This month’s jobs day could be coming late.

The US government has shut down after Congress failed to pass a spending bill before the 12:01 a.m. Wednesday deadline. Depending on how long it goes on, that could affect the Bureau of Labor Statistics’ reports that help businesses, workers, and the Federal Reserve know what’s happening in the economy.

Based on the Department of Labor’s contingency plan, if the government shutdown is still happening on Friday, the monthly employment situation, commonly known as the jobs report, won’t be published as planned. If it’s still happening by mid-October, it could affect the annual cost-of-living adjustment for Social Security benefits because inflation data wouldn’t be released on schedule.

The Department of Labor said the Bureau of Labor Statistics would “suspend all operations,” planned publications wouldn’t be released, data collection would stop, and its website wouldn’t be updated during the funding lapse. If it continues for a while, planned data releases could be delayed, and could affect data quality down the line.

In the 2013 government shutdown, the September jobs report was delayed about two weeks, and the subsequent October report was delayed a week “to allow enough time to collect data,” after the shutdown, BLS said. In the longest US government shutdown, which took place in late 2018 and early 2019 during President Donald Trump’s first term, the BLS was funded, so data collection wasn’t affected, and reports were released as planned.

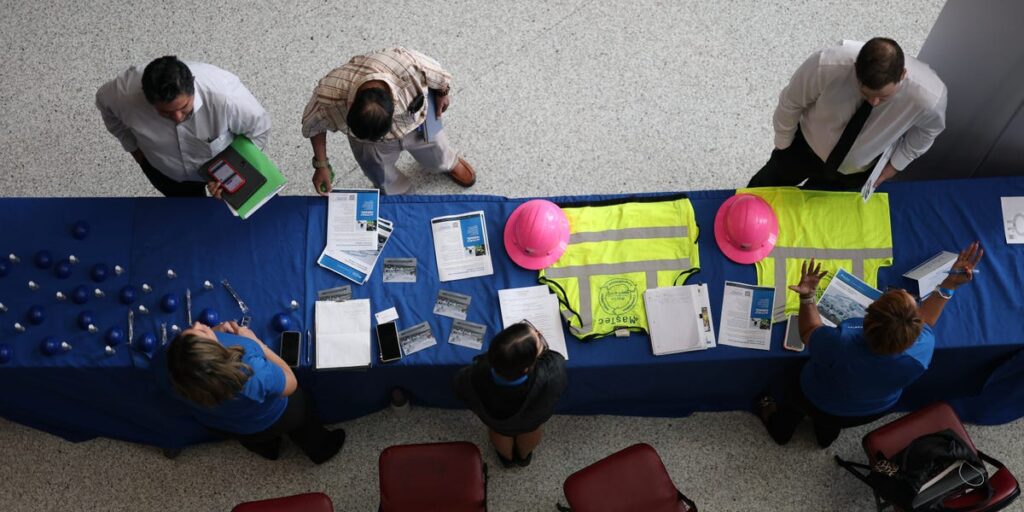

The jobs report helps job seekers have a better understanding about labor demand, how many people are competing for job offers, and what earnings look like. Job growth in the past two reports was below expectations, and although unemployment is low, it has increased.

The jobs report is just one of the monthly reports that the Bureau of Labor Statistics publishes. The consumer price index and the producer price index are key inflation indicators, and the shutdown could delay their release. Labor market and inflation data help the Fed make decisions for its dual mandate balancing maximum employment and stable prices.

The consumer price index and producer price index are scheduled to run on October 15 and October 16, respectively. Real earnings, which the BLS uses the consumer price index to calculate and average hourly earnings from the jobs report, are also supposed to be published on October 15.

Every year, the Social Security Administration evaluates whether to increase Social Security benefits with a cost-of-living adjustment, which is based on consumer price index inflation data from the third quarter of the year. Without September’s result rounding out that third-quarter data, it could delay the announcement that typically comes out in October.

José Torres, a senior economist at Interactive Brokers, said in written commentary that “an extended halt” would affect both consumer spending and unemployment.

“The immediate economic impact would be tangible,” Gregory Daco, EY’s chief economist, said in a newsletter.

“Each week of shutdown could reduce Q4 GDP by 0.1 percentage points (annualized), or about $7 billion per week — largely due to lost wages, procurement delays and softer final demand,” Daco added. “The fiscal drag would eventually be partially offset by back pay and a rebound in activity, but the confidence hit to markets and consumers could prove longer lasting.”

Read the full article here