certainly does not seem unreasonable that the company’s revenues will scale to $50 million or more in the next five years.

Based on other companies that achieve revenue growth rates of 50% per annum over three years, price-to-sales ratios rarely, if ever, go above 100. The best comparison here is Nvidia (NVDA), which has a 54.4% three-year annual revenue growth rate, but a much more reasonable price-to-sales ratio of 31. Indeed, at the peak of investor sentiment during the current AI boom, the stock’s price-to-sales ratio was approximately 45. This reaffirms that investing in Rigetti at a price-to-sales ratio of around 250 would be irrational for fundamentally-oriented investors.

Counter-analysis

Some speculative investors may say that Rigetti trades at a one-of-a-kind valuation, similar to the intangible value embedded in Tesla (TSLA) or Palantir (PLTR) stock. However, in the case of Rigetti, I consider this sentiment-based attitude to the stock as being reckless, as the company does not have a proven track record of sustained high sentiment related to intangible value, like an exceptional brand with Tesla. Moreover, Rigetti is valued at higher multiples compared to both Tesla and Palantir, so the “one-of-a-kind” argument loses credibility. This is the case even though Rigetti truly is a one-of-a-kind quantum computing company and one of the only publicly traded quantum computing stocks. Too much intangible value embedded in a stock price inevitably leads to an exhibition of irrationality from the market, which indicates a good time to sell, not buy shares.

Investors who are looking at the company for its future earning potential will also likely be waiting for many years. That said, there is some credence to the notion that the stock could trade with exceptional goodwill once it proves stable earnings growth. However, for the foreseeable future of the next three or so years, a net loss appears inevitable as the company continues to scale and manage its technological leadership and further define its moat.

Quantum computing industry

Multiple estimates from leading research companies indicate that the quantum computing market will generate up to $1 trillion in economic value by 2035. 2030 is also likely to be a year of significant culmination for the quantum computing industry, revolutionizing logistics and supply chains, manufacturing, pharmaceutical and healthcare breakthroughs, artificial intelligence and machine learning efficiencies, financial services, cybersecurity, and many other high-value domains.

The reason for these exceptional advancements is due to the fact that quantum computing can solve certain classes of problems far more efficiently than classical computers. This provides exponential computing power, providing revolutionary benefits to most industries reliant on computation for workflows and development. Indeed, the industry is going to be very popular and hence make for a great investment, but as this analysis of Rigetti shows, it is presently the wrong company to allocate capital to due to an already heavily overextended valuation.

Other quantum computing investments

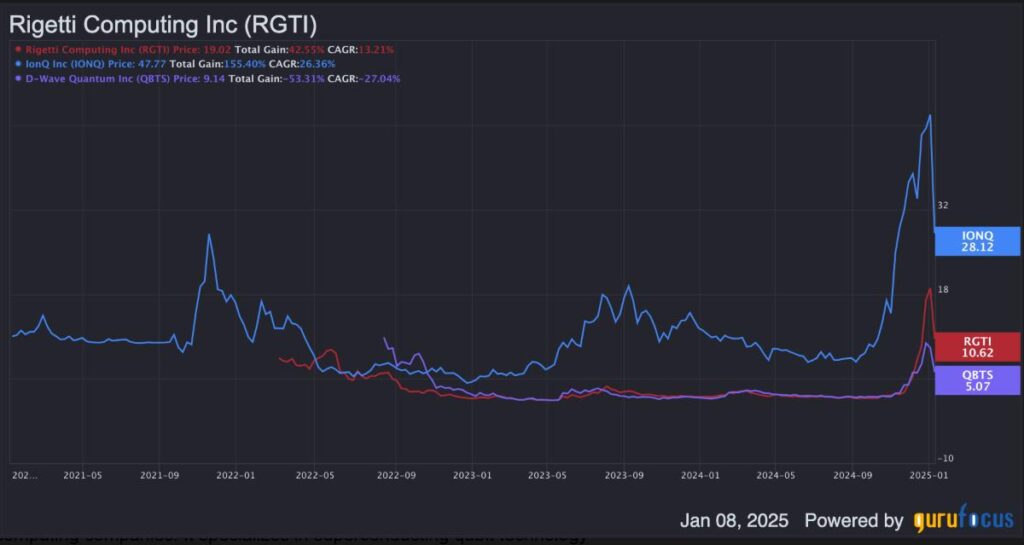

There are a few other publicly traded quantum computing companies worth knowing about, other than leading Big Tech names. Namely, IonQ (IONQ), D-Wave Quantum (QBTS), Quantum Computing Inc. (QUBT), Honeywell (HON), and emerging player Zapata (ZPTA). In the following chart I have removed Quantum Computing Inc. because its price-to-sales ratio is too high and therefore not meaningful, and I have removed Zapata because it is too small and its price-to-sales ratio was below 1 at the time of analysis, which is also not meaningful.

Rigetti has a one-year revenue growth rate of -36%, IonQ has a one-year revenue growth rate of 84%, D-Wave Quantum has a one-year revenue growth rate of -17%, and Honeywell has a one-year revenue growth rate of 6.3%.

Rigetti has a future three-year consensus revenue growth rate estimate of 46%, IonQ has a future three-year consensus revenue growth rate estimate of 90%, D-Wave Quantum has a future three-year revenue growth rate estimate of 54%, and Honeywell has a future three-year revenue growth rate estimate of 6.3%.

Given the above data points, it appears reasonable to assess all three of the emerging players, Rigetti, IonQ, and D-Wave, as overvalued. However, of the three, D-Wave is somewhat more reasonably valued. Honeywell offers a good valuation but only moderate growth prospects.

Conclusion

I’m certainly bullish on the quantum computing industry in general. The field will likely be marked by high-growth companies revolutionizing workflow and industry development through exponentially faster computational power. However, as far as Rigetti goes, this industry-forefront quantum computing company is trading at an egregious valuation. In my opinion, a price-to-sales multiple of no more than 100 would be justified. Even then, a lot of intangible value would be attached to the stock, and I would much prefer to own it at a price-to-sales ratio of 50 or less. Therefore, I think it’s best to look at other investments on the market than Rigetti for now.

Read the full article here